Overview:

The market has called the Fed's bluff - Last week's report, "Is the Fed Bluffing?" discussed the possibility that the Fed is "bluffing" in regards to ending monetary easing.

A slowdown in monetary easing is unlikely as US economic data continues to be weaker than expected. In addition, Europe's continued recessionary problems provide a need for continued liquidity to prevent a larger global slowdown.

As a result, equity investors continue to aggressively move into US equities. The recent "steady" trend of the euphoric-Fed-driven market has become more pronounced.

The breakout of this "steady" trend may provide nimble investors another entry point into a rising market. Investors may want to focus on sectors that continue to outperform the S&P 500 - as the current rise in the market seems to be mostly momentum driven and not driven by fundamentals.

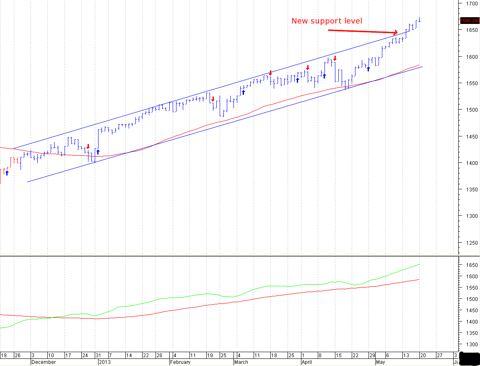

Last week, this chart of the S&P 500 (SPY) was included in the Weekly Macro View, showing the steady rise of the current trend:

(click to enlarge)

Source: Riverbend Investment Management

This week, the S&P 500 has broken out of the "steady" trend and has accelerated upward - another sign of euphoria in the market.

However, this breakout does present an interesting risk/reward ratio for nimble investors.

The past trend line may be viewed by many, especially technical-based traders, as an entry level in a rising market:

(click to enlarge)

Source: Riverbend Investment Management

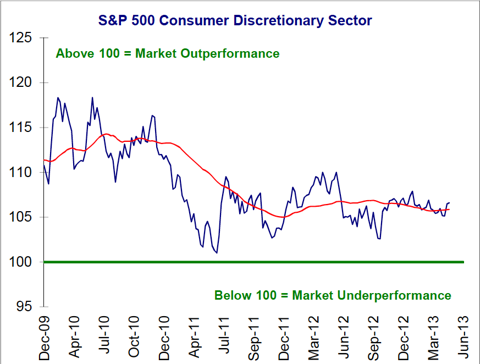

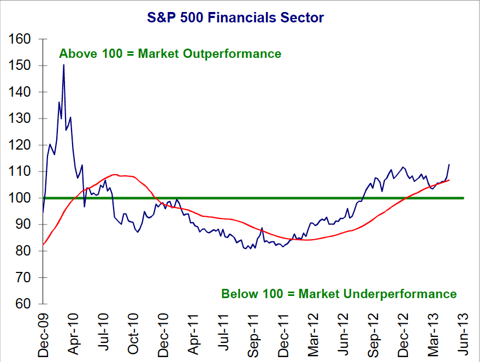

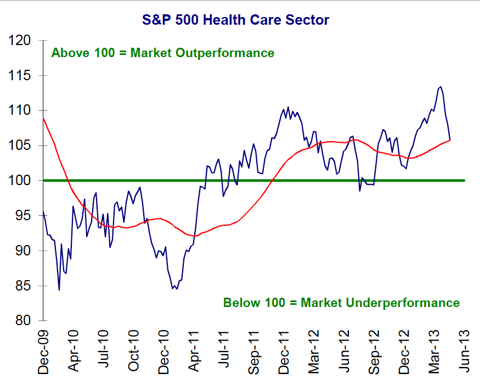

Investors continue to reward sectors with positive relative strength vs the S&P 500 index without regard for fundamentals.

Consumer Discretionary (XLY):

(click to enlarge)

Source: Standard and Poor's

Financials (XLF):

(click to enlarge)

Source: Standard and Poor's

Healthcare (XLV):

(click to enlarge)

Source: Standard and Poor's

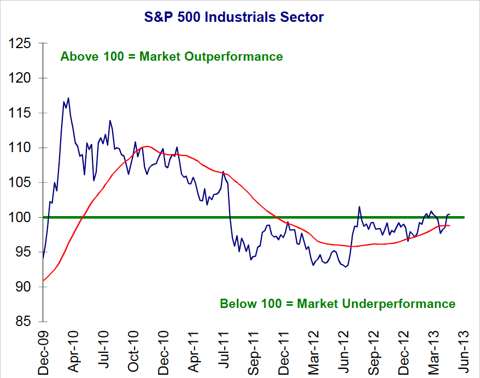

Industrials (XLI):

(click to enlarge)

Source: Standard and Poor's

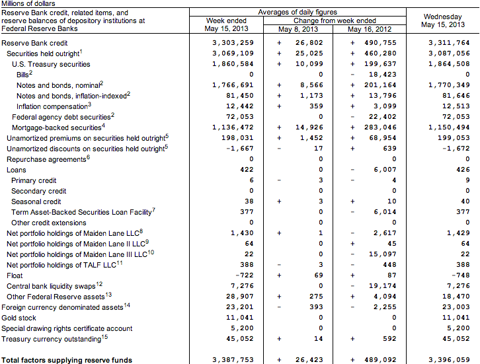

Investors should keep a close on the Fed's balance sheet to see what the Fed does vs. what they say.

A reduction in the Fed's balance sheet may provide investors an early indication to shift out of equites.

(click to enlarge)

Source: Federal Reserve

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.