Are we there yet?

Are we there yet?

You would think the media would have learned from the Fiscal Cliff non-event that there's no reason to cry wolf but, unfortunately for an ill-informed citizenry, "WOLF!" = ratings. In fact, they even have a guy named Wolf giving us the news (but, ironically, he gets no ratings).

It's the end of the month today so, probably, the markets will flat-line but we had our fun yesterday as we jumped right on the bullish bandwagon at 9:42 (we were, as noted in the morning post, already bullish from the previous day) with a bullish play on the Nikkei Futures (/NKD) in our Member Chat at 11,250 (same entry we hit last Thursday, in fact) and those gave us a 200-point ride at $5 per point, per contract for $1,000 gains on the day. The Nikkei actually tested 11,500 after hours but we were long gone by then.

We also continue to build into our brand new Income Portfolio, bringing us up to 6 positions in the first two days of our shopping spree. We also added a nice SDS hedge into the close to lock in some of our gains – just because we're bullish doesn't mean we can't be careful!

We also continue to build into our brand new Income Portfolio, bringing us up to 6 positions in the first two days of our shopping spree. We also added a nice SDS hedge into the close to lock in some of our gains – just because we're bullish doesn't mean we can't be careful!

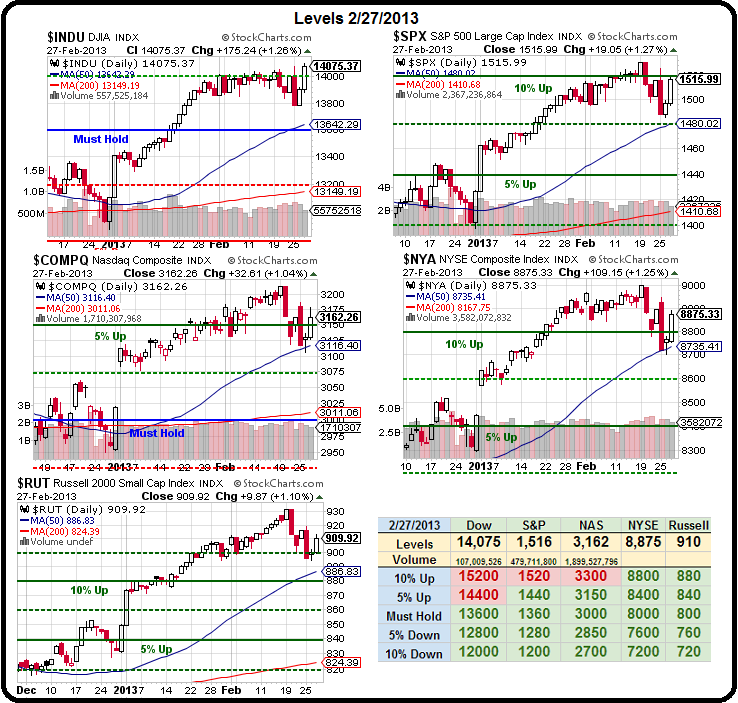

The Dow is already over it's previous high so we'll be looking at adding some Dow components today and tomorrow – in case they get away from us. As the S&P is testing our 10% line, they were the logical short hedge but we also have a very clear indicator of when to get out of the trade with a small loss if they do pop 1,520 and hold it over the weekend.

This morning we had another opportunity to go long on Copper (/HG) at $3.565 and Silver (/SI) came back down to $28.85 – exactly where we drew a line in the sand early Tuesday morning in Member Chat, where I called it "the best long of the moment." As I noted in Tuesday morning's post, the Dollar is under 81.85 (81.69) so it's a no-brainer to make this entry to make some Egg McMuffin money in the morning.

Oil has gotten boring, flat-lining at $92.50 (see Dave Fry chart) but nat gas has fallen back to $3.40 on warmer weather (inventory today at 10:30) and gasoline is back to $3.10 but,…

Oil has gotten boring, flat-lining at $92.50 (see Dave Fry chart) but nat gas has fallen back to $3.40 on warmer weather (inventory today at 10:30) and gasoline is back to $3.10 but,…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.