That was a fun dip, wasn't it?

That was a fun dip, wasn't it?

Did you know that yesterday there were a record number of VIX options purchased and that 28% were bought at the bid (indicating panic buying)? People sure are getting nervous ahead of the Sequestration which clearly, if you watch Fox or CNBC, marks the beginning of the END OF THE WOLRD.

Aren't these the same people who screamed for the past 4 years that we MUST cut the budget or we're doomed? Now the budget is being cut by about 8% and they are FREAKING OUT. So, were they wrong before or are they wrong now or are they just generally idiots we should ignore at all times?

I'm pretty sure it's the third one but the herd doesn't need a good reason to stampede – just a few of the nervous ones need to start running away and others will simply follow rather than waiting to find out what horrible thing the others are running away from. When that horrible thing is the MSM screaming about how HORRIBLE this new, artificial crisis will be – it does make it a lot harder for the average sheeple to ignore.

I'm pretty sure it's the third one but the herd doesn't need a good reason to stampede – just a few of the nervous ones need to start running away and others will simply follow rather than waiting to find out what horrible thing the others are running away from. When that horrible thing is the MSM screaming about how HORRIBLE this new, artificial crisis will be – it does make it a lot harder for the average sheeple to ignore.

It's fun to panic. We're designed to panic – we're not carnivores, we are omnivores who only developed sharp teeth pretty recently. Man, as an animal, has a highly developed flight reflex and that can influence our trading and it does as predators (ie. Cramer and his buddies) know that they can force you to abandon your positions if they simply make a lot of noise with threatening gestures (or charts).

This is why it's so dangerous to take positions in stocks you don't actually believe in. It makes you and easy target for predators because you'd rather abandon your position (which you have no real vested interest in keeping) rather than risk a loss. It's one thing to plant a tree but quite another thing to nurture it and fend off predators until it is strong enough to take root. We were discussing scaling in and sticking with positions in Member Chat this morning and it's well worth a read.

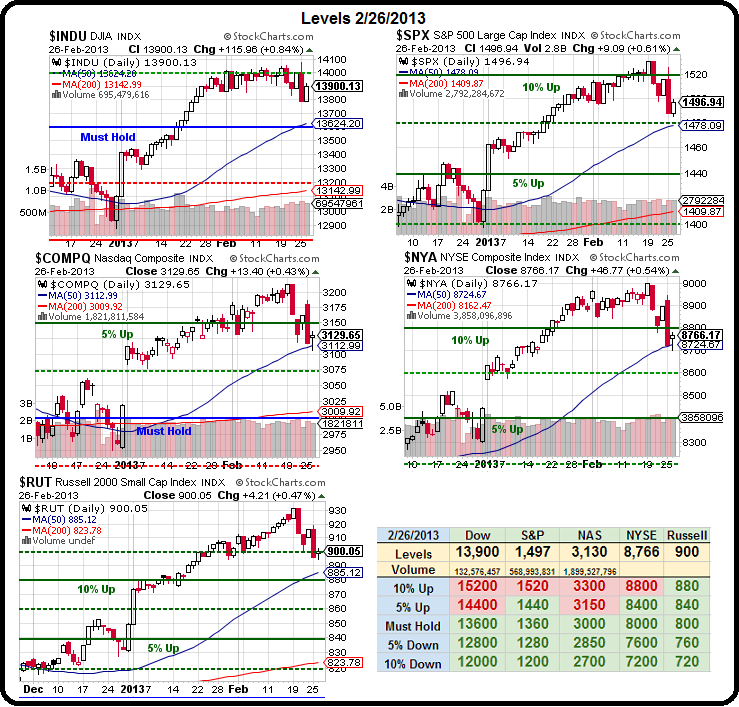

As predicted in yesterday's post, we held our 50 dmas on our first crash test but we are certainly not out of the woods as we have something called strong and weak…

As predicted in yesterday's post, we held our 50 dmas on our first crash test but we are certainly not out of the woods as we have something called strong and weak…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.