Mergermarket just released its global M&A report for the first three quarters of 2015. Here’s a breakdown of the key findings.

The Numbers

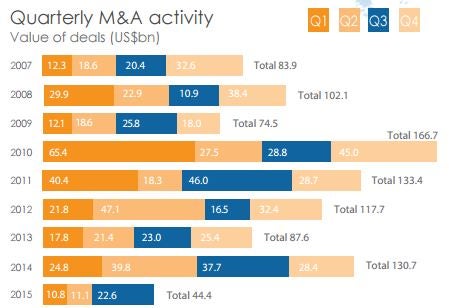

Through the end of Q3, the world has witnessed about $2.87 trillion in global M&A deals in 2015. That number represents a 21.1 percent increase over the first three quarters of 2014 and puts the world on track to break the all-time record for total annual M&A value this year, eclipsing 2007’s peak number of $3.66 trillion.

Central, South American Slump

Despite the global boom in M&A activity, Central and South America have been left out of the party. Falling oil prices have weighed heavily on the economies of many countries in the region and total M&A values have fallen by an incredible 56.6 percent during the first three quarters of 2015.

Mega-Deals

According to the report, the world has witnessed a record-paced number of $1 billion-plus mega-deals so far in 2015. The 43 mega-deals through the first three quarters of 2015 have been worth a combined $1.1 trillion. This year's total number of mega-deals falls only eight deals short of 2006’s record of 51.

The three largest deals so far this year are the Royal Dutch Shell plc (ADR) RDS RDS $81.2 billion buyout of BG Group plc (ADR) BRGYY, the Charter Communications, Inc. CHTR $77.8 billion buyout of Time Warner Cable Inc TWC and the Energy Transfer Equity LP ETE $55.9 billion buyout of Williams Companies Inc WMB.

Disclosure: The author holds no position in the stocks mentioned. Image Credit: Public Domain© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.