Financial giants have made a conspicuous bearish move on Amazon.com. Our analysis of options history for Amazon.com AMZN revealed 17 unusual trades.

Delving into the details, we found 35% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $133,537, and 14 were calls, valued at $719,827.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $200.0 for Amazon.com, spanning the last three months.

Analyzing Volume & Open Interest

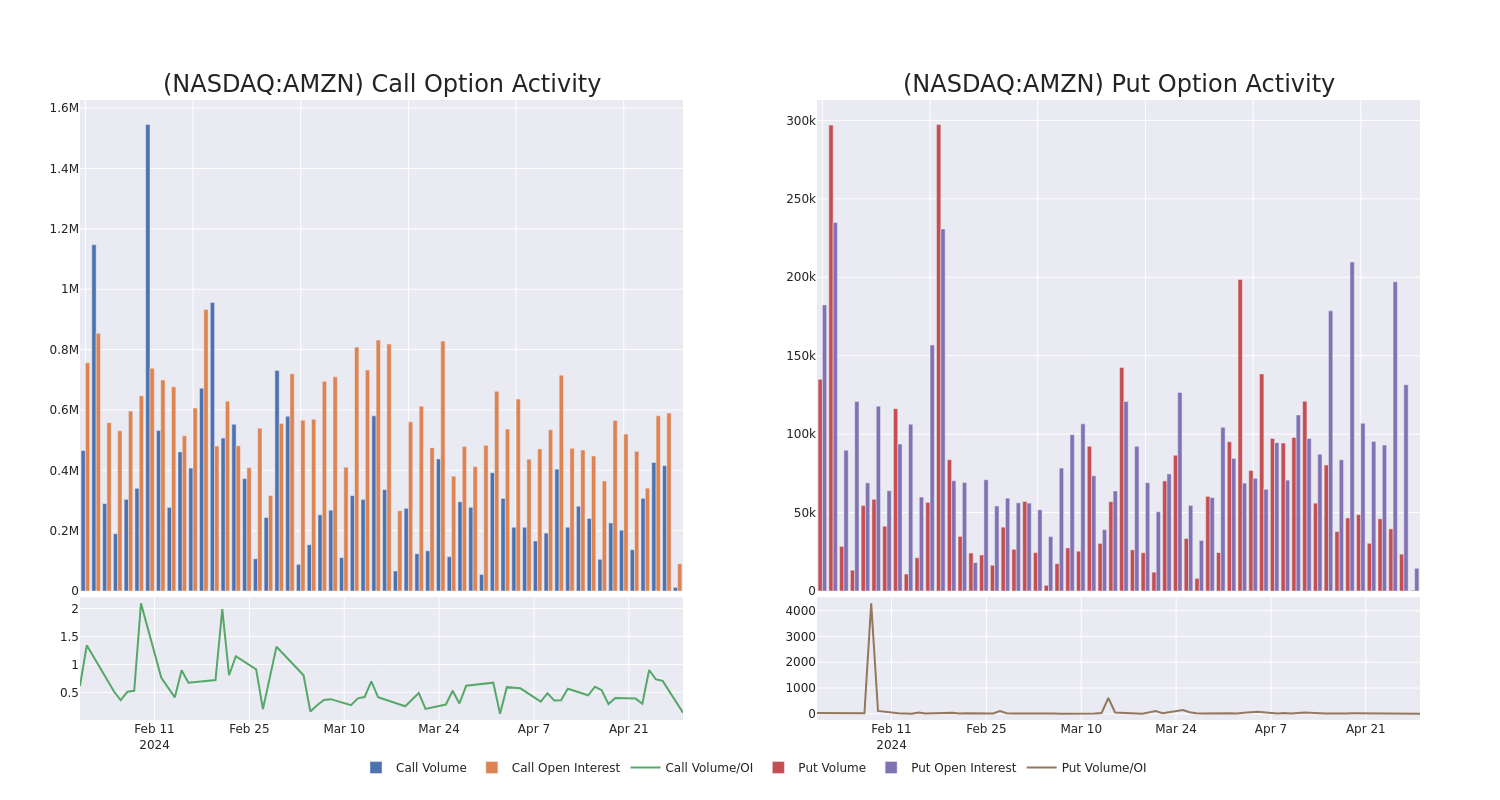

In today's trading context, the average open interest for options of Amazon.com stands at 11633.0, with a total volume reaching 12,707.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amazon.com, situated within the strike price corridor from $150.0 to $200.0, throughout the last 30 days.

Amazon.com Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | SWEEP | BULLISH | 05/03/24 | $6.05 | $6.0 | $6.05 | $185.00 | $122.2K | 18.5K | 1.2K |

| AMZN | CALL | TRADE | BEARISH | 05/03/24 | $4.75 | $4.65 | $4.65 | $187.50 | $116.2K | 4.2K | 778 |

| AMZN | CALL | SWEEP | BEARISH | 05/03/24 | $1.32 | $1.3 | $1.24 | $200.00 | $95.4K | 13.7K | 2.4K |

| AMZN | CALL | SWEEP | BULLISH | 05/03/24 | $5.95 | $5.85 | $5.93 | $185.00 | $59.4K | 18.5K | 2.4K |

| AMZN | PUT | SWEEP | NEUTRAL | 05/03/24 | $3.75 | $3.65 | $3.71 | $175.00 | $48.9K | 8.5K | 467 |

About Amazon.com

Amazon is a leading online retailer and one of the highest-grossing e-commerce aggregators, with $386 billion in net sales and approximately $578 billion in estimated physical/digital online gross merchandise volume in 2021. Retail-related revenue represents approximately 80% of the total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (10%-15%), advertising services (5%), and other. International segments constitute 25%-30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

After a thorough review of the options trading surrounding Amazon.com, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Amazon.com

- Trading volume stands at 2,944,812, with AMZN's price up by 1.3%, positioned at $181.95.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 1 days.

What Analysts Are Saying About Amazon.com

5 market experts have recently issued ratings for this stock, with a consensus target price of $210.6.

- An analyst from Roth MKM has decided to maintain their Buy rating on Amazon.com, which currently sits at a price target of $205.

- In a cautious move, an analyst from Benchmark downgraded its rating to Buy, setting a price target of $200.

- An analyst from BMO Capital persists with their Outperform rating on Amazon.com, maintaining a target price of $215.

- An analyst from Wells Fargo persists with their Overweight rating on Amazon.com, maintaining a target price of $217.

- Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Amazon.com, targeting a price of $216.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Amazon.com with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.