Twilio Inc TWLO provided preliminary financial results for the fourth quarter on Thursday.

After the market close on Thursday, Twilio introduced new financial expectations in a regulatory filing. The company said it now expects fourth-quarter revenue growth of approximately 11% year-over-year, up from prior guidance of 7% to 8%.

Twilio said it now expects adjusted income from operations for the fourth quarter to be above the top end of its prior guidance of $185 million to $195 million. The company also anticipates positive GAAP income from operations in the fourth quarter.

Twilio shares gained 0.7% to close at $113.40 on Thursday.

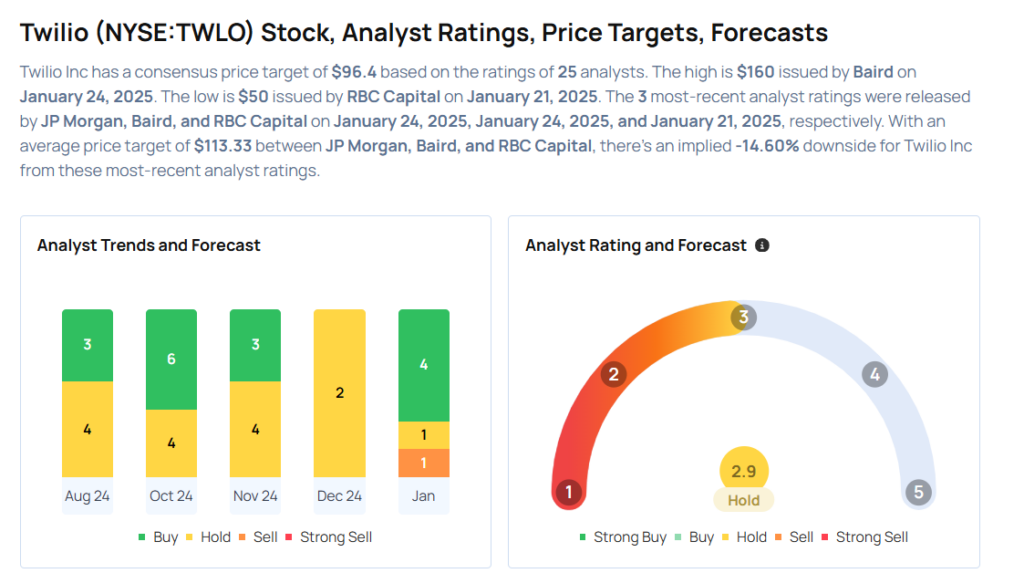

These analysts made changes to their price targets on Twilio following the announcement.

- Baird analyst William Power upgraded Twilio from Neutral to Outperform and raised the price target from $115 to $160.

- JP Morgan analyst Mark Murphy maintained Twilio with an Overweight and raised the price target from $83 to $130.

Considering buying TWLO stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.