By Surly Trader

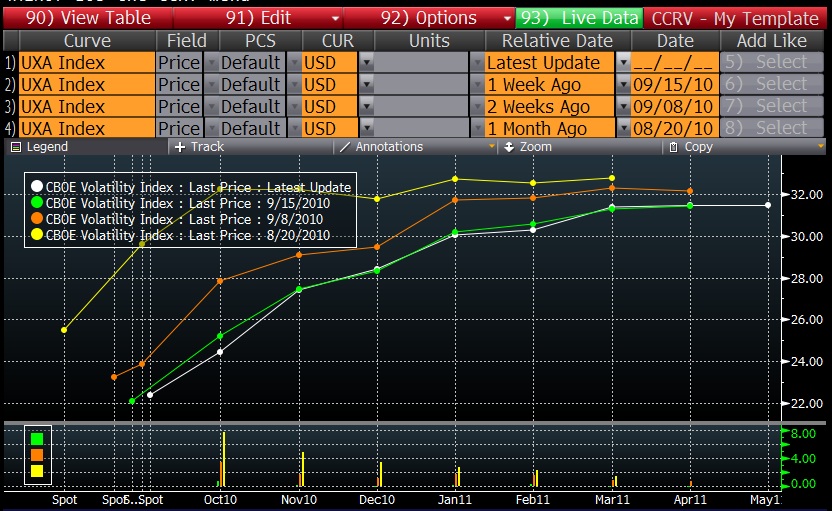

September is adding up to be a very tame month much to the dismay of all the doomsday predictors. The result has been a steady fall in the VIX and a slightly delayed fall in the front part of the VIX futures curve. What does not seem to fade is the longer term bet that volatility is going to be very high in the future….

The front part of the curve has fallen, but why so sticky February out?

October futures are trading near 24% while the March 2011 futures are trading over 31%. What ever happened to the buy in January rule? If you are scared about a flare-up in risk, then you can buy the front part of the curve and sell the back part of the curve (use options on the VIX futures to make smaller trades). If you want to make the directional trade alone, then selling calls on the March futures seems attractive.

Post Footer automatically generated by Add Post Footer Plugin for wordpress.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.