Coinbase stock has fallen more than 30% from its highs, from an intraday price (on the day of its direct listing) of $429 to about $300 at the time of writing. This comes at a time of big price swings in crypto currencies. Below we'll look at how traders are pricing potential movement in the stock, and how options might be used.

The Expected Move

How a new listing like COIN will behave in early trading is unknown, but we can look to the options market to uncover how traders are positioning themselves. With the Options AI chart we can visualize the expected move (from option implied volatility) to get a sense of the magnitude of move, up or down, that traders are expecting over time.

At the time of writing, we see that options are pricing about a 13% move for the next month, with about 7% of the that move expected by next Friday (April 30).

With COIN trading near $300, the expected move for May 21st corresponds to about $340 for a bullish consensus, and $260 for bearish. Via Options AI:

As a comparison to crypto currency volatility, Bitcoin options are pricing about a 9% move by April 30th and about an 18% move for the next month.

Bullish Alternatives

The at-the-money $300 Call (expiring May 21st) currently costs about $24. That Call would need COIN to be above $324 on May 21st to be profitable.

Using Options AI we can compare the at-the-money Call above to alternative strategies like debit and credit spreads that, in this case, use the expected move to guide strike selection for the spread.

Here's an example, with a bullish price target in line with the expected move for May 21st. Note the risk, reward and probability (of break-even) on the trade comparison of the debit and credit spreads vs the outright call. The GIF then compares the at-the-money Call to a debit Call spread alternative at a lower cost:

Debit Call Spread (bullish) – For instance, the +300/-340 debit call spread costs about $13.50. It buys an at-the-money Call (the 300), while simultaneously selling a Call (the 340) near the expected move in the stock. At a Cost of around $13.50, it is therefore profitable with the stock above $313.50 on May 21st expiration.

That's clearly closer to where the stock is currently trading. That difference in breakeven price is reflected in the probability of profit below:

The debit spread trades unlimited upside for a higher probability of profit. And if the stock does indeed move higher to be roughly in line with the expected move, the call spread sees more profits. The outright call needs the stock to move beyond the expected move to see that same profitability or more.

Credit Put Spreads (bullish) – Another way to express a bullish view is via Credit Put Spreads. A trade that might be viewed as ‘selling to the bears'. In the example below the COIN May 21st -300/+260 Credit Put Spread sells an at at-the-money Put while simultaneously buying a Put around the bearish consensus expected move level. In being short an at-the-money Put and having received premium upfront, the breakeven level of the trade at expiry can be below where the stock is currently trading. In turn, this can help push probability of profit at expiry above 50%.

Of course, with options there are always trade-offs. When it comes to Credit Spreads, one of the trade-offs for enjoying higher probabilities is that more must be risked in relation to maximum potential reward. Here you can see the difference in probability between paying for a bullish debit spread vs receiving a credit for a bullish credit put spread:

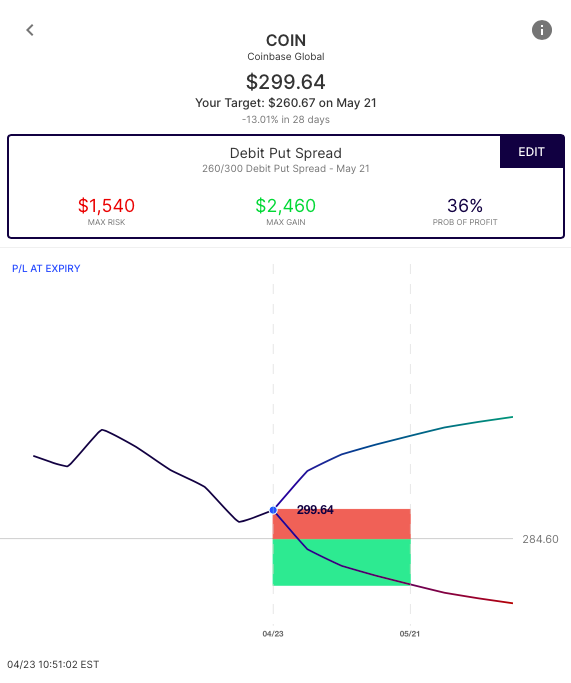

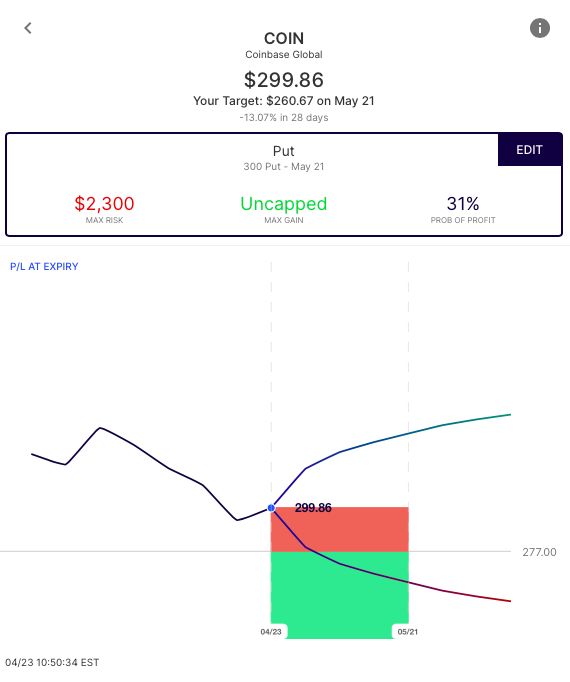

Bearish Alternatives

The at-the-money $300 Put (expiring May 21st) costs about $23. That Put would need COIN below $277 on May 21st to be profitable.

Using Options AI we can compare the at-the-money put to alternative strategies like put spreads and credit call spreads, once again using the expected move:

A direct comparison of the debit put spread vs vs the at the money shows the difference in breakeven level, with the put spread breakeven nearly $8 closer to where the stock is currently trading:

A note on skew – You may notice here that bearish Credit Call Spreads risk more to make less in comparison to bullish Credit Put Spreads in the Bullish section. Despite both strategies having strikes that map to the expected move and the same width. That is a result of options skew. The skew, in this case, is a result of demand for upside calls in COIN. Those upside calls are trading at a slightly higher implied volatility than at-the-money calls. When buying a debit call spread, the trader is taking advantage of skew, buying a call at a lower volatility than the call they simultaneously sell. Selling bearish credit call spreads are somewhat negatively affected by that skew, selling a call at a slightly lower volatility than they call being bought.

Options AI puts the expected move at the heart of its trading experience. Traders are able to quickly generate trades based on the move, or to place their own price target in context of the expected move. Options AI provides a couple of free tools like an expected move calculator, as well as an earnings calendar with expected moves. More education on expected moves and spread trading can be found at Learn / Options AI.

Based upon publicly available information derived from option prices at the time of publishing. Intended for informational and educational purposes only and is not any form of recommendation of a particular security, strategy or to open a brokerage account. Options price data and past performance data should not be construed as being indicative of future results and do not guarantee future results or returns. Options involve risk, including exposing investors to potentially significant losses and are therefore not suitable for all investors. Option spreads involve additional risks that should be fully understood prior to investing. Securities trading is offered through Options AI Financial, LLC a registered broker-dealer.

The post Coinbase. Expected move and option alternatives. appeared first on Options AI: Learn.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.