Woman Holding Bitcoin (Moose Photos/Pexels)

Crypto Bank Powers Small Portfolio

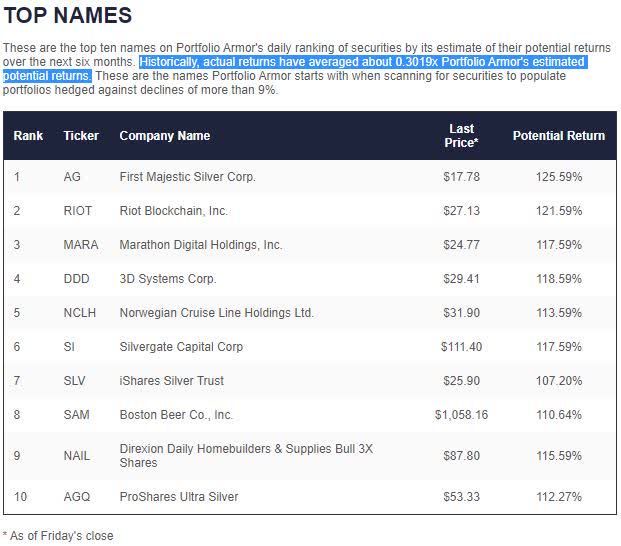

Regular readers may recall that we mentioned Silvergate Capital Corporation SI was one of our top names this past summer. For example, we pointed out it was one of our top ten names when Bitcoin was trading below $40,000 at the end of May ("A Hedged Bet On A Bitcoin Bottom"):

On Friday, we had a new Bitcoin-related name hit our top ten: the miner Marathon Digital Holdings, Inc. MARA.

Screen capture via Portfolio Armor on Friday, 5/28/2021.

MARA joined Riot Blockchain (RIOT) and Silvergate Capital (SI) as the other Bitcoin-related names.

Since it was one of our top names then, Silvergate appeared in our hedged portfolios at the time.

A Hedged Portfolio For A Small Investor

Our system can be used to create hedged portfolios for dollar amounts as low as $30,000. At the end of May, this was the hedged portfolio our site created for users with $30,000 to invest, who weren't willing to risk a decline of more than 13% over the next six months.

Screen capture via Portfolio Armor on 5/27/2021.

The two primary securities in this portfolio were Silvergate, and the Direxion Daily S&P Oil & Gas Exp. & Prod. 3x Shares ETF GUSH. After rounding down roughly equal dollar amounts to round lots of both names, our system used a tightly collared position in the iPath Series B Bloomberg Coffee Subindex Total Return ETN JO to absorb most of the leftover cash.

The worst case scenario for this portfolio (Max Drawdown) was a decline of 10.59%; the best case scenario (Net Potential Return) was a gain of 19.36%; and the more likely scenario (Expected Return) was 6.84%.

A note about the decimals: when our system crunches the data, the numbers go out to more than two decimals. We make no claim to that level of precision; cutting the numbers off at two decimal points is an aesthetic choice, as it matches how we count dollars and cents.

How That Portfolio Performed

Here's how that small hedged portfolio performed over the next six months.

Net of hedging and trading costs, this portfolio was up 13.51%, versus 10.18% for SPY over the same time frame. As you can see in the table of exited positions, the biggest contributor to the portfolio's performance was Silvergate Capital.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.