By Michael Arrington, Senior Analyst/Director of Editorial, BDS Analytics

Worldwide sales of legal cannabis re-accelerated in 2019, growing nearly 46% to almost $15 billion. The increase represents the largest yearly sales gain since Colorado launched adult-use sales in January, 2014. The growth is further magnified when compared to 2018, which only saw 17% growth.

An in-depth analysis of global markets, as well as several other insights and updates, are presented in Arcview Market Research and BDS Analytics’ 2020 update to “The State of Legal Cannabis Markets, 7th Edition,” the industry’s preeminent annual data sourcebook.

Latest Startup Investment Opportunities:

Key Data On The Global Legal Cannabis Industry

- 2019 legal cannabis sales worldwide reached $14.9 billion, up from $10.2 billion in 2018.

- Sales grew by 45.7% in 2019, compared to just 17% in 2018.

- Sales are forecast to reach $20.7 billion in 2020, representing 38.8% growth from 2019.

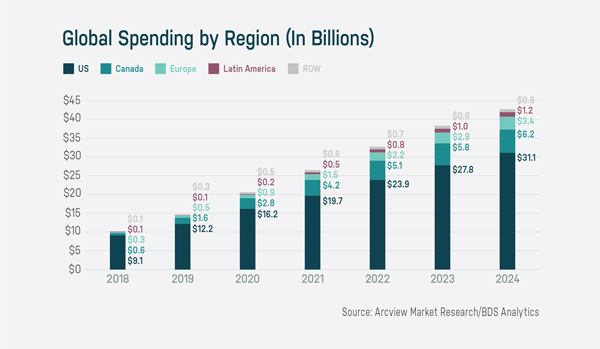

- In 2024, worldwide sales are expected to reach $42.7 billion, rising at a compound annual growth rate (CAGR) of 26.9% from 2018.

Key Data On Regional Markets Across The Globe

- The U.S. remains the largest legal cannabis market with an estimated $12.2 billion in 2019 spending. That number is expected to grow to $16.2 billion in 2020 and $31.1 billion in 2024, rising at a CAGR of 22.7% from 2018. By 2024, every U.S. jurisdiction is expected to have at least a medical cannabis program; 24 states are expected to begin legal adult-use cannabis sales by 2024 as well.

- Canadian sales are forecast to reach $1.6 billion in 2019—following a year of strong growth in adult-use spending as the provincial retail footprints expanded and supply chain constrictions eased. In 2020, the expansion of available products, including concentrates and edibles is expected to help boost sales to a total of $2.8 billion. Sales are forecast to reach $6.2 billion in 2024, with a CAGR of 48.4% from 2018.

- Spending in Europe reached an estimated $547 million in 2019 and is expected to reach $907 million in 2020 and $3.4 billion in 2024 (CAGR of 48.9% from 2018). Germany and the U.K. are expected to lead the European market with France, Italy, Switzerland and a few smaller markets contributing towards growth.

- Latin American countries reached a combined $113 million in 2019 legal cannabis sales with 78% of sales attributable to Mexico (medical-only for now) and Uruguay (the first legal adult-use market outside of the U.S.). Sales are forecast to nearly double to $204 million in 2020 and grow to $1.2 billion in 2024 (CAGR of 62.7% from 2018).

Additional details and projections covering the global cannabis industry—including insights into the investment landscape—are presented in “The State of Legal Cannabis Markets, 7th Edition” and the recently released 55-page, 2020 update to the report, now available for purchase at shop.bdsanalytics.com.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving—don’t get left behind!

Curious about what’s next for the industry and how to stay ahead in today’s competitive market?

Join top executives, investors, and industry leaders at the Benzinga Cannabis Capital Conference in Chicago on June 9-10. Dive deep into market-shaping strategies, investment trends, and brand-building insights that will define the future of cannabis.

Secure your spot now before prices go up—this is where the biggest deals and connections happen!