Highlights:

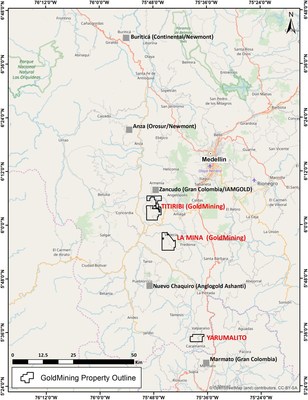

- Yarumalito acquisition will further expand GoldMining's portfolio of gold-copper projects in the Mid Cauca Belt of central Colombia;

- Total consideration will be comprised of $1,200,000, payable in common shares, and $200,000, payable in cash;

- The Mid Cauca Belt is host to several multi-million ounce gold deposits including Buritica (Continental Gold Inc.), Titiribi and La Mina (GoldMining), Nuevo Chaquiro (Anglogold Ashanti Limited – B2Gold Corp.) and Marmato (Gran Colombia Gold Corp.);

- Yarumalito hosts both bulk-tonnage, gold-copper porphyry and high-grade, intermediate sulphidation epithermal systems with six geophysical and geochemical targets identified on the Project;

- 18,540 m of historic drilling (55 holes) completed on the Project, primarily focused on two targets; and

- Upon closing, GoldMining intends to engage an independent qualified person to verify historic exploration results and undertake a resource estimate assuming sufficient sampling density, which will be documented in an updated technical report.

VANCOUVER, Nov. 4, 2019 /PRNewswire/ - GoldMining Inc. (the "Company" or "GoldMining") (TSX:GOLD, OTCQX:GLDLF) is pleased to announce that it has entered into an agreement (the "Agreement") with Newrange Gold Corp. ("Newrange"), to indirectly acquire a 100% interest of the Yarumalito Gold Project ("Yarumalito" or the "Project") located in central Colombia.

Amir Adnani, Chairman of GoldMining, commented: "With our third acquisition in the Mid Cauca Belt, we continue to consolidate a district-scale property package, which we believe will provide optionality through future exploration, joint venture or cash-generating transactions."

Garnet Dawson, CEO of GoldMining, commented: "Our team believes the Mid Cauca Belt of Colombia is one of the more underexplored gold-copper belts in the world. Yarumalito has seen significant exploration by Newrange and senior mining company partners, including 18,540 metres of drilling in 55 holes, metallurgical testwork and historic small-scale underground development and production by the original owner. Upon closing, we plan to commission an updated technical report for the Project as well as identify opportunities for follow-up exploration.

The Agreement

Newrange will retain a 1% net smelter returns royalty, which can be purchased by GoldMining at any time before the completion of a feasibility study on the Project for total consideration of $1,000,000.

The GoldMining Shares to be issued under the transaction are subject to a four month and one day hold period and certain additional resale restrictions pursuant to the terms of the Agreement.

The transaction is subject to customary closing conditions, including receipt of requisite third party and regulatory consents and approvals. The parties currently expect closing to occur by December 2, 2019.

The Project

Table 1: Selected historic drill intersections from the Balastreras-Escuela targets.

GoldMining intends to engage an independent qualified person to, among other things, complete a technical report for GoldMining on the Project, including verifying historic exploration results and, assuming sufficient sample density, completing a resource estimate for the Project.

GoldMining expects future exploration programs will look to expand mineralization outlined at the Balastreras-Escuela targets and drill test the remaining four geophysical and geochemical anomalies.

Qualified Person

About GoldMining Inc.

Forward-looking Statements

SOURCE GoldMining Inc.

© 2026 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

To add Benzinga News as your preferred source on Google, click here.