The Q3 2022 Global X China Sector Report can be viewed here. The report provides macro-level and sector-specific insights across the eleven major economic sectors in China’s equity market. In addition to a summary of developments in Q3, we also offer our outlook for the current quarter and beyond. For a broader look at Global X’s international funds, please see the latest International Outlook: Q4 2022.

Q3 Summary: Investors Focus on Zero-COVID Policy

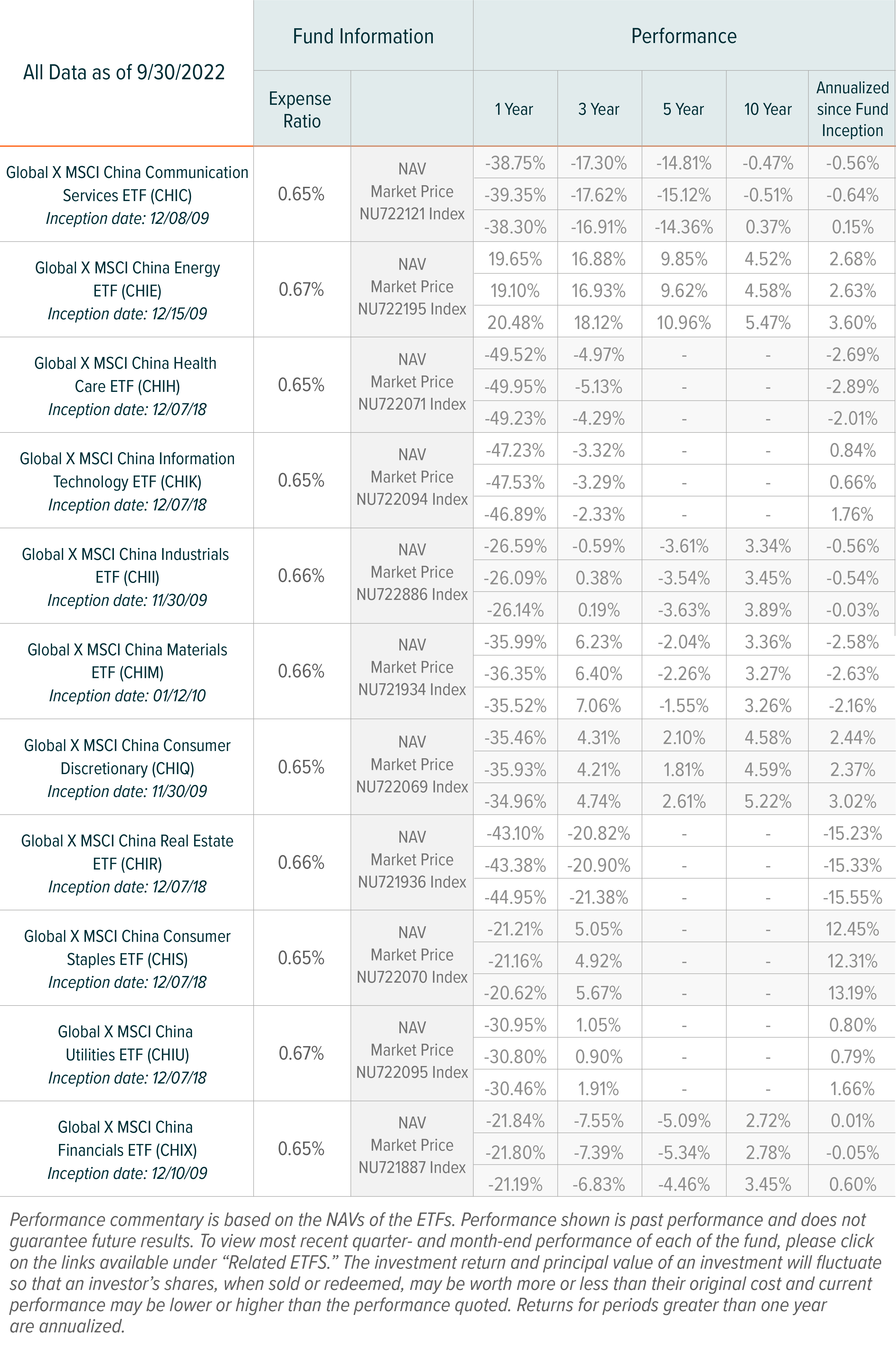

Performance shown is past performance, based on the NAVs of the underlying sector ETFs and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. To see performance current to the most recent month- or quarter-end for each of the funds, please click the fund name below.

Chinese equities tumbled again in Q3 2022 amid a backdrop of elevated “risk-off” sentiment and geopolitical uncertainty. China’s long-term policy direction was top of mind in Q3 as the 20th Party Congress in October drew closer and closer. Speculation and rumors over the expected outcome of the 20th Party Congress had mixed effects on investor sentiment throughout the quarter. The idea that China was waiting until after the 20th Party Congress to relax the zero-COVID policy was debated among analysts.

In terms of macro performance, China managed to beat expectations with its Q3 year-on-year (YoY) GDP growth of 3.9%, but other data points revealed areas of weakness. While retail sales grew 2.5% YoY in Q3, undershooting expectations in a sign of weak consumer appetite, exports beat expectations at 5.7% YoY growth.1

One of the biggest highlights of Q3 was the signing of a deal between US and Chinese regulators to allow the US side to inspect audit papers of Chinese companies listed on US exchanges. A conflict between the Holding Foreign Companies Accountable Act (HFCAA) and Chinese law meant Chinese American Depositary Receipts (ADRs) were on course to be delisted in 2023 or 2024. This agreement is a positive breakthrough because it greatly reduces the risk of that.

However, implementation should be watched closely. If the US and China cannot overcome differences in interpretation of how the agreement should be implemented, the risk of delisting could increase again. This likely led to elevated volatility in Chinese equities in the quarter.

Returns greater than one year are annualized.

Q4 Insights: Finding Signals Amid the Noise

In mid-October, observers from around the world tuned into the 20th Party Congress to get a sense for China’s direction. As a meeting first and foremost to determine leadership and long-term direction, the 20th Party Congress did not offer much direct insight into short-term policy, though some clues could certainly be gleaned from it.

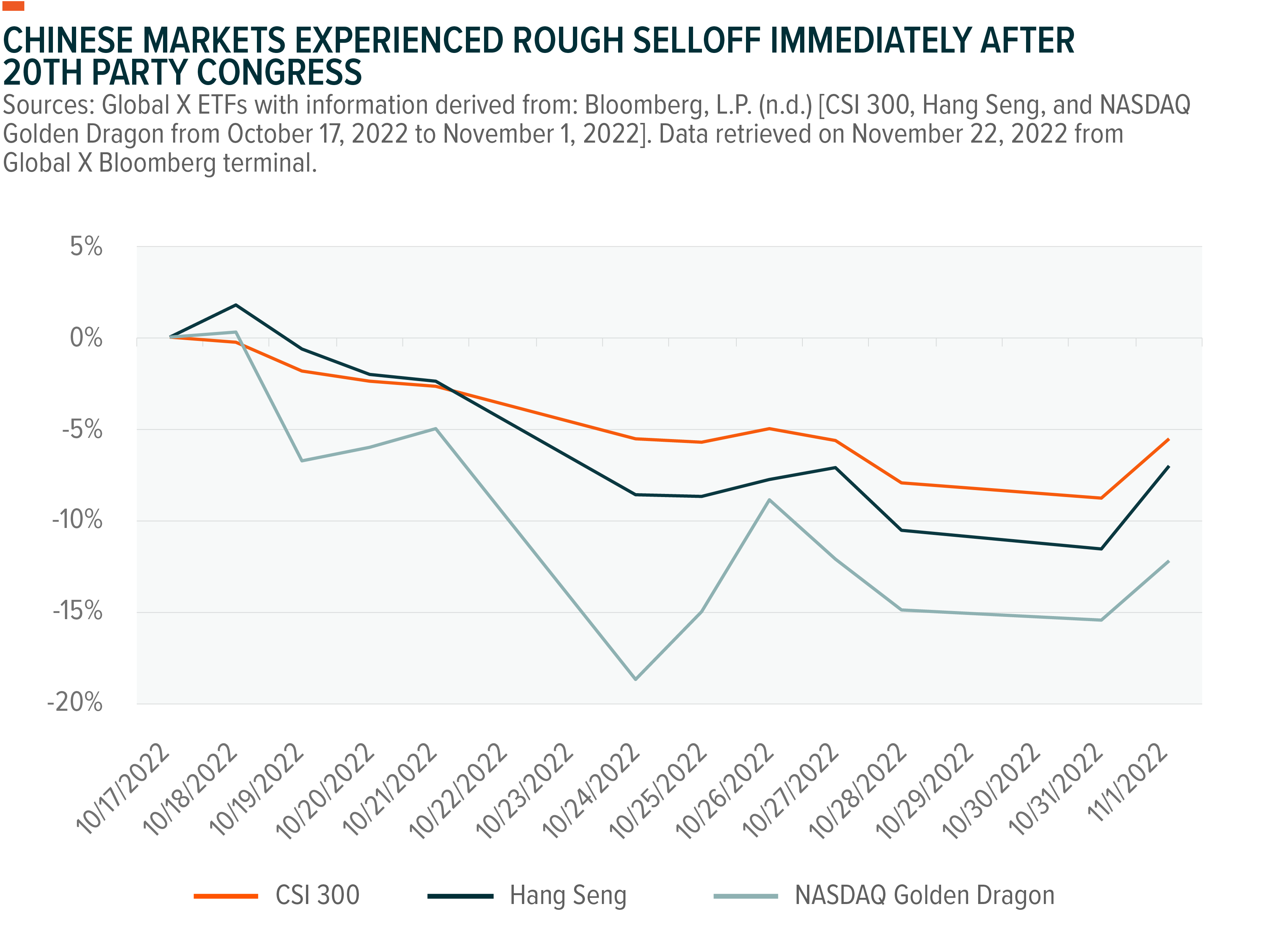

Chinese equities experienced an intense selloff on a scale not seen since 2008 on the Monday following the 20th Party Congress. The CSI 300 Index fell by -5.39%, the Hang Seng by -8.32%, and the NASDAQ Golden Dragon by -10.50% in the week following Oct 21, after the Party Congress closing ceremony. This was in part a reaction to the new Standing Committee (SC), a seven man group that handles the highest level of decision-making in China, which leans heavily in President Xi’s favor. The promotion of Li Qiang and Cai Qi to the SC was not expected by most analysts. Meanwhile, the retirement of Premier Li Keqiang, a seasoned Beijing University-trained economist, opened up uncertainty on what to expect from the incoming Premier.

The 20th Party Congress began on Oct 16 and concluded on Oct 22.

Going forward, investors may factor in a risk premium for Chinese securities as they weigh the risks presented by a SC that is not balanced between factions.

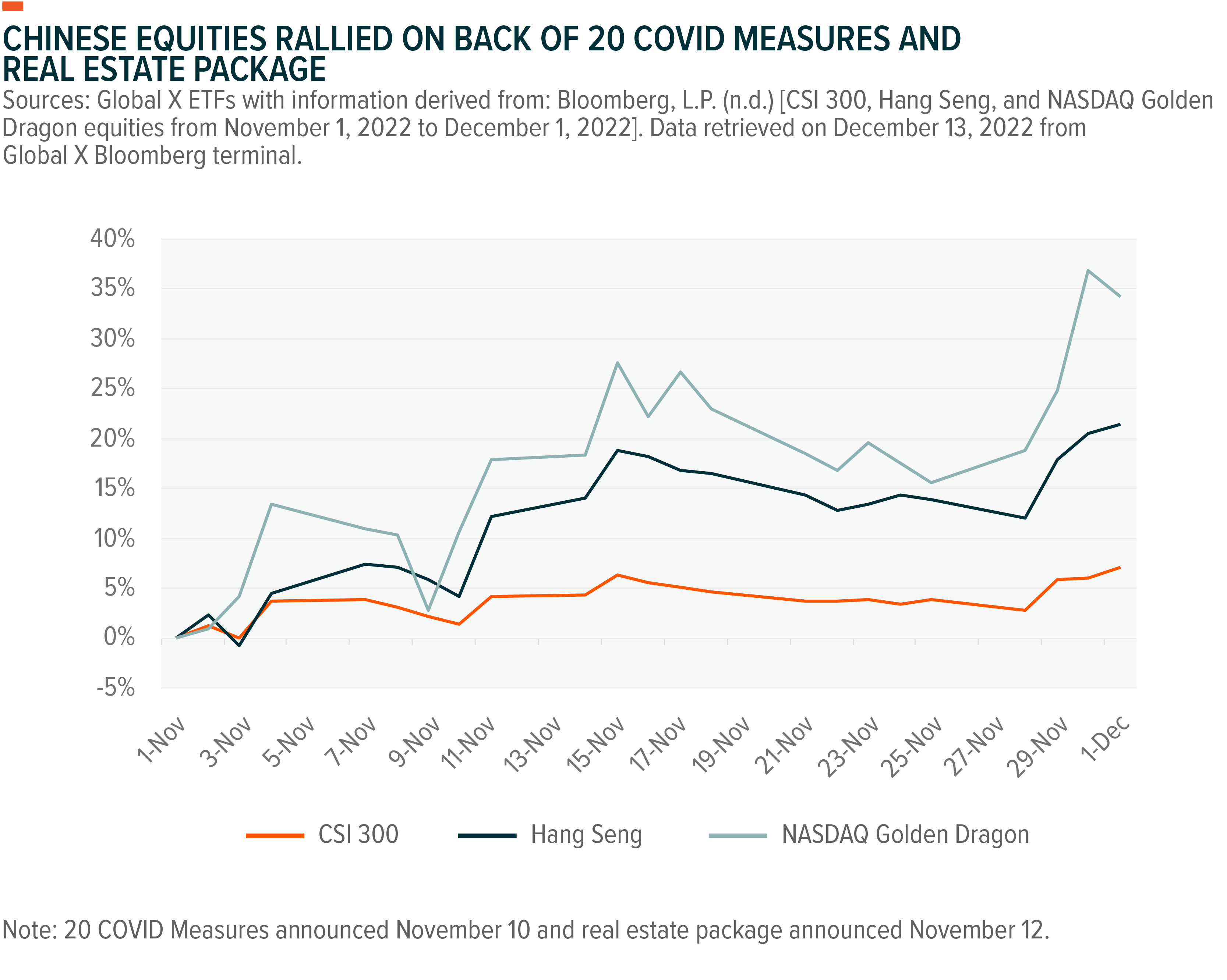

However, since late October’s selloff, market sentiment has turned positive in the first two weeks of November with the announcement of 20 measures to optimize zero-COVID, a rescue package for the embattled property sector, and mild reconciliatory tones in a meeting between Xi and Biden. We believe there are some reasons to be cautious about the current rally. Chinese equities are cheaply valued, and we continue to believe a recovery over the long-term is likely, but there are some factors that could potentially elicit negative market reactions in the short-term.

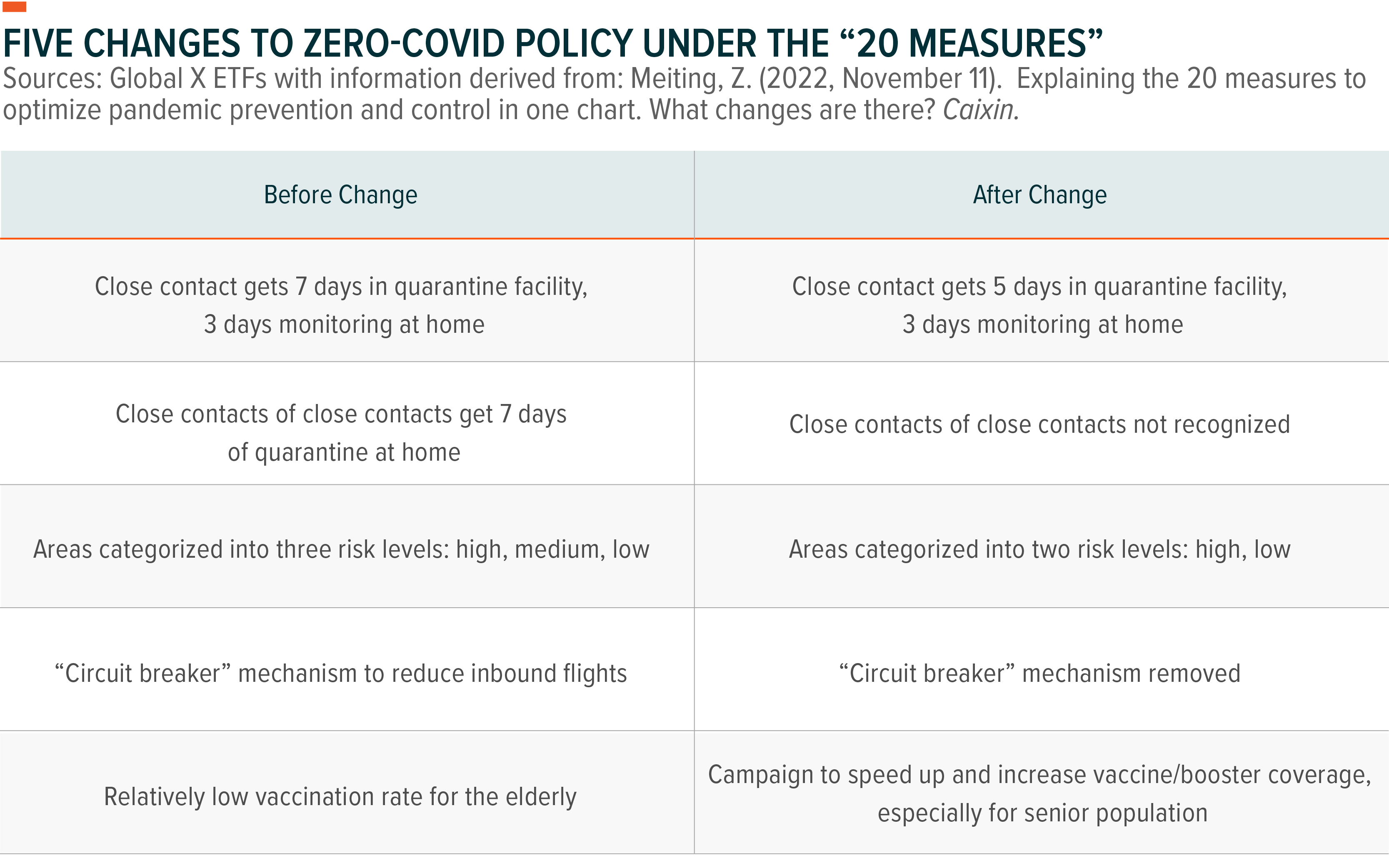

The direction of China’s zero-COVID policy is a paramount concern for investors. Markets are reacting well to the “20 Measures to Optimize Zero-COVID” policy, which will partially ease tracing, mass-testing, and quarantine requirements. The key word here is “optimize.” Section 4.1 of the announcement by the National Health commission goes out of its way to say that the optimization measures are meant to make dynamic zero-COVID more scientific and precise, and that government officials should not allow them to be misread as reopening or “lying flat.” This is not meant to be a sudden pivot.

Simply put, China wants to open up on its own terms and not have the narrative changed on its behalf. We expect reopening to be a very gradual process with some trial-and-error along the way.

With this in mind, it is possible that investors who are excited now could become spooked if one city experiences a surge in cases and subsequently flinches. To some extent, we are already seeing this scenario unfold in the cities of Shijiazhuang, Beijing, and Guangzhou, at the time of writing. Rumors about a reopening committee drove a rally in late October and it is very possible unverified rumors could push equities in the other direction in Q4. Furthermore, state media and government language continues to emphasize adherence to “dynamic zero-COVID.”

We maintain the belief that COVID restrictions will be significantly eased around the end of the first half of 2023. Instead of trying to read into the tea leaves of state media articles and social media posts, we are also looking at pragmatic constraints that make easing more necessary, such as the fiscal pressure faced by local governments. As the property sector experiences headwinds, local governments that have relied on land sales for revenue are dealing with lower cash from lower land sales.

Fiscal pressure from mass-testing, tracing, and quarantines is exacerbating local government finances, as demonstrated by the accounts receivable at China’s 11 main PCR testing labs surging near 90% in the month of September.2 With this pressure mounting, it will become increasingly clear that further reopening is the pragmatic choice. Further reopening beyond the 20 measures could be a more reliable driver for a sustained recovery by Chinese equities in Q2 and Q3 2023.

On the earnings front, the results rolling in for Q3 so far lean more towards negative surprises than positive. According to Bloomberg, as of Nov 18, 47.54% of the earnings surprises for the CSI 300 Index were negative in Q3.3 With the macro headwinds blowing on the economy, there was not a lot of room for surprises to the upside.

Overall, the Singles’ Day shopping festival data for 2023 came in anemic, with Alibaba notably choosing not to disclose its gross merchandise value (GMV) for the first time. However, amid the gloomy figures, JD.com stood out for beating analyst expectations with an 11.4% increase in Q3 revenue, despite low desire to consume.4

Thus far in Q4, October data is pointing towards continued difficulties but also continued easing. China’s inflation reading came in at 2.1% in October, relatively low compared to the rest of the world.5 While the youth unemployment rate remained concerningly high at 17.9% in October, unmoved from where it was in September, we believe this gives the government an incentive not to engage in dramatic regulatory moves against tech companies as it did in 2021.

Aside from the 20 measures to optimize zero-COVID, the most salient form of easing we are seeing now is the 16-point Real Estate rescue package. The measures include loans for developers, fundraising for construction companies, extensions on existing developer loans, support for bond issuance by quality developers, assistance in getting incomplete projects through the finish line, encouragement for banks to negotiate mortgage with homebuyers, leniency on credit score adjustments for homebuyers and more.6

The package should offer a sigh of relief for the embattled sector and for the broader economy, and Chinese equities are already reflecting that and may continue to reflect that through the rest of Q4. Over the long run, it is worth remembering that a recovery towards the state of the sector before the Evergrande crisis may not be feasible nor even desirable. When the property giant Evergrande began facing liquidity issues in August 2021, a chill gradually spread out throughout the whole sector. Homebuyers who once operated under the paradigm of constantly rising prices seem to be adjusting their expectations, and that in turn could continue to prevent house sales from rising dramatically in 2023. In the grand scheme of things, finding more sustainable engines of growth than Real Estate should be better for China’s economic well-being.

Conclusion

Q4 will mark the end of a challenging year for China’s economy. However, the 20 measures to optimize zero-COVID could be the sign of a major shift in 2023. On top of that, the Real Estate rescue package is offering short-term relief for a sector that has soured investor sentiment for more than a year. A November meeting between General Secretary Xi and President Biden is also being seen as a first step for increased channels of communication between the US and China. As we approach 2023, these three trends are worth watching for investors interested in the Chinese equity market. Attractive valuations and a potential shift in COVID stance could also be a catalyst for Chinese equities in the near term.

Related ETFs

CHIC: The Global X MSCI China Communication Services ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI China Communication Services 10/50 Index.

CHIE: The Global X MSCI China Energy ETF seeks to invest in large-, mid- and small-capitalization segments of the MSCI China IMI Index that are classified in the Energy Sector as per the Global Industry Classification System (GICS).

CHIH: The Global X MSCI China Health Care ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Health Care Sector as per the Global Industry Classification System (GICS).

CHII: The Global X MSCI China Industrials ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Industrials Sector as per the Global Industry Classification System (GICS).

CHIK: The Global X MSCI China Information Technology ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Information Technology Sector as per the Global Industry Classification System (GICS).

CHIM: The Global X MSCI China Materials ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Materials Sector as per the Global Industry Classification System (GICS).

CHIQ: The Global X MSCI China Consumer Discretionary ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Consumer Discretionary Sector as per the Global Industry Classification System (GICS).

CHIR: The Global X MSCI China Real Estate ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Real Estate Sector as per the Global Industry Classification System (GICS).

CHIS: The Global X MSCI China Consumer Staples ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Consumer Staples Sector as per the Global Industry Classification System (GICS).

CHIU: The Global X MSCI China Utilities ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Utilities Sector as per the Global Industry Classification System (GICS).

CHIX: The Global X MSCI China Financials ETF seeks to invest in large- and mid-capitalization segments of the MSCI China Index that are classified in the Financials Sector as per the Global Industry Classification System (GICS).

Please click the fund name above for current fund holdings and important performance information. Holdings are subject to change.

Image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.