Last month, Global X attended the 2023 New York International Auto Show (NYIAS). The 123rd iteration of the auto show spanned over one million square feet of exhibit space with hundreds of vehicles on display.1 The NYIAS is where automakers showcase their newest models, providing an overview of key automotive trends. This year, electric vehicles (EVs) were prominently featured, with many automakers dedicating primary signage and presentations to EV models and technologies.

In this piece, we share our takeaways from the conference, with the NYIAS reaffirming our conviction that the future of transport is increasingly electric.

Key Takeaways

- Electric vehicles are increasingly the focus of innovation for traditional automakers, with most original equipment manufacturers (OEMs) prominently displaying upcoming EV models.

- Automakers are making significant efforts to educate potential buyers on EVs and charging system capabilities in order to reduce anxieties around EV ownership.

- New York State’s Drive Clean Rebate Program and New York City’s efforts to electrify public vehicles demonstrate how government policies can create tailwinds for EV adoption.

Automakers Expanding EV Offerings in Latest Lineups

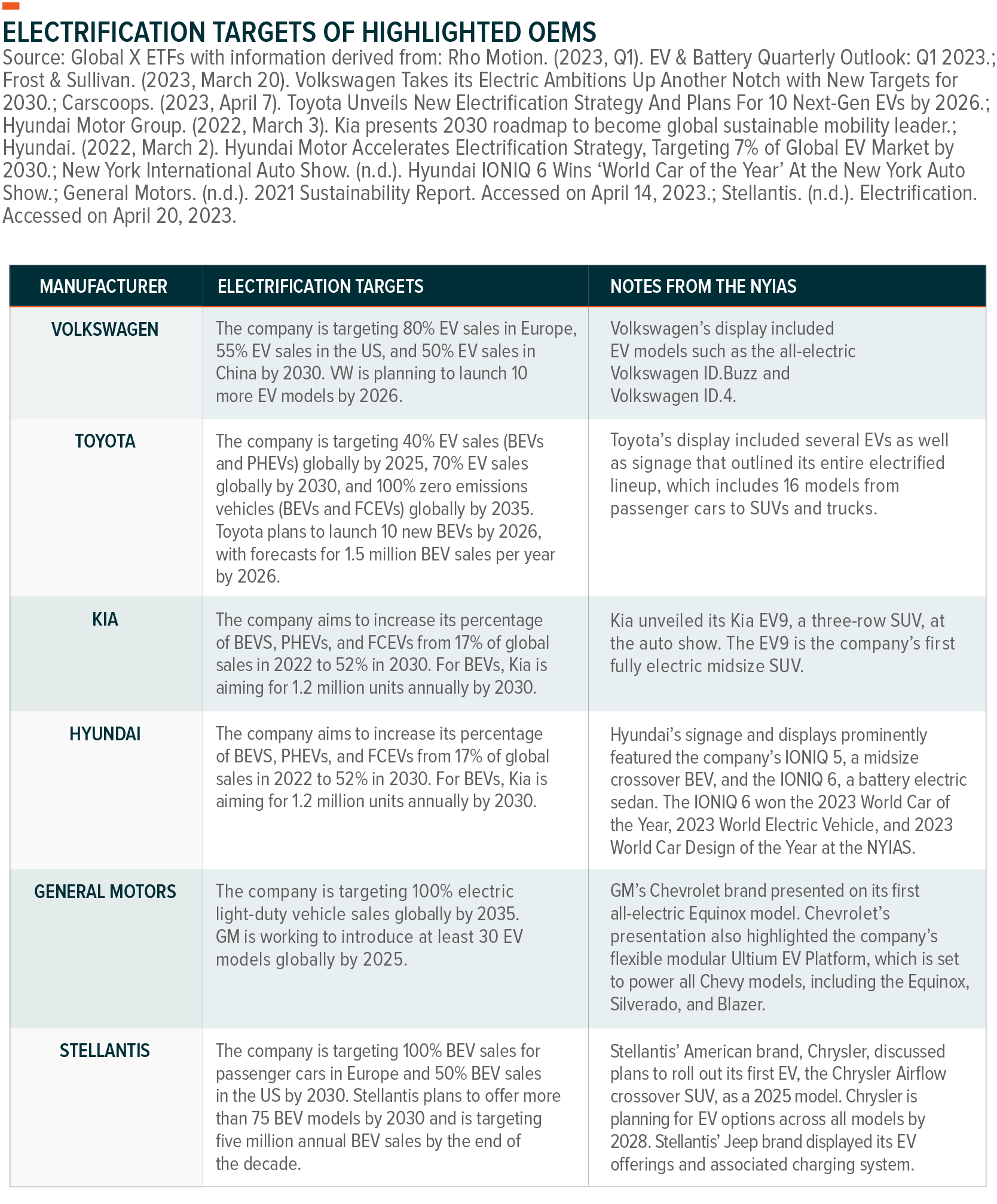

OEMs showcased an estimated 216 light-duty passenger cars, trucks, crossovers, and SUVs at the NYIAS.2 Of these, 34 models were plug-in hybrid EVs (PHEVs), 19 were battery EVs (BEVs), and two were fuel cell EVs (FCEVs).3 While this means that EVs accounted for around 25% of vehicles on display, their presence felt much larger, with many OEMs prominently displaying their EV offerings on primary signage. For example, walking into the auto show, attendees were greeted with large banners for Toyota’s BZ4X, an all-electric SUV, Kia’s EV9, a three-row battery electric SUV, and Hyundai’s IONIQ 5 and IONIQ 6 battery EVs. Toyota, Jeep, a division of Stellantis, and Chevrolet, a division of General Motors, were among the OEMs that dedicated much of their signage and displays to their upcoming EV lineups. The substantial focus on EVs aligns with OEMs’ plans to electrify their fleets.

Furthermore, two of the most anticipated reveals at the auto show were EVs. Dodge, a division of Stellantis, introduced the Dodge Ram 1500 REV in its production form. The model, which is the first EV version of the Ram Truck, is expected to be available starting in Q4 2024.4 Kia unveiled its Kia EV9, a three-row SUV that is one of the company’s largest-ever models.5

In our view, the debuts of these two large vehicles point to companies making progress in electrifying the SUV and truck segments that are most popular with US consumers. Combined, the SUV and truck segments accounted for nearly 80% of US auto sales in March 2023.6 The SUV segment is also gaining market share in other major auto markets, accounting for more than 50% of passenger vehicle sales in India in 2022 and nearly 50% of new vehicle sales in Europe over H1 2022.7,8

Education on EV Range and Charging Essential to Reducing Consumer Anxiety

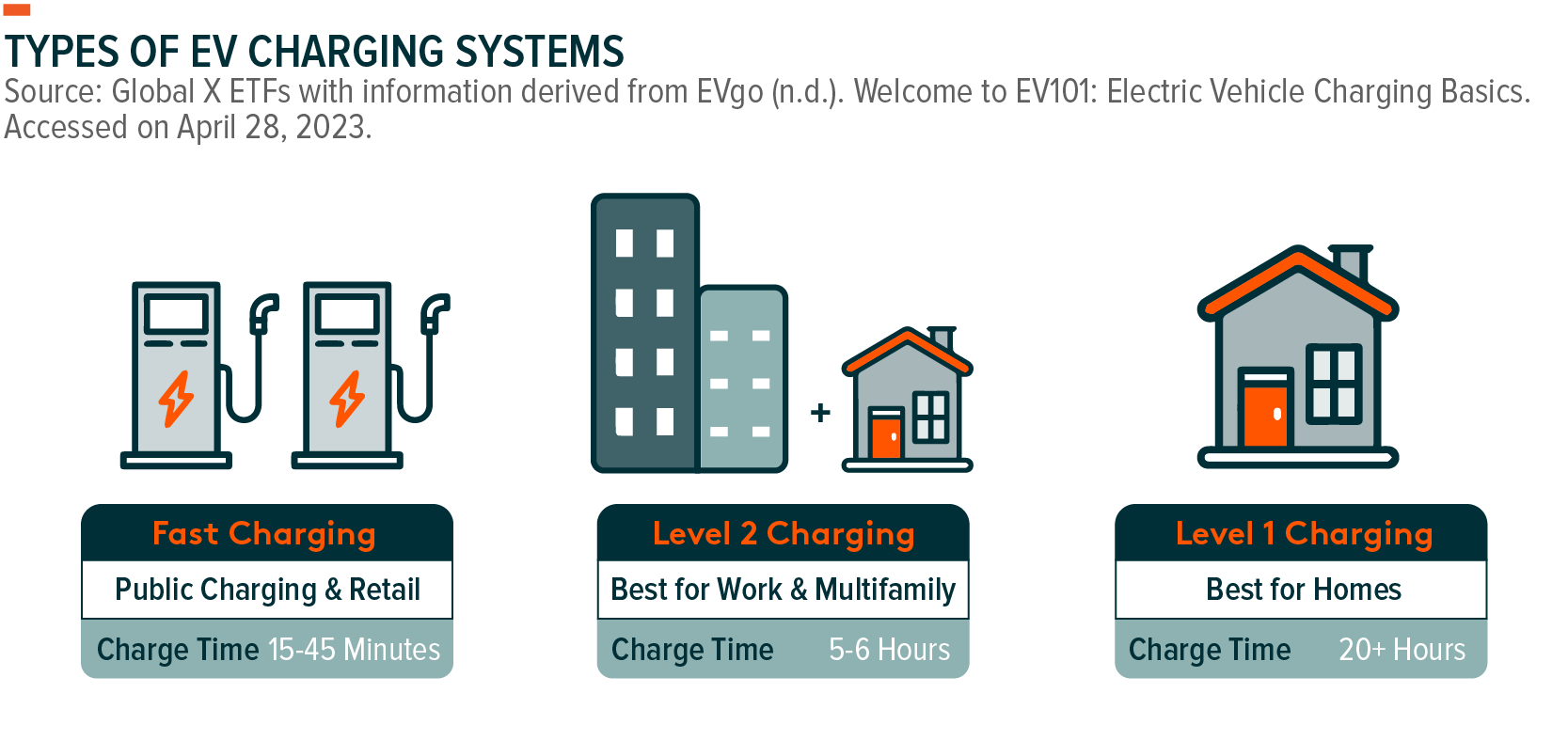

OEMs also used the auto show to educate potential auto buyers on EVs’ drivability, range, and charging systems. EV demos onsite included ride-alongs in Hyundai’s Ioniq EVs and Ford’s Mustang Mach-E, as well as test drives of EVs from Chevrolet, Volkswagen, BMW, Nissan, and Kia. OEMs such as Volkswagen, Jeep, and Chevrolet also had notable displays on EV charging systems that provided overviews of estimated EV charging times and potential benefits. For example, the Jeep Brand Level II EV Home Charging Station can be installed indoors or outdoors, can be remotely controlled via built-in wifi connectivity and a mobile app, and can charge up to six times faster than Level 1 charging systems.9

In addition, the New York Power Authority and New York State Energy Research & Development Agency (NYSERDA) had an entire exhibit dedicated to educating consumers on the different levels of EV charging systems and how EVs could fit into different types of car users’ day-to-day lives. EV charging systems range from Level 1, which take the longest to charge and are built for home charging, to Level 3, which are found at public fast charging stations and can fully charge an EV in as little as 15 minutes.10 In our view, efforts by OEMs and local governments to communicate advancements in EV range and charging infrastructure are essential in reducing concerns that some consumers still have around EV ownership.

New York Presents Prime Example of Governments Driving EV Adoption

In addition to EV charging, departments from the State of New York also had materials to educate potential buyers on the state’s Drive Clean Rebate. In the state of New York, EV buyers can get a rebate of up to $2,000 for EV purchases or leases.11 The rebate can be combined with the federal EV tax credit of up to $7,500 for purchases of qualified new EVs and up to $4,000 for purchases of qualified used EVs.12

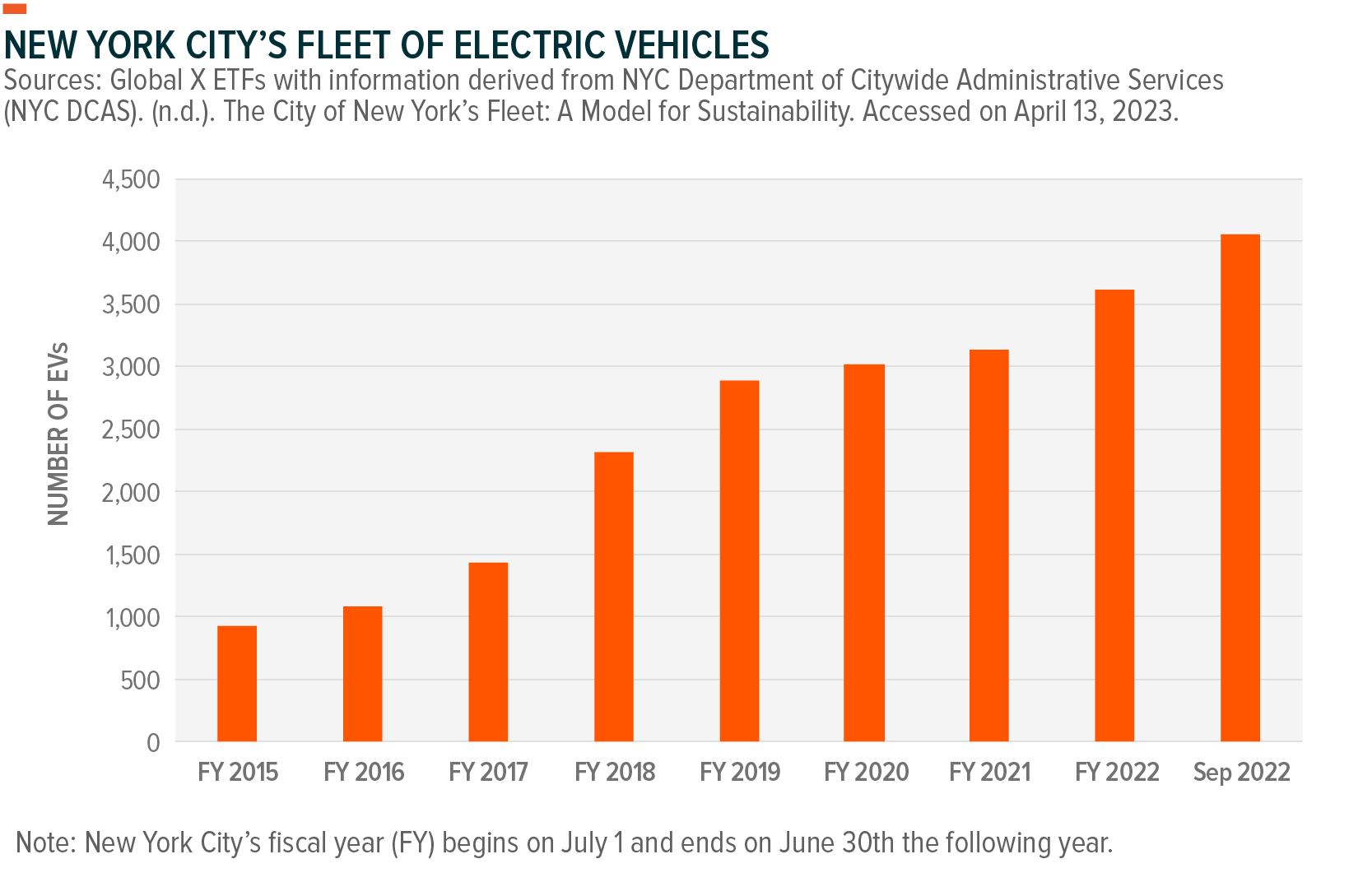

The City of New York also had displays showcasing some the city’s fully electric buses, utility vehicles, taxis, and sanitation trucks. Notably, NYC’s fleet of electric vehicles grew from 929 in 2015 to more than 4,050 by September 2022, with the city reaching its 4,000 EV target more than three years ahead of schedule.13,14 NYC is targeting electrifying its municipal fleet of around 30,000 vehicles by 2035.15

In our view, New York’s state and local governments offer a key example of how sub-national governments can create additional tailwinds for EV adoption. State-level financial incentives for EV buyers can add onto the strong policy tailwinds at the federal level. EV purchases from city-level governments also present a growing potential customer segment for automakers.

Conclusion: NYIAS is Testament to EV Revolution

As expected, the NYIAS showcased the latest innovation in EVs and EV charging infrastructure. The substantial progress that OEMs are making on electrifying their fleets, combined with strong policy tailwinds, support robust EV sales growth outlooks. EVs are forecast to reach a 25% global sales penetration rate in 2025, 42% in 2030, and 62% in 2035.16 As the future of transport becomes increasingly electric, companies throughout the electric vehicle value chain could benefit, including EV manufacturers, EV battery producers, and lithium miners.

Related ETFs

DRIV – Global X Autonomous & Electric Vehicles ETF

LIT – Global X Lithium & Battery Tech ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

1. New York International Auto Show. (n.d.). 2023 New York International Auto Show. Accessed on April 14, 2023.

2. New York International Auto Show. (n.d.). Vehicles. Accessed on April 14, 2023.

3. Ibid.

4. Stellantis. (2023, April 5). All-new, All-electric 2025 Ram 1500 REV Unveiled at New York International Auto Show with Targeted Range of up to an Unsurpassed 500 Miles.

5. InsideEVs. (2023, April 5). 2024 Kia EV9 Makes US Debut, Will Be Built in Georgia From 2024.

6. Marklines. (2023, April 4). USA – Automotive Sales volume, 2023.

7. Reuters. (2023, April 13). SUVs boost India’s passenger vehicle sales to record high in FY23.

8. JATO. (2022, August 11). H1 2022: Europe by Segments.

9. Mopar. (n.d.). Jeep Brand Plug-In Charger. Accessed on April 20, 2023.

10. EVgo. (n.d.). Welcome to EV101: Electric Vehicle Charging Basics. Accessed on April 28, 2023.

11. New York State Energy Research & Development Authority (NYSERDA). (n.d.). Drive Clean Rebate for Electric Cars. Accessed on April 27, 2023.

12. Ibid.

13. NYC Department of Citywide Administrative Services (NYC DCAS). (n.d.). The City of New York’s Fleet: A Model for Sustainability. Accessed on April 13, 2023.

14. Electrek. (2022, September 26). NYC Surpasses 4,050 city-owned electric vehicles, meeting its target 3 years ahead of schedule.

15. NYC Department of Citywide Administrative Services (NYC DCAS). (n.d.). Fleet Sustainability. Accessed on April 13, 2023.

16. Rho Motion. (2023, Q1). EV & Battery Quarterly Outlook: Q1 2023.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.