The market’s mood hung on every syllable from the Federal Reserve (Fed) in 2022, and 2023 may rhyme. Different for the Fed in 2023 is finding a balance between curbing inflation and expanding economic weakness. Consensus expects a shallow but potentially longer recession. The U.S. economy held up reasonably well in 2022, propped up by consumer strength, but cracks are forming, including slowdowns in consumption and the labor market. Forever forward looking, markets typically bottom prior to economic data improving. Year-to-date, forward PE ratios on the S&P 500 Index have contracted and there may be some further multiple compression as economic growth uncertainty continues to weigh on valuations.

The Fed may take its foot off the pedal when it looks like inflation has been tamed, which will likely coincide with markets finding a bottom. With the market hoping for a pause, we believe a critical moment for portfolio positioning will occur when the Fed’s language shifts from the path of rate hikes to reaching its terminal rate. But hope is not an investment strategy we support. Mood swings are understandable in this market environment, but it’s the even-keeled investor who typically prevails. Growth opportunities are not limited to “ideal” market conditions, and some of the best investments are made during periods of dislocation.

Portfolio Positioning: Markets Go Up and Down, but Innovation Never Stops

This challenging macro backdrop forces investors to balance near-term volatility with long-term opportunities. In the near term, we expect a bumpy ride for markets.

- We favor quality companies with strong cash flows. The risk of a deeper economic contraction, lower liquidity, and declining earnings growth are all factors that could limit a meaningful recovery in risk assets.

- The U.S. consumer’s health will likely deteriorate with inflation elevated and the job market showing weakness. These conditions favor defensive sectors such as Health Care, Consumer Staples, and Utilities, while negatively impacting cyclical sectors, like Consumer Discretionary.

- Globally, a peak in the U.S. dollar could create attractive opportunities. China is a focus due to its gradual reopening from COVID-19 lockdowns, which could spur economic growth. In Europe, energy reserves are high, which could boost sentiment.

- Declining asset class correlation can reinforce bonds as a volatility hedge in a balanced portfolio. The outlook for longer duration products in fixed income could improve as central banks slow their trajectory of rate hikes. However, we expect fixed income to remain challenged in the first half of 2023 as policy rates rise to the terminal rate.

Even in a slower economy, we are in an uncharted era of new technologies disrupting paradigms, shifting consumer behaviors, shaping changes to business models, and transforming how we interact with our physical environment. This year’s pullback in growth equities is an opportunity for long-term investors, especially as inflation begins to decline and the pace of rate hikes slow.

We favor themes like Cybersecurity, Clean Energy, Lithium, and U.S. Infrastructure Development, where demand is likely to expand despite slower global economic growth.

- Cybersecurity: Cyberattacks across all industry sectors increased by 28% year-over-year (YoY) in Q3 2022, a trend that is expected to continue as cloud adoption increases, end-point devices gain penetration, and geopolitical conflicts persist.1 These pressures are likely to drive greater spending at the corporate and government levels.

- Clean Energy: The Inflation Reduction Act (IRA) will direct nearly $370 billion towards bolstering U.S. climate change mitigation. Accelerated adoption of cleantech and renewable energy is essential as the world takes steps toward net-zero emissions.

- Lithium: In November 2022, prices for battery grade lithium carbonate in China hit an all-time high of $85,058 per tonne, eclipsing the record set just a month prior.2 Lithium pricing trends are deeply rooted in the transportation segment’s ongoing shift toward electrification. Elevated lithium prices boost the top and bottom lines for relevant miners.

- U.S. Infrastructure Development: The 2021 “infrastructure trade” may have passed, but the unwind has created a potential buying opportunity. The Bipartisan Infrastructure Bill from 2021 only accounted for $1.2 trillion of the estimated $2.6 trillion in infrastructure spending over the next 10 years, and private sector investment may be positioned to help fund the shortfall.3

Slow, Pause, Pivot: An Investor’s Guide to the Fed’s Next Moves

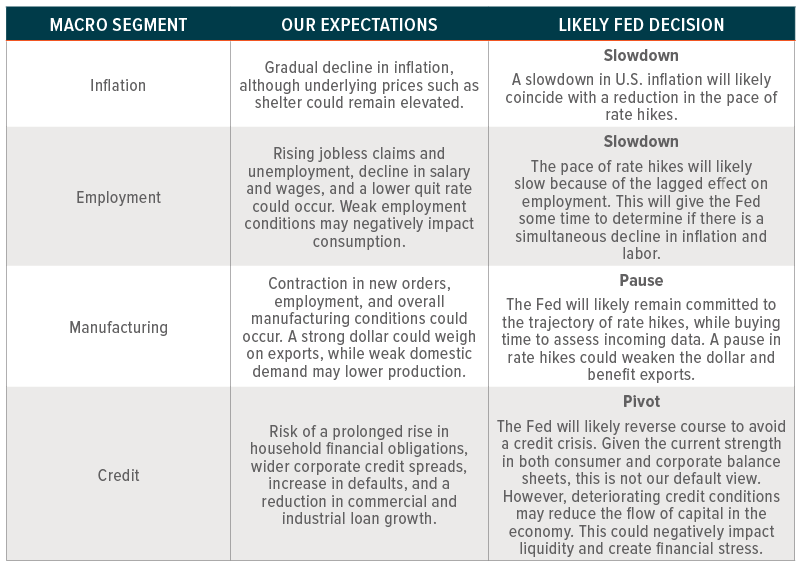

Inflation, employment, manufacturing, and credit are near-term variables that could impact the Fed’s rate trajectory. We expect the Fed to continue to raise rates during the first half of 2023 and then maintain rates at a higher level throughout much of the year. The U.S. terminal rate is expected to peak around 5%, and markets are starting to price in a slower pace of rate hikes in 2023. While the terminal rate gives investors reason for optimism, the approach to it comes at a cost: slowing economic growth.

The table below highlights our expectations for inflation, employment, manufacturing, and credit. We also highlight the Fed’s potential rate response: slow, pause, or pivot. In the sections that follow, we go into detail about each of these areas.

Inflation: Gradual Decline Expected, Shelter Risks Remain

After surging over the past two years, aggregate inflation in the U.S. is at 7.7%, slightly lower than aggregate global inflation at 9%.4 We expect global inflation to gradually decline in 2023 amid reduced base effects due to normalized supply chains, reduced shipping costs, and lower oil and commodity prices. Within the U.S., wage growth has not kept pace with inflation and expectations for inflation normalization has fed into more muted wage growth negotiations.5 We believe this is likely to help reduce the risk of a price-wage spiral.

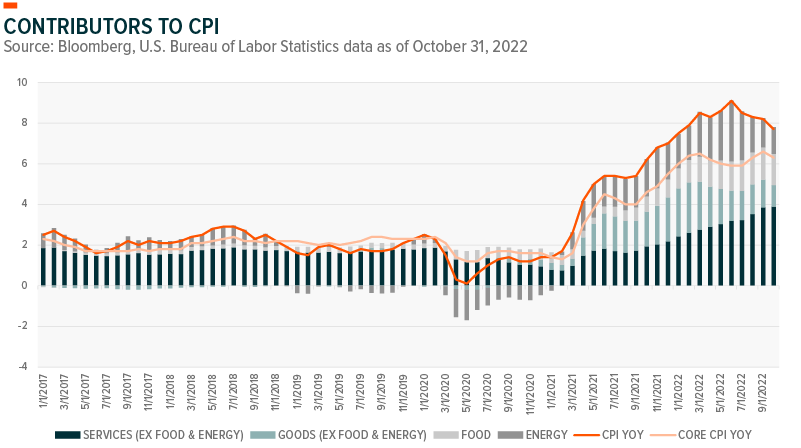

The chart below shows that, initially, energy and goods contributed the most to the rise in U.S. inflation pressures. Severe supply-demand imbalances were compounded by supply chain disruptions. As supply chains untangled and the world reopened, consumers shifted their spending to services. Over the last year, services inflation increased from 31% of headline inflation to 50%.6 Higher wages have a direct impact on services costs, making this area of inflation more susceptible to the risk of a price-wage spiral.

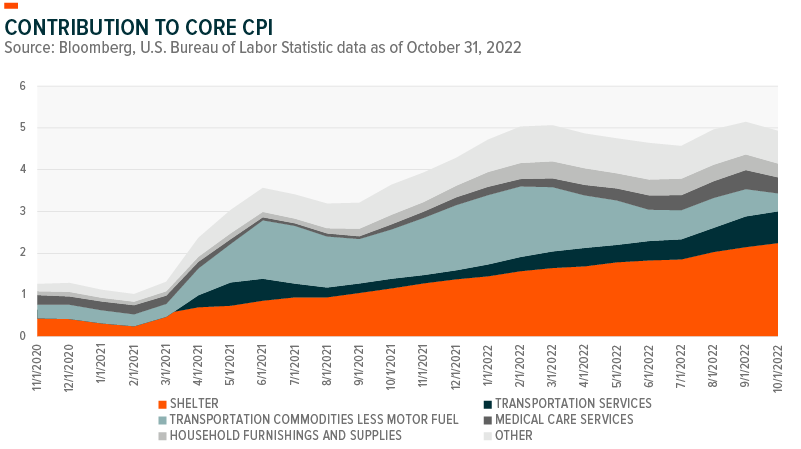

Shelter remains one of the biggest U.S. inflationary concerns because it represents about 40% of the Consumer Price Index (CPI) basket. Shelter prices rose 6.9% in October from a year ago, the highest annual level since 1982, and contributed over half of the monthly CPI increase.7 The U.S. housing market is starting to slow, but rental prices may remain elevated with high home prices and mortgage rates.

Food and energy are also key components to monitor given that they tend to be important in shaping expectations for future inflation, which can become self-fulfilling. Russia’s war in Ukraine continues to wreak havoc on commodities supplies resulting in spiking energy and food prices across the globe. With no end to the war in sight, we expect food and energy prices to remain elevated and volatile.

Employment: Cooling Signals as Layoffs Rise

The strong U.S. labor market contributed to elevated inflation. The U.S. economy added 263,000 jobs in November, roughly in line with previous months, boosted by gains in service-oriented areas including leisure and hospitality, and health care.8 The ratio of job openings to unemployed workers remains near its highest level in more than two decades. However, there are starting to be signs of moderation in the labor market. Job openings edged down in November and wage growth among job switchers decelerated.9 Improved balance between labor supply and demand could lead to slower wage growth, bolstering the case for a slower pace of rate hikes. On an encouraging note, wage growth in hospitality and leisure, food services, retail, and manufacturing started to slow from peak levels, according to data from the U.S. Bureau of Labor Statistics, potentially reducing inflationary pressures.

We believe unemployment is likely to rise in 2023 as companies focus on operational efficiency. During the Q3 earnings season, S&P 500 companies reported their fifth straight decline in profit margins.10 Higher wages ate into margins with the Employment Cost Index (ECI), a quarterly measurement of the level of average costs per hour worked, rising 5% for the 12-month period ending September 2022, versus a 2.1% rise in the prior year.11

In aggregate, sales growth has not kept pace with headcount and labor costs. Companies are starting to reduce headcount as the demand outlook softens. In November, the number of news mentions of job cuts, firings, and layoffs spiked above 2020 levels. Layoffs and hiring freezes have so far been predominantly in technology jobs, and, as shown in the chart below, layoffs in this area are on track to exceed Q2 2020 levels.

Weakening Consumer Impacting Demand

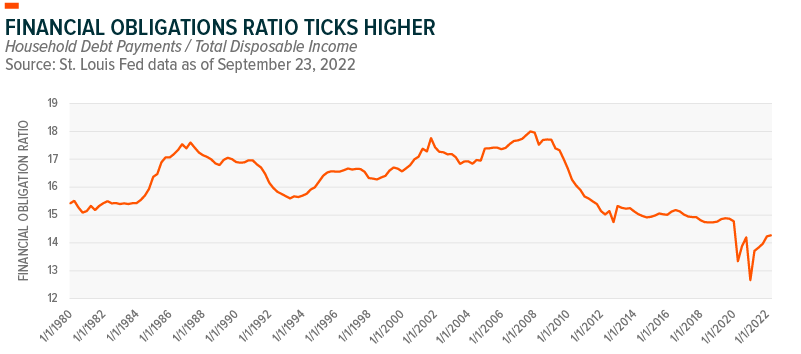

In 2023, the feedback loop between employment and consumption is the greatest risk to U.S. economic growth. Excess pandemic savings supported U.S. consumption despite wages not keeping pace with inflation. However, the personal savings rate has dropped to 2.3%, its lowest level since 2005, and substantially below the average savings rate from the last decade.12 However, on aggregate, households are entering the economic slowdown with solid balance sheets. The chart below shows the rise in the financial obligations ratio, which measures household debt payments relative to total disposable income. The ratio is at the highest level since 2020, although it remains low relative to its historical average. Households deleveraged over the past decade and may be positioned to withstand economic weakness. However, a prolonged rise in the financial obligations ratio in 2023 could be a concern, both for consumer demand and the credit market.

Deteriorating credit conditions could amplify recession risks over the coming months. U.S. banks are tightening lending standards, which could reduce loan growth. During the Q3 earnings season, several banks reported less favorable economic outlooks and set aside more money for loan loss reserves.

Tighter financial conditions have implications for consumers and businesses. While manufacturing demonstrated continued strength in 2022, recent indicators suggest that the outlook is not quite as bright. U.S. November Manufacturing PMI fell into contractionary territory, and we expect the reduced demand outlook to weigh on manufacturing activity into 2023.

During November, U.S. export orders fell at the fastest pace since the pandemic, reflecting reduced demand domestically and globally.13 Manufacturers cut jobs for the second month in a row as capacity utilization dwindled and backlogs contracted.14 Meanwhile, business confidence remained historically subdued as concerns about inflation and customer hesitancy weighed on optimism.15 These factors led companies to reduce inventories via lower prices.

U.S. real economic growth expectations have deteriorated; however, the U.S. economy remains in a stronger position relative to most other economies. High energy costs and the risk of energy shortages weighed on European sentiment in 2022. Europe’s high energy storage levels going into this winter reduces near term risks, but improved energy independence remains an area of investment focus. China has also faced its own set of challenges, but the potential removal or lightening of COVID-19 restrictions could spur Chinese demand. This is the wildcard that could support global growth should both Europe and the U.S. experience a decrease in economic activity.

While rising recession risks encourage defensive positioning, the shift away from peak dollar opens global opportunities. This reflects an environment where portfolio diversification is highly important. While we remain short duration on our fixed income exposure, we are starting to add incremental duration exposure. Although fixed income may face headwinds during the final stages of the rate rising cycle, this year’s yield reset is likely to improve the environment for the 60:40 portfolio going forward. As asset class correlations normalize, opportunities are likely to arise, and we expect portfolio positioning choices will grow in importance.

Conclusion: A Near-Term/Long-Term Balancing Act

Heading into a challenging 2023, the market is likely to remain hypersensitive to factors including inflation, employment, manufacturing, and credit, and of course the Fed’s response. But for the long-term health of an investment portfolio, we believe finding exposure to disruptive themes with strong demand and improving profitability can be as important as near-term defensive positioning. The positive side of the broad-based selloff of 2022 is that it may provide attractive entry points to emerging areas like Cybersecurity, Clean Energy, Lithium, and U.S. Infrastructure Development. However, diversification is an important consideration given this fragile macro environment. Even though we expect volatility to persist, so too will innovation.

We wish you all the best this holiday season and a happy and healthy new year.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.