Established in 1996 in Gland, Switzerland, Swissquote Group Holding Ltd. (SWK: SQN) is a banking group that has become one of Switzerland’s leading providers of online foreign exchange (forex) trading and financial services. The company went public in May 2000, and its stock trades on the SIX Swiss Exchange under the symbol SQN.

Swissquote has an impressive range of offerings, with a vast selection of over 3 million securities, forex and CFD instruments. Additionally, they excel in execution, boasting a remarkable median execution speed of 9 ms, establishing them as leaders in the industry.

Their platform offerings include the standard MetaTrader 4 & 5, as well as a user-friendly proprietary CFXD platform that integrates charts from TradingView. With swift execution and intuitive platforms, Swissquote caters well to the requirements of day traders and scalpers alike.

Swissquote offers clients extensive resources to trade foreign currency and other assets as well as providing excellent trading platforms with a wide variety of research tools.

The biggest downside to the platform is the trading fees are above average, and its minimum deposit requirement is $1,000.

- Wide range of tradable assets

- Excellent trading platforms

- Quantitative asset management (QAM)

- Robo-Advisor for automated trading

- Over 3 million instruments

- Lightning-fast execution speeds

- Excellent education tools and resources

- No U.S. clients

- High minimum deposit

- Higher trading fees than other industry leaders

Swissquote Ratings at a Glance

For most retail traders, trading forex involves making short-term speculative transactions in a margin account held with an online forex broker. Swissquote is a Swiss banking group that provides an online trading platform that allows traders to make transactions in numerous forex currency pairs, cryptocurrencies, stocks and a variety of contracts for difference.

Some investors who maintain a portfolio of long-term foreign investments might employ a forex portfolio of currency positions to hedge the currency risk involved in making such investments. Swissquote forex accounts can also be used for hedging commercial currency exposures and currency futures and options positions.

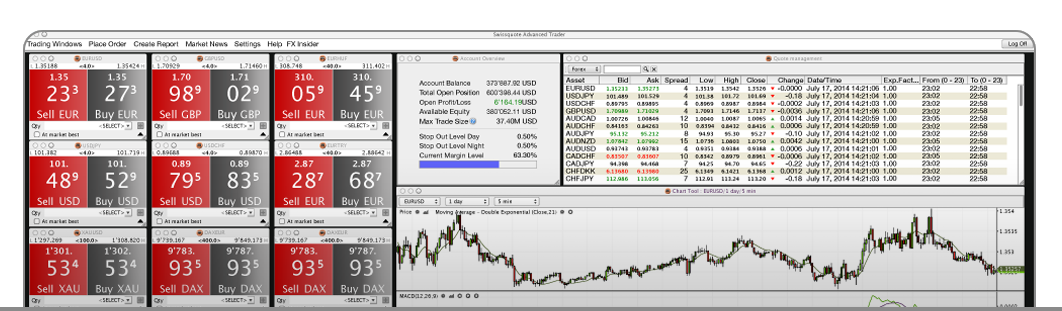

Swissquote graphic. Source: Swissquote.

Swissquote offers four different private accounts for individual retail traders as well as two business accounts. Depending on your trading or investment goals, Swissquotes’ various account offerings will most likely fit your needs.

Private Accounts

- Trading: Swissquotes’ basic account offers its clients access to competitive pricing on 3 million financial products listed on 60 world stock exchanges.

- Forex: This account lets you trade over 400 forex and CFD instruments, including forex options on three cutting-edge trading platforms: MetaTrader 4 and 5 and Swissquote’s proprietary Advance Trader platform. You also get access to premium plugins and other tools to find the best trading ideas.

- Robo advisory: This tailor-made investment management tool is the first of its kind in Switzerland. It can be customized to fit your particular investment style and portfolio.

- Crypto assets: Swissquotes lets clients trade 40 major cryptocurrencies with low fees. You can also trade multiple crypto-asset classes to better diversify your crypto holdings.

Business Accounts

- Asset managers: This type of account lets asset managers cater to their clients’ needs with made-to-measure services, such as Swissquote Professionals. To find out more about this type of account, you can contact Swissquote directly via telephone at +41 44 825 89 90.

- Companies: You can open an account for businesses of any size Swissquote. This type of account provides businesses with a multicurrency Swiss International Bank Account Number (IBAN), and it gives corporate account holders direct access to global markets. Companies also get a Level 3 system connection and an extended range of analysis functions, such as equity and portfolio analyzers, Warrant Chooser, Fund Finder, Fund Optimizer and Order Book services.

FX Platforms

Swissquote’s proprietary Advance Trader trading platform. Source: Swissquote.

Swissquote offers some of the best forex trading platforms in the business, as well as plugins and tools you can use to improve your trading. The Swissquote platforms include:

- Advanced Trader: Swissquote’s proprietary trading platform offers advanced features such as over 50 intelligent charting tools, more than 80 technical indicators and a synchronized layout for multiple charts provided by TradingView. The platform is available for both desktop and mobile devices. You can drag and drop any component of the platform to customize the interface. You can also set up your own personalized watchlist as well as customize charts, drawing tools and indicators.

- FIX API: The Financial Information Exchange (FIX) protocol consists of an international standard for electronic trading. The protocol was developed to increase connectivity among traders and other market participants. Swissquote’s application programming interface (API) can be plugged directly into your trading platform to exchange trade data with Swissquote’s servers based on the FIX 4.4 protocol. The protocol gives users high-speed connectivity and direct access to competitive pricing from Swissquote’s deep liquidity pools.

- MetaTrader 4 and 5 (MT4/5): These related trading platforms developed by MetaQuotes are the most popular online platforms among retail traders for making forex and CFD transactions. The MT4/5 software is seamlessly integrated with Swissquote to provide fast trade execution times and deep liquidity. You can even use these platforms to engage in social trading and automate your trading by using expert advisor (EA) add ons.

- MetaTrader plugins: In addition to EAs, Swissquote lets you upgrade your MetaTrader platform with the MetaTrader Master Edition plugin. The plugin is offered free of charge to Swissquote clients and features 12 advanced tools, 15 new indicators, two trade terminals and a correlation matrix to manage your trades and mitigate market exposure. Trading Central (TC) is another useful MT5 plugin Swissquotes provides at no cost. This award-winning plugin gives you analyst views, adaptive candlesticks and an adaptive divergence convergence (ADC) indicator. The TC plugin provides a Daily Market Report and features pattern-recognition software that lets you build your trading strategies in real-time.

- Autochartist: This helpful technical analysis tool features automated trade alerts and timely, factual analysis. The Autochartist search engine continuously scans the markets to automatically send alerts and recognize trade setups in your preferred currency pair and other tradable assets. The software sends alerts based on popular technical analysis methods, including key support and resistance levels, classic chart patterns and Fibonacci levels.

Swissquote provides direct customer service access in more than 10 languages via a live chat button on the Swissquote website. The company can also be reached by telephone directly at its international headquarters in Switzerland, at its Middle East offices in the United Arab Emirates and at its Asian offices in Hong Kong and Singapore.

You can also get customer service via Swissquote’s Client Hotline, which connects to its forex dealing desk and payment card help desk. The international support hub is available from 8 a.m. to 10 p.m. Monday through Friday Central European time (CET). Other customer service hours vary depending on the office location, although the client hotline is available around the clock from 11 p.m. Sunday until 11 p.m. Friday CET. Swissquote can also be reached on social media via Twitter, Instagram, LinkedIn, Facebook and YouTube.

Swissquote’s focus on technology and transaction automation gives the banking group the ability to significantly reduce its transaction and account management fees. Most tradable assets cost a flat fee of 9 Swiss Francs (CHF) per transaction. These include:

- Stocks

- Exchange-traded funds (ETFs)

- Swiss derivatives over-the-counter (OTC) trading system (DOTS)

- Funds

- Themes trading

- Structured products

- Bonds

Forex transactions incur no commissions; the dealing spreads and minimum deposit amounts vary depending on the type of account you operate in as follows:

- Standard: This account requires a minimum deposit of $1,000 with forex dealing spreads from 1.7 pips and stock commissions of 0.15% of the trade amount.

- Premium: A minimum of $10,000 is required for this type of account and features forex dealing spreads from 1.4 pips and stock commissions of 0.12% of the trade amount.

- Prime: This account type requires a minimum of $50,000 with forex dealing spreads beginning at 1.1 pips and stock commissions of 0.09% of the trade amount.

For a more detailed commission chart, you can download Swissquote’s complete pricing schedule at this link.

Swissquote also offers educational resources, an online magazine, market webinars, a newsletter and a newsroom.

You can trade over 90,000 over-the-counter derivative products directly with the issuer via Swissquote’s exclusive Swiss DOTS platform. If you like to trade cryptocurrencies, you can take advantage of the 27 major cryptocurrencies Swissquote lets clients trade in, including Bitcoin (CRYPTO: BTC), Litecoin (CRYPTO: LTE), Ethereum (CRYPTO: ETH), Ripple (CRYPTO: XRP) and Stellar (CRYPTO: XLM). You can buy, sell and hold actual crypto assets in your Swissquote wallet as well as trade CFDs on them.

Through Swissquote’s Themes Trading service, you can select from among a collection of dynamic thematic portfolios. Themes trading certificates consist of portfolios of specific stocks or assets that have been carefully selected by Swissquote’s financial experts. Examples of Themes trading certificates include a Smart Contracts platform, Cannabis 2.0, Global Recycling and eMobility.

Swissquote’s support of the popular MetaTrader platforms and its excellent proprietary Advance Trader platform give traders at all expertise levels an excellent trading experience. The platforms are highly intuitive and can easily be learned by beginners.

More advanced traders will appreciate the Advance Trader platform’s many features, including TradingView’s excellent customizable charting service, Swissquote’s deep market liquidity and its super-fast trade executions.

Basically, other online platforms would find it hard to match, let alone exceed, Swissquote’s exceptional user experience.

Swissquote vs Competitors

With respect to Swissquote’s competitors, not many online brokers can match the quality trade execution service and tradeable product offerings Swissquote provides to its clients. While the banking group’s minimum deposits, dealing spreads and commissions may be slightly higher than some competing online brokers, the number of amenities provided to its clients make Swissquote an excellent choice for traders of any experience level. Benzinga has compiled the chart below to show how Swissquote compares to various online trading platform providers.

- Best For:Earning Cashback on FX TradesVIEW PROS & CONS:securely through Forex.com's website

- Best For:$10,000 Funding BonusVIEW PROS & CONS:securely through tastyfx's website

- Best For:Spread Betting, CFD and Forex TradersVIEW PROS & CONS:securely through City Index's website

Overall, Swissquote deserves an unusually excellent 5-star rating, although a 4.5-star rating was given for Swissquote’s slightly higher commissions compared with some other highly competitive online trading providers. The maximum rating given in this review was largely based on Swissquote’s wide range of high-quality services and tradable assets for traders of all experience levels.

Swissquote Forex Tutorial Videos

Swissquote offers various educational videos and resources via its website, such as this forex trading learning center link. You can also find more interesting videos from Swissquote on its YouTube channel.

Frequently Asked Questions

How do you withdraw from Swissquote?

Swissquote only allows bank transfers to withdraw funds, and withdrawals generally take one business day to complete. Swissquote charges 2 Swiss francs, 2 euros or $10 per withdrawal, depending on the currency you withdraw.

Is Swissquote good for trading?

Yes, Swissquote is among the top companies providing online trading platforms for a wide range of tradable assets, and it offers extensive market analysis and educational resources for traders at all levels of expertise.

Is Swissquote secure?

Swissquote is considered to be a secure platform as they are a Swiss bank regulated by the Swiss Financial Market Supervisory Authority (FINMA). They follow strict security measures to protect customer data and ensure secure transactions.

User Reviews

Alice Luna

I was scammed of $89,000 worth of bitcoin with a scam forest investment unknowingly then, I didn’t know what to do.. I felt like committing suicide, but fortunately for me, my friend introduced me to a cyber crime investigator ( Mr. Julius Patrick) who al

TT

SwissQuote is a total scam, they stopped paying out my money and give no reason, no answer, now I have to sue them them for nothing. Do not open account here they try take your money!

Omar

very high spread, market maker

James Pataguel

I really enjoyed their proprietary platform Advanced Trader on mobile

Submit Your One Minute Opinion

Get a Forex Pro on Your Side

FOREX.com, registered with the Commodity Futures Trading Commission (CFTC), lets you trade a wide range of forex markets with low pricing and fast, quality execution on every trade.

You can also tap into:

- EUR/USD as low as 0.2 with fixed $5 commissions per 100,000

- Powerful, purpose-built currency trading platforms

- Monthly cash rebates of up to $9 per million dollars traded with FOREX.com’s Active Trader Program

Learn more about FOREX.com’s low pricing and how you can get started trading with FOREX.com.

About Jay and Julie Hawk

Jay and Julie Hawk are the married co-founders of TheFXperts, a provider of financial writing services particularly renowned for its coverage of forex-related topics. With over 40 years of collective trading expertise and more than 15 years of collaborative writing experience, the Hawks specialize in crafting insightful financial content on trading strategies, market analysis and online trading for a broad audience. While their prolific writing career includes seven books and contributions to numerous financial websites and newswires, much of their recent work was published at Benzinga.