Chinese Stocks Are 'A Risk Worth Taking,' Says Asset Manager Amid Economic Uncertainty: '...Trading At The Cheapest They've Ever Been'

Chinese Stock Valuations Are 'Way Too Low,' Says Prominent Strategist Amid Economic Uncertainty

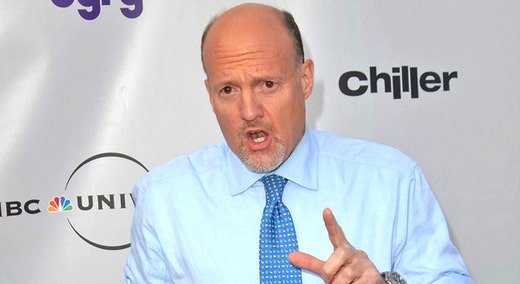

Jim Cramer Draws Comparison Between Nvidia's Microchips And Potato Chips Amid Wealth Gap Debate: The Bottom Line Is...Never The Twain Shall Meet

El-Erian Says Market Justified In Worrying About Economic Growth If 2 To 3 Fed Rate Cuts Don't Happen This Year: 'Last Mile Getting To 2% Is Really, Really Difficult'

Mohamed El-Erian Recent News

Chinese Investors Seek Refuge Offshore Amid Domestic Market Fears

Top Economist Mohamed El-Erian Advises Treating China As Short-Term Speculation, Not A Long-Term Bet

El-Erian Thinks Biden's Economic Woes Could Be Self-Inflicted As Trump Gains Ground In Voter Confidence

China Stock Rout Continues: Worst Week In 5 Years For Shanghai Index

El-Erian Says Bond Market Is Now More Consistent With Economy Evading 'Deep Recession'

El-Erian Warns Merely Adding Fuel To China's 'Tired Growth Engine' Won't Bring Durable Prosperity: 'Needs Deeper Reform'

Premature Rate Cuts Could Please Markets But Spell Trouble For Fed, Warns El-Erian: 'That Would Not Be New'

Mohamed El-Erian Says America's Leadership Eroding, Foresees More Global Disorder If Western-Led Economic Order Fails

Mohamed El-Erian Attributes Biggest Monthly Financial Loosening To 'Market Romance' And Anticipation Of Soft Landing

Mohamed El-Erian Says Deluge Of 'Fedspeak' Fueling Market Volatility Worries

Mohamed El-Erian Says Inflation Is The Reason Behind Team Biden's Low Approval Ratings Despite Consistently Outperforming US Economy

Mohamed El-Erian Caution Central Banks To Use Their 'Time Outs' Wisely

2-Year Treasury Yields Hit 17-Year Highs, Analyst Says US Bond Market 'Is Losing Its Strategic Anchor'

IMF Raises Alarm On US Debt, Israel-Hamas War Woes, Trump Jr Slamming Paul Krugman Over Inflation And More: Top Economics News This Week

Mohamed El-Erian Says Likey 'We See 8% Mortgages Soon' As US Bond Yields Flirt With 4.5%

Mohamed El-Erian Identifies Seismic Shift In The World's Economic Landscape — Implications Extend 'Well Beyond' Fed's Policy Guidance

El-Erian Says Bargaining Power Shifts To Workers As Labor Strikes Rise To 23-Year High: 'Surprised It Took So Long'

China 'Unlikely' To Topple US As World's Leading Economy, Says Mohamed El-Erian

El-Erian Sees No Reason For Recession 'Unless There's Another Policy Mistake,' Predicts Fed Pause This Month

El-Erian Raises Alarm On Yen's Exchange Rate: Delayed Exit From Yield Curve Control Heightens Risk Of 'Adverse Cross-Border Spillovers'

El-Erian Lists 3 Possible Paths For Fed's Powell At Jackson Hole: 'If I Were Advising Him ...'

China Grapples With Deflation As Reopening Efforts Falter: El-Erian Says CPI Data 'Deepens Worries'

El-Erian Pours Cold Water On Market Convergence Hopes, Says It's Wiser To Brace For Bumpier 2nd Half