Looking for the best rate and coverage for term life insurance? Consider Bestow.

The loss of your income could put your family in a position to default on the mortgage or struggle to pay for ongoing expenses. Term life insurance can protect your loved ones in the event that you pass away or become too disabled to work. But with so many term life insurance plans, how do you balance what’s affordable and with great service and coverage?

Benzinga’s guide outlines term life insurance and helps you find the best life insurance policies for your needs.

Quick Look: Best Term Life Insurance Quotes

- Best Overall for Term Life Insurance: Bestow

- Best for People with Children: Fabric

- Best for Individuals Under 45: Haven Life

- Best for Seniors: Mutual of Omaha

- Best for Level Premiums: New York Life

Best Term Life Insurance

Let’s take a look at some of the best term life insurance companies currently offering new policies.

1. Best Overall: Bestow

- Best For:Term life insuranceVIEW PROS & CONS:securely through Bestow Life Insurance's website

A new company offering term life insurance, Bestow is committed to making life insurance simpler to find and understand. You can get a quote and apply for coverage in as little as a few minutes if approved , and you don’t need a medical exam or to sift through tons of paperwork when you choose Bestow.

Bestow’s premiums are affordable — from just $8 per month you can obtain up to $1 million in coverage.

2. Best for People with Children: Fabric

- Best For:Young familiesVIEW PROS & CONS:securely through Fabric Life Insurance's website

Fabric offers flexible and affordable insurance coverage designed with parents in mind. You can apply and see your price in under 10 minutes.

You can also tailor your policy’s terms to create a one-of-a-kind insurance policy that’s fit for your family. Fabric’s free app is available to organize family finances, create a will and share important policy information with your beneficiaries.

3. Best for Men and Women Under 45: Haven Life

Haven Life is another online insurance company focused on affordable, easy-to-understand life insurance. Haven Life offers cheap policies — especially for younger men and women. A 30-year-old female can find coverage from Haven Life for less than $15 per month.

Haven also offers a mobile process to digitally purchase and compare life insurance options.

4. Best for Senior Citizens: Mutual of Omaha

Finding term life insurance for seniors can be a challenge. Age brings a higher risk of death, and many insurance companies put an age cap on term life policies, diverting older customers to more expensive whole life insurance instead.

Mutual of Omaha is one of the best life insurance companies for older men and women — term policies are available up to 80 years of age. You can apply online and customize your term to receive more than $100,000 worth of coverage.

5. Best for Level Premiums: New York Life

Many term life insurance providers reserve the right to raise your monthly premium as you age. New York Life lets you choose a level premium convertible to keep your premium the same throughout your term. This can be an excellent option for predictability and a strict household budget.

You can also convert your term life insurance policy to a whole life policy if your term expires and your beneficiaries don’t receive a death benefit. New York Life also boasts customizable add-ons and budget-friendly pricing.

Term Life Insurance Quotes for Females

Check out term life insurance rates for females of varying ages from top life insurance providers. Rates were collected with the profile of a female nonsmoker in excellent health with a 20-year term.

| Age | Coverage Amount | Term | Company | Average Monthly Quote | Your Quote | Medical Exam? |

|---|---|---|---|---|---|---|

| 20 | $500,000 | 20-year | Haven Life | $19.03 | Click Here | Yes |

| 20 | $500,000 | 20-year | AIG | $16.74 | Click Here | Yes |

| 21 | $500,000 | 20-year | Bestow | $17.50 | Click Here | No |

| 30 | $500,000 | 20-year | SBLI | $17.05 | Click Here | No |

| 30 | $500,000 | 20-year | Haven Life | $19.46 | Click Here | Yes |

| 30 | $500,000 | 20-year | Bestow | $19.58 | Click Here | No |

| 40 | $500,000 | 20-year | Pacific Life | $25.07 | Click Here | Yes |

| 40 | $500,000 | 20-year | Bestow | $31.25 | Click Here | No |

| 40 | $500,000 | 20-year | Haven Life | $28.07 | Click Here | Yes |

Term Life Insurance Quotes for Males

Insurance rates vary between men and women. The table below outlines sample rates for a male nonsmoker in excellent health with a 20-year term.

| Age | Coverage Amount | Term | Company | Average Monthly Quote | Your Quote | Medical Exam? |

|---|---|---|---|---|---|---|

| 20 | $500,000 | 20-year | Protective | $18.98 | Click Here | Yes |

| 20 | $500,000 | 20-year | Haven Life | $22.04 | Click Here | Yes |

| 21 | $500,000 | 20-year | Bestow | $25.00 | Click Here | No |

| 30 | $500,000 | 20-year | Minnesota Life | $22.42 | Click Here | Yes |

| 30 | $500,000 | 20-year | Principal | $21.43 | Click Here | Yes |

| 30 | $500,000 | 20-year | Bestow | $26.25 | Click Here | No |

| 40 | $500,000 | 20-year | Pacific Life | $29.66 | Click Here | Yes |

| 40 | $500,000 | 20-year | Prudential | $42.44 | Click Here | Yes |

| 40 | $500,000 | 20-year | Bestow | $39.16 | Click Here | No |

What is Term Life Insurance?

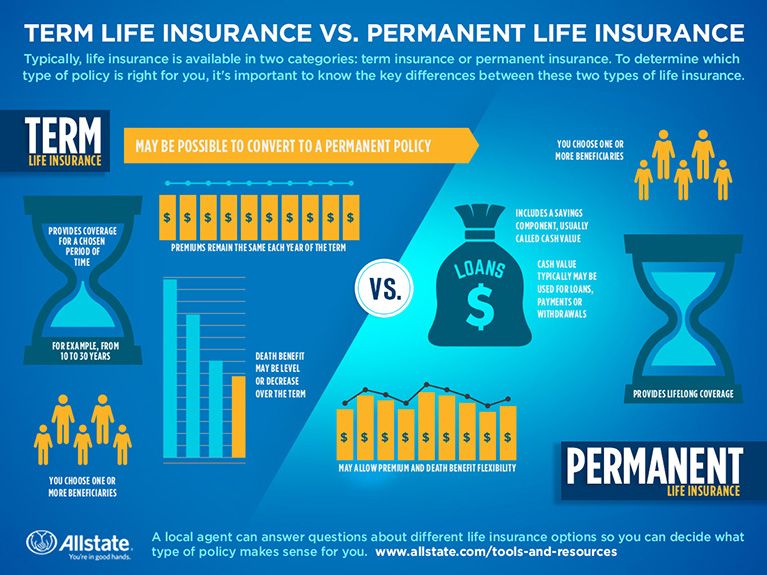

Term life insurance is a product designed to financially protect your family in the event you die with some companies offering the ability to add a rider that can offer a payout if you become permanently disabled. You choose an initial term and policy benefit. Your term is the number of years your policy is valid — typically between 20 and 30 years. During your term, you pay a monthly premium to keep your insurance active. If you stop paying your premiums, your insurance provider may cancel your insurance.

Your policy benefit is also known as your life insurance payouts. This is what your beneficiaries receive upon your death.

Beneficiaries are the people or organizations you choose to receive your life insurance benefit upon death. You can choose your children, spouse, business partner, church or even your favorite charitable organization as your beneficiary. If you have more than one beneficiary, your Will should specify how to divide your benefit.

There are no limitations on how beneficiaries can use your death benefit after you pass. Most use life insurance payments to cover end-of-life care, funeral costs and ongoing living expenses.

Your insurance provider will simply close your account and terminate the plan at the end of your term if a death or disability claim is not submitted. You typically cannot recapture any percentage of your premiums.

Term life insurance is different from whole life insurance. Whole life insurance does not have a policy term — your provider guarantees a death benefit no matter when you die. Whole life insurance policies can be significantly more expensive than term life policies.

When Does Term Life Insurance Make Sense?

Choosing to buy term or whole life insurance (or even both) can seem tricky. Take a look at a few situations when term life insurance can be a wiser choice than whole life policies.

- You want affordable life insurance. Term life insurance policies are typically more affordable than whole life policies because there’s no guaranteed payout. If you’re searching for cheap life insurance, look at a term policy.

- You only need coverage for a select period of time. Term life insurance can cover you until you reach a particular financial milestone like paying off your mortgage or funding a child’s college education.

- You aren’t sure if you want whole life or term life. Most term life insurance companies allow you to convert your policy to whole life when you reach the end of your term. If you aren’t sure which type is right for you, begin with a term life policy.

Protecting Your Future with Life Insurance

Protect your family with the right life insurance policy. Use our easy and free comparison tool to learn more about term life policies you may qualify for. Just enter your ZIP code, collect quotes and browse your options — and get on the path to a more fully-protected life.

Frequently Asked Questions

What are the advantages of term life insurance?

A term life policy allows you to purchase coverage at a guaranteed premium for a limited amount of time. This structure makes term life an affordable choice to protect your family if you have a financial commitment that won’t last forever, like a mortgage or the cost of raising kids. A 20-year term life insurance policy is the most popular life insurance policy purchased to protect loved ones if the unexpected happens. Get a quote here from top providers.

How much life insurance do I need?

Many in the industry recommend that you carry 8-12 times your annual income in life insurance coverage. A more granular approach can be beneficial, however, and accounting for debt and ongoing financial commitments in more detail when choosing a coverage amount can better provide for your family than an arbitrary multiple of earnings. Get a customized quote for the best policy.

How can I lower my life insurance premiums?

Life insurance premiums are based on age, insured amount, and a number of health and behavioral risk factors. Rates have fallen in recent years as longevity has increased and insurers have become better at pricing risk factors. If you have an old policy, it may be possible to replace your coverage for a lower premium with a new policy. If you don’t have coverage yet, don’t wait too long to buy a policy. Rates increase with age. Many insurers also offer a sizeable discount on auto insurance if you have a life insurance policy with the company as well, creating a way to save money on your overall insurance costs. Get the best deals here.

Methodology

Benzinga crafted a specific methodology to rank life insurance. To see a comprehensive breakdown of our methodology, please visit our Life Insurance Methodology page.

About Sarah Horvath

Sarah Horvath is a highly respected freelance senior copywriter specializing in insurance content. With a wealth of experience, she is recognized as one of the top insurance copywriters in the industry. Sarah’s expertise encompasses various aspects of insurance, including home warranties, life insurance, health insurance, and more. Her insightful articles and guides are regularly featured on major finance sites, providing invaluable information to readers seeking to navigate the complexities of insurance policies. Known for her clear, concise writing style and comprehensive understanding of insurance products, Sarah is dedicated to empowering individuals with the knowledge they need to make informed decisions about their insurance coverage.