Across the pond, the Eurozone has been dealing with the potential for stifled future expectations in housing markets as talk of rate hikes heats up. The economy appears to be losing steam according to Capital IQ analysts. The ECB is using it's "bag of stimulatory tricks", Germany confidence levels continue to "fall off", France's economic rebound is still "elusive", and Italy's rebound has been "delicate" even though tax cuts have increased wages and industrial production continues to post gains. Regardless of the US equity bull market the IMF saw through the FED impact on prices and cut the US growth rate forecast from 2.8 percent to 2 percent. Globally, things are showing the true signs of weakness and the facade of easy monetary policy is cracking.

The UK continues to battle with rapidly increasing housing prices and the Bank Of England's governor Mark Carney stated in June that a rate hike could come sooner than the market may be expecting. Directly commenting on the UK housing market Carney stated the Bank does preference using mortgage controls over rate hikes as a means to prevent further choking out positive economic activity. Markit services showed UK PMI dropped 1 basis point (bps), CPI fell 30 bps, retail sales dipped 50 bps and the labor market unemployment rate fell to 6.6 percent, it's lowest rate in 5 years.

The Germans have seen PMI fall, economic expectation collapse, and inflation fall as tensions and long-term impacts on domestic trade and energy are connected to supply links involved in the Russia and Ukraine conflict. France is a "non-starter" according Capital IQ as PMI slumps to 48, two points below the tipping point between economic expansion (above 50) and contraction (below 50). The business climate degraded in June according to the National Institute of Statistics and Economic Studies. The NISES said in a report that they witnessed a deterioration since March 2014 in all sectors of France's economy. Italy's recovery remains slow and Spain's tax-cuts and stimulus measures have bought some more time to enjoy an engineered recovery.

Speaking to the credit market in Europe and in North America, Capital IQ said:

"On average, spreads widened in both European and North American investment-grade universes. We saw widening in all sectors apart from the European materials sector which tightened by 1 basis point".Overall analyst are growing weary of the global rally sustainability in the face of talk from central banks about raising rates and ways to manage accelerating home prices. The worry being shared comes right on cue with the expectation of a technically seasonal period of volatility in US equity markets.

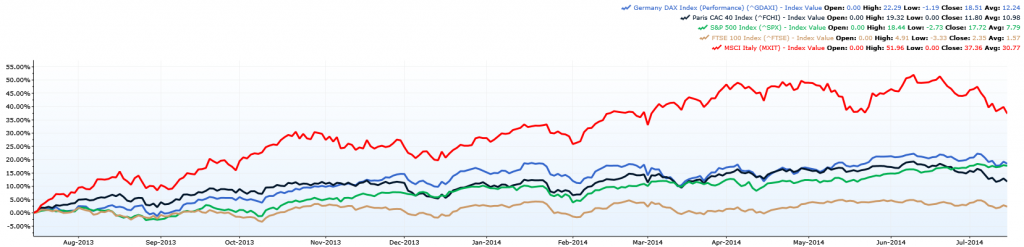

Chart 1 below shows the return on equity markets. Italy is set to the left-axis so that the global downturn which began in June (excluding the S&P 500, which rallied continuously) could be more easily seen. When paired along the same axis, Italy's performance is clear, as shown on Chart 2.

Chart 1 (Click To Enlarge):

Chart 2 (Click To Enlarge):

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.