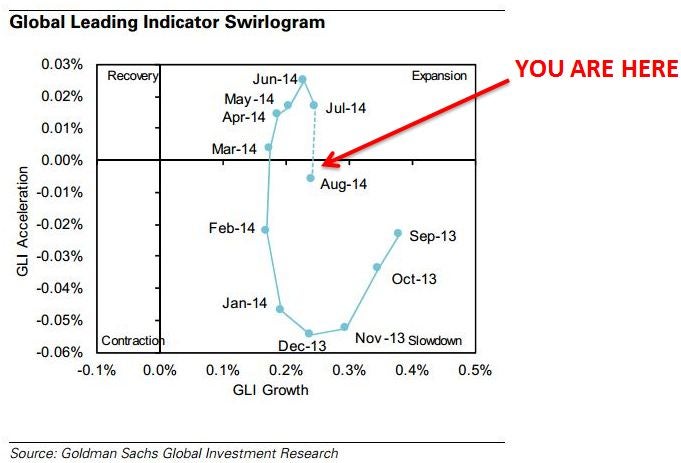

Goldman Sachs GS came out with a new update on their Global Leading Indicator. Goldman decided to admit that the advanced GLI reading "places the global cycle in the 'slowdown' phase". This latest statement comes on the heels of a year riddled with conflicting statements such as :

- months of waiting patiently for an "expansion" signal,

- claiming the S&P 500 was "overvalued",

- flipping views from "slowdown" to "expansion",

- issuing a 2050 S&P 500 price target and,

- announcing a downgraded S&P 500 view from August to October.

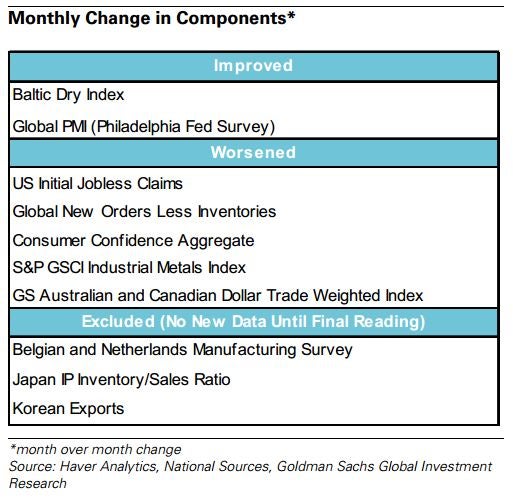

The August Advanced GLI data fell 3.0 percent YoY with momentum falling to 0.24 percent MoM from 0.25 MoM in July. The compression in the GLI reading is being attributed to "an unusually large deterioration in the New Orders less Inventories component. Two of the seven indicators that make up the GLI have improved in July.

(Click To Enlarge)

So if the recent volatility in the market and the pricing behavior is leaving you befuddled, you're not along, even Goldman is roaming around the woods blindfolded

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.