( click to enlarge )

Rambus Inc. RMBS ended the day 6.51% higher at $5.89 on above average volume of 1.29 million after touching an intra-day high of $5.90. It broke through the $5.82 resistance and looks poised to make new highs this year. From the technical chart, the MACD and RSI both signal positive strength. The accumulation/distribution line also confirms buying pressure. The stock is trading above both 50-day and 200-day SMA and 50-day SMA is on top of 200-day SMA heading upwards. In my view, we could see $6.2- $6.27 in the next trading sessions.

( click to enlarge )

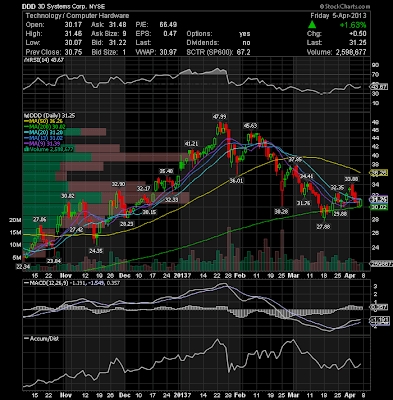

3D Systems Corporation DDD The stock made a turnaround by the $30 support area, which contains the 200-day SMA, so I expect to see a new surge towards the 20-day SMA with a daily close above to confirm a possible new uptrend. Stop 29.86

( click to enlarge )

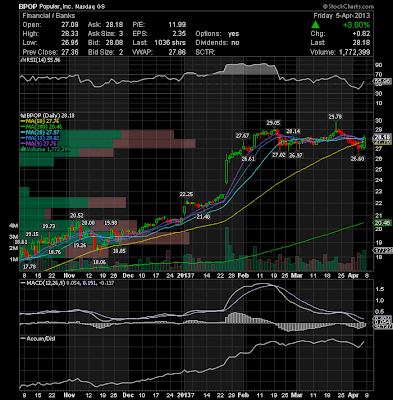

Popular Inc BPOP Nice rally on volume today, next buy area when clears $29.05 on volume.

( click to enlarge )

Zynga Inc ZNGA Keep on watch, if it breaks 3.63, should make a good long imho. The stock is still trading above both 50-day and 200-day moving average showing strength.

( click to enlarge )

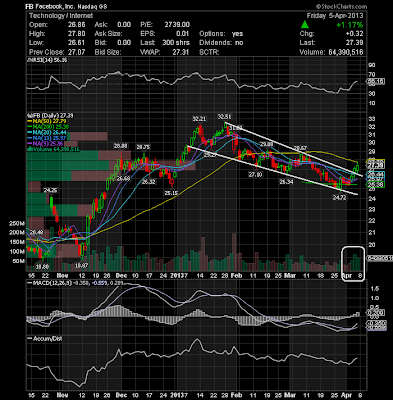

Facebook FB had a nice follow through day after breaking this "long falling wedge", next buy area when it clears the 50-day SMA on volume, needs a consolidation / pullback here.

( click to enlarge )

Eagle Materials, Inc. EXP Watch for this one to go higher. The stock had good volume and a big bullish engulfing candlestick pattern today.

( click to enlarge )

Joe's Jeans Inc JOEZ is looking like a good solid setup. Next buy add area when clears 1.88 on heavy volume.

( click to enlarge )

Keep on watch, looks like Cemex SAB de CV (ADR) CX wants to break through this resistance to new highs.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in