By Poly

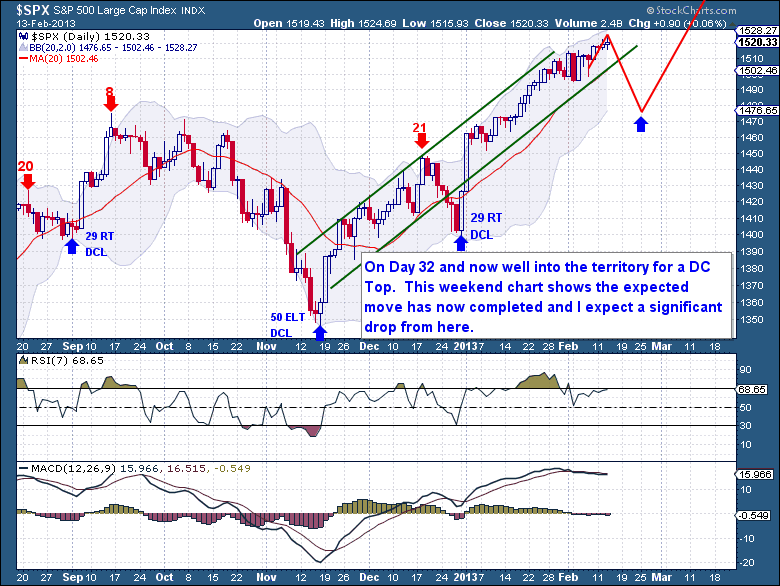

This 32 day Daily Cycle rally is beginning to get “long in the tooth” now. It's no longer about fundamentals or earnings; in the short term it's just the fear of missing a rally. When a Cycle becomes this stretched and deep in the count then they will just keep piling in until there is significant profit taking that will drive the ever weaker and speculative longs into a selling panic.

As simple as that sounds, it doesn't require much more thought or analysis beyond that. This is a 125 point; 32 day Daily Cycle rally that almost everybody is convinced will never end.

That's an impressive move and it needs to be consolidated. Obviously liquidity is sloshing freely and speculative capital is piling in. But I can guarantee you that some resemblance of a Daily Cycle Low is on the horizon and it will serve to reset sentiment in the short term. That means a drop of at least 25 points, but more likely 50 to 75 points over a very short period.

I'm sure you all know by now that I remain bullish here beyond this coming DCL. Obviously it's not that I believe in the underlying fundamentals of the market. It's because I see this Investor Cycle taking out the all-time highs and stretching deep both into the Cycle count and into overbought territory.

This is an excerpt from this week's premium update published on Wednesday (2.13) focusing on equities from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly, as well as real time trade alerts to profit from market inefficiencies.

They offer a FREE 15-day trial where you'll receive complete access to the entire site. Coupon code (ZEN) saves you 15%.

Related Posts:

Conflicting Influences Are Distorting Gold's Price

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.