The latest U.S. housing numbers from Freddie Mac indicate that the market is continuing its steady recovery from its disastrous crash during the mortgage crisis. The housing bubble scared away many investors, despite the fact that housing had been a solid part of a diversified investment portfolio for decades prior to the bubble.

Now, post-crisis lending regulations are in place to help ensure that the market stays under control, and investors are back to generating large, but not unreasonable, gains in a healthy U.S. housing market.

Become A Part Of The Healthy Housing Boom

Once the excess of the U.S. housing bubble was cleared from the market, the natural growth associated with an exploding younger population took over and prices and building rates began to recover to their natural growth levels.

If you’re looking for a way to invest in the companies powering a surging U.S. housing market, Stash’s “Home Sweet Home” ETF, more commonly known as the SPDR S&P Homebuilders (ETF) XHB might be worth a look.

The ETF is nicknamed “Home Sweet Home” because it includes shares of around 40 companies that are pivotal in the U.S. housing market.

Which Companies Are Included?

Most of the companies included in “Home Sweet Home” are household names to millions of Americans because we all use their products and services for home improvement all the time. Top holdings include two companies that are favorite destinations when it’s time for a fix-it-up project: Home Depot Inc HD and Lowe’s Companies, Inc. LOW. These two companies have more than 4,000 nationwide locations that sell nearly every home improvement product imaginable.

Another top holding, NVR, Inc. (NYSE; NVR), is a top choice for Americans who want to start from scratch and build their own dream house.

Once a house is built, Americans turn to top “Home Sweet Home” holdings Owens Corning OC, A. O. Smith Corp AOS and Masco Corp MAS to make the house a home by adding insulation, water heaters, windows and cabinets. Finally, top holdings Allegion PLC ALLE and Fortune Brands Home & Security Inc FBHS keep the home safe and secure with doors and locks.

Returns

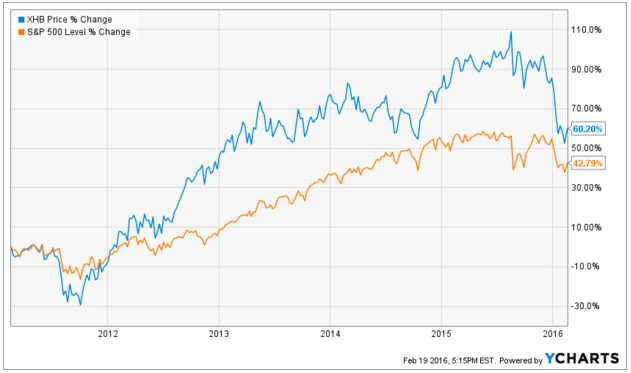

How good of an investment is “Home Sweet Home”? The fund’s performance speaks for itself. In the past five years, it has generated a 60.2 percent return, more than 17 percent higher than the return of the S&P 500, according to Morningstar.

In addition, the fund’s expense ratio, the amount of money spent on fees and administrative costs, is only 0.35 percent.

Takeaway

The “Home Sweet Home” fund is only one of the “I Like” investments that allows investors to avoid hundreds of dollars in trading fees and invest in a wide range of stocks they like all at once by buying a single ETF.

Disclosure: the author has no position in the stocks mentioned. Past performance is not indicative of future results.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.