S&P 2,000 – YAY!!!

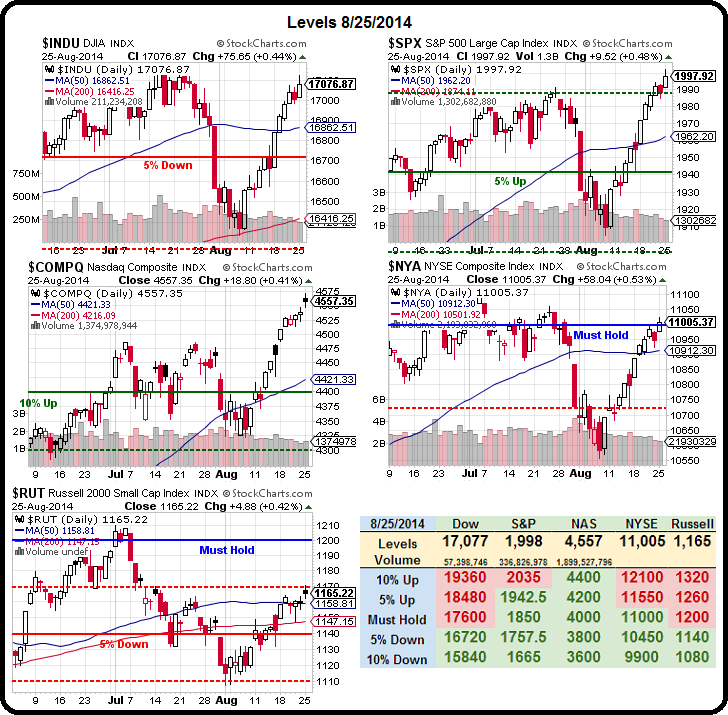

OK, I'm cheating, that's what I wrote on August 26th, when we first hit that mark. At the time, everyone was in rally mode and our Big Chart looked like this:

Despite the HUGE rally signals, I remained skeptical (imagine that!) and said we needed to confirm 17,160 on the Dow and 11,000 on the NYSE before we even began thinking of looking for our real bullish goals of 1,200 on the Russell (the July high) and 17,600 on the Dow (the Must Hold line we have yet to have held). As I said at the time: "Until then, we need to be just a little bit cautious."

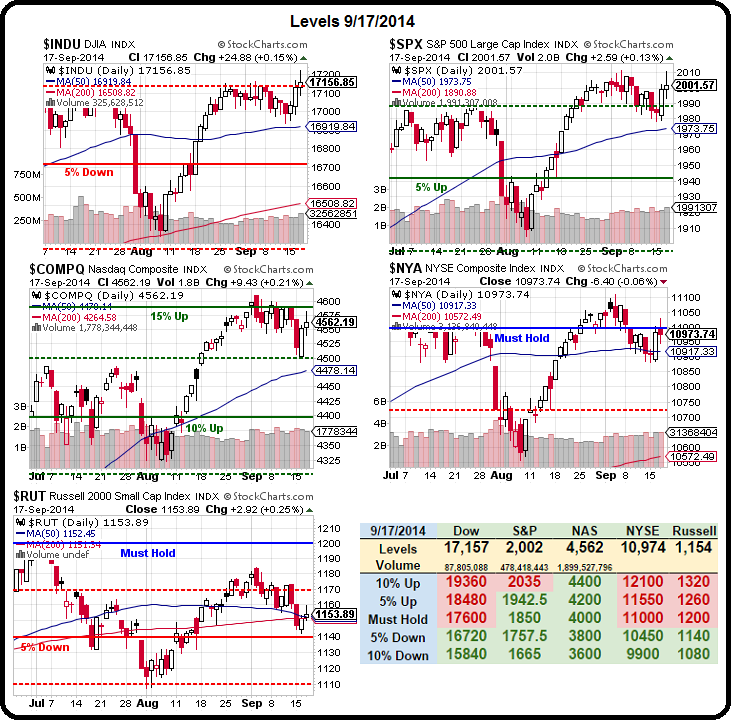

Turns out that cautious was a good play because, since then it was mostly downhill – until this week and our Big Chart now looks like this:

So you can see why we're not terribly impressed with this Fed-induced rally and we're not impressed with yesterday's silly spike – especially with such erratic action. On 8/26, I laid out my logic for you in the morning post and our shorting lines for the Futures were:

So you can see why we're not terribly impressed with this Fed-induced rally and we're not impressed with yesterday's silly spike – especially with such erratic action. On 8/26, I laid out my logic for you in the morning post and our shorting lines for the Futures were:

- Dow (/YM) 17,058, bottomed at 16,839 on 9/11 – up $1,095 per contact

- S&P (/ES) 1,995, bottomed at 1,968 on 9/15 – up $1,350 per contract

- Nasdaq (/NQ) 4,066, bottomed at 4,004 on 9/16 – up $1,240 per contract

- Russell (/TF) 1,165, bottomed at 1,135 on 9/16 – up $3,000 per contract.

As I mentioned in yesterday's post (and you can get these ideas delivered to you every morning, pre-market in addition to much more in our Live Daily Chat Room, by subscribing here) we called the dead bottom on Monday and we published our expected bounce lines for the week (in anticipation of a doveish Fed report) using our 5% Rule™, which were:

- Dow 16,980 (weak) and 17,010 (strong)

- S&P 1,985 (weak) and 1,990 (strong)

- Nasdaq 4,560 (weak) and 4,570 (strong)

- NYSE 10,950 (weak) and 11,000 (strong)

- Russell

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.