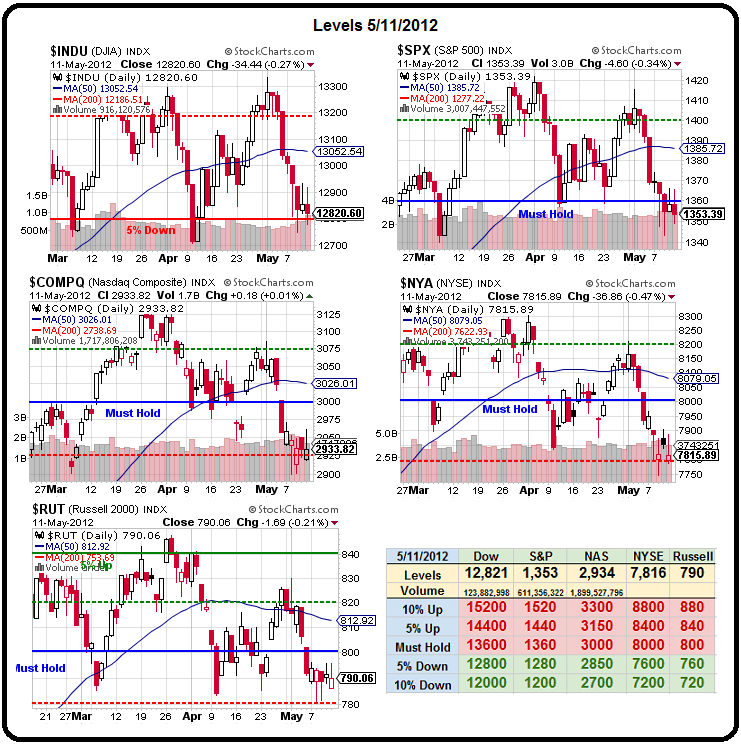

Our "Must Hold" lines didn't hold:

Our "Must Hold" lines didn't hold:

It's not too complicated to know what happens next – we've been talking about it for long enough and the Dow has already tested that 12,800 line – leading the way for the next 5% drop on all of our major indices.

It's far too late to say "I told you so" as there's nothing to be done about it now – I can only tell you what's going to happen in the future – the rest is up to you and now we'll be seeing our RUT 775 goal and maybe 12,500 on the Dow and this is the point at which we expect the Central Banksters to step in with at least TALK about more easing although Europe is such a mess, it may put off intervention a bit longer than we had expected.

So, as I keep saying: "Cash is KING" as we wait for a clear sign that it's safe to do some bargain-hunting once again. We've already gotten some nice entries on out-of-favor stocks like CHK and, soon, JPM but that doesn't mean they won't get even cheaper in a real panic so we'll see how things play out but hopefully the real bottom-fishers show up soon and at least put a floor under some of our discounted equities.

It's a very long way down to our next support level on the S&P which never filled the gap up over 1,320 from early February, which just so happens to be our 2.5% line for that index as well – so we'd expect to see some strong support around there.

It's a very long way down to our next support level on the S&P which never filled the gap up over 1,320 from early February, which just so happens to be our 2.5% line for that index as well – so we'd expect to see some strong support around there.

That then, brings us to the question – is the news bad enough to justify more than a 7% correction in the S&P? Other than JPM, which I feel is an isolated incident and not even a really big deal to JPM, the rest of this Global mess is nothing more than the stuff we've been pointing to all year as we warned the Emperor seemed a bit under-dressed for a rally.

We initiated our Long Put List on March 15th – a little early with our top call but it certainly gave us plenty of time to nail down some great entry points. The next Friday (3/23) I was wondering "Are There Any Dips Left to Buy?" and it's amusing to look back at…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.