Bad news will be good news!

Bad news will be good news!

Yesterday Fed Chairman, Ben Bernanke, reassured the markets that the Fed will be "Keeping interest rates low is still appropriate for our economy" (see statement) saying the committee had "had no difficulty coming to a consensus" about keeping rates low. Mr. Bernanke is "really laying the groundwork to show he's serious on holding the line on the federal-funds rate target until well into 2014," said Michael Dueker, chief economist at Russell Investments.

While this is not QE3, the promise of endless supplies of ZIRP "Free Money" was enough to kick the markets up a notch and we finished the day at the highs (we followed through with our morning plan of going bearish into the run-up in Member Chat) – up about one percent overall as the Dollar dove to month lows. In fact, the Dollar bottomed out at 78.9 this morning, the lowest level since early April, when the S&P was at 1,422 and the Dow was at 13,300.

What does it mean then, that the Dollar is back to it's lows but the markets are not back to their highs? Oil was $105, gold was $1,675, copper was $3.96 – all are lower now despite the Dollar being pressed back down to the lows. Therefore, the buying power of our Dollars is actually increasing (we can buy more stocks and commodities for the same Dollars we had in March) – even though it's not apparent from the charts.

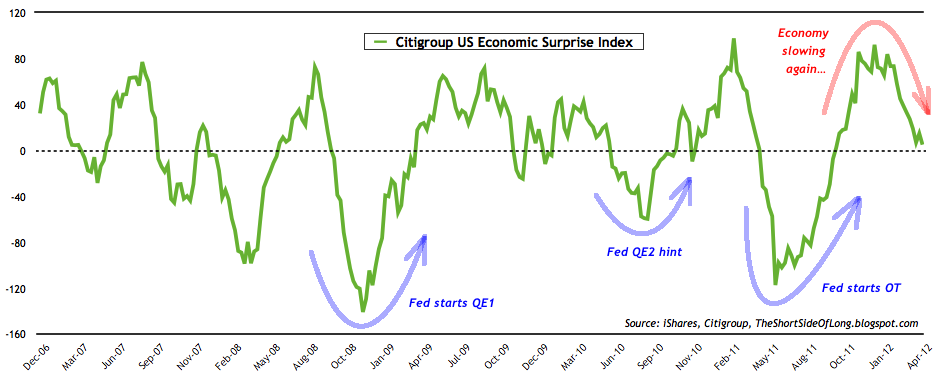

Also not apparent then is the declining value of those stocks and commodities which seem, at this point, to only be supported by the Dollar's renewed weakness. So our market premise needs to very much focus on whether or not we believe the Dollar is a weaker currency than the Euro or the Yen. There is, of course, a tremendous difference between SAYING the Fed would ease under certain conditions – which is what Dr. Bernanke said yesterday – and ACTUALLY printing more money – something the Fed has not done since Operation Twist began way back on September 21st (when the Dollar was around 80.

Operation Twist does run until the Fed's next meeting in June but we have been given no certainty from the Fed that QE3 or OT2 will follow – just a lot of vague promises from Uncle Ben telling us that – if we…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.