First the good news:

First the good news:

India's industrial production grew at a slower-than-expected pace in February, weighed down by a contraction in consumer durables and consumer goods. Production of consumer durable goods shrank 6.7 percent in February from a year earlier. Consumer goods contracted 0.2 percent on year. Inflation is still running at 6.7% but at least it's down from 6.95% last month. Now the bad news, January's Industrial Production Report has been revised down from a blistering 6.8% to an almost contracting 1.14% (and when it's that low, 0.04% really matters!).

It turns out the massive 38% run in the EPI based on all these FANTASTIC numbers coming out of India may have been based on totally false information and it's funny how the selling begin along with the release of that spectacular 6.8% report – almost as if some Bankster was pumping out fake data in order to bring in the suckers so he could unload his shares before the real data came out.

Not that that would happen in our fine Kleptocracy, right? We had a similar run-up in our markets as analysts raised their earnings expectations for the S&P 500 from $90 to $100 to $110 and then raised the multiple they felt should be applied from 10 to 11 to 12 to 13 to 14 to 15 or even 16 – coming up with huge targets for the S&P – as well as our other indexes. This caused our markets to rocket higher as it was all sunshine and lollipops from our Corporate Media – all the way back to October.

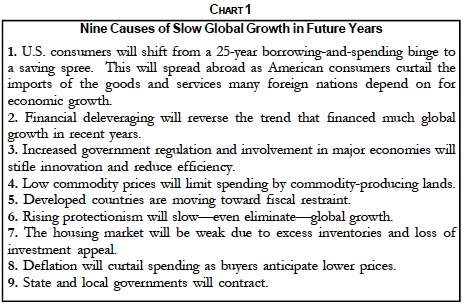

Now that all the sheeple have been herded into the markets at those MASSIVE valuations, suddenly estimates are going the other way – $105, $102 and now Gary Shilling says $80 may be the right number. Shilling notes the S&P's dependence on foreign earnings, a stronger Dollar, higher oil prices, consumer retrenchment and a hard landing in China (and India!) and he recommends going long Treasuries and short stocks and commodities (see Gary's 2012 Investment Themes).

Now that all the sheeple have been herded into the markets at those MASSIVE valuations, suddenly estimates are going the other way – $105, $102 and now Gary Shilling says $80 may be the right number. Shilling notes the S&P's dependence on foreign earnings, a stronger Dollar, higher oil prices, consumer retrenchment and a hard landing in China (and India!) and he recommends going long Treasuries and short stocks and commodities (see Gary's 2012 Investment Themes).

Garry was right on the money in 2011, missing just 3 out of 19 investment themes he was tracking at the time so let's not dismiss him out of hand. With S&P earnings dipping back to 80, Shilling says the p/e multiple is likely to contract back to 10 and that brings…

Garry was right on the money in 2011, missing just 3 out of 19 investment themes he was tracking at the time so let's not dismiss him out of hand. With S&P earnings dipping back to 80, Shilling says the p/e multiple is likely to contract back to 10 and that brings…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.