( click to enlarge )

Good evening everyone !!! Let's take a look at the chart of the Apple Inc. AAPL once again. The stock remains one of the hottest stocks on the market with a lot of hot indicators showing up. The slope of the upward move is very steep accompanied by increasing volume. This suggest that this run-up is well supported by the buyers. AAPL's has been in a nice uptrend for the last two months and it looks very strong with both 50-day and 200-day moving average going up while MACD is positive and above the signal line. RSI is moving up and just crossed its 85% level, so this means a possible correction is near. This may give us a chance to jump in on the stock when it moves lower. Resistance is now $503.83, which was Monday's high of the day. Add to your position once there is a close above this level. On the downside, in case the stock price drops, the current support is $491. If that breaks, the next support could be the previous breakout area.

( click to enlarge )

The breakout in Velti Plc VELT shares was something that I tweeted early this morning. If you were following my twitter account you would have gotten the tweet when the stock was trading at 9.95. It ended the day at $10.43 trading more than 800.000 shares, well above its average volume. Technical chart above shows bullish sign with %K line on top of %D line and MACD on top of signal line. Let's see if tomorrow stock will confirm intraday breakout.

( click to enlarge )

Intel Corporation INTC looks great on both a weekly and daily charts. The good news , however is that stock is getting closer to a major break-out, so keep an eye on her for a possible breakout over $27. Looking at the daily chart, the stock is still in bull market as 50-day moving average is still above 200-day moving average so any pull back would mean buying opportunity. Stay tuned.

( click to enlarge )

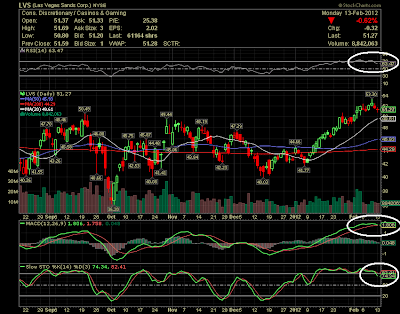

Las Vegas Sands Corp. LVS - If its support of $50.49 is broken on a close basis then the chances of stock touching the level of $49 becomes high. The internal indicators are moving down and in the world of technical analysis, that's not good. Buy only when the stock reverses from the support.

( click to enlarge )

Dendreon Corporation DNDN displayed some impressive relative strength with a 2.9% gain. The stock still showing strong accumulation on up days with high volume and selling on low volume. The overall outlook for the stock appears bullish IMO. Only a close below $12.82 would negate the bullish outlook for the stock. A close above $15.21 would reinstate short-term bullish trend that could propel the stock to the next target zone of $17.

( click to enlarge )

Aetna Inc. AET - Broke out on decent volume today placing this stock on the map for technical analysis breakout buyers. Looking for $45 to now act as support.

( click to enlarge )

Camelot Information Systems Inc (Public, NYSE: CIS) - I'll continue to accumulate this Chinese stock on weakness. The technical indicators are looking better now for the stock. The stock has just entered into a short-term bull market as the stock is on top of 20 day and 50 day moving averages. Other technical indicator such as MACD, is above 0 showing positive momentum while KD line also show buy signal as %K line is top of %D line. The ADX is indicating a bullish outlook with +DMI cross above –DMI. Technically speaking the stock is now painting a short-term “Bullish” picture. Consistent move above $2.75 could be a beginning of a new technical bullish reversal at least testing 3/3.20 area.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in