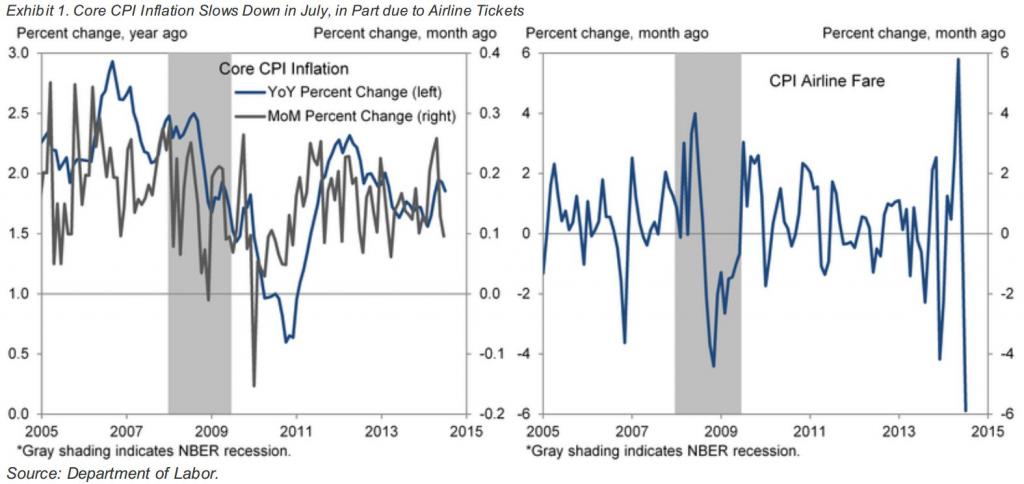

The upward movement in CPI continues to come at a pace below expectations, notching a roughly 0.10 percent increase for July Core CPI. Goldman Sachs GS Jan Hatzius is blaming this on “out-sized drag in the air travel category” and notes the collapse in CPI Airline Fare on a MoM basis is the driving force for the MoM collapse in Core CPI. In the image below, provided by Goldman, the steady increase in CPI from March through May ended as CPI Airline Fare (right-side image) dropped dramatically.

(Click to Enlarge)

The volatility in the CPI Airline Fare reading appears to be tied to the Labor Department's methodology, as Hatzius explains:

“Heightened volatility in air travel appears to be due to a recent change to the Labor Department's methodology for collecting prices. For example, the May jump seems to have been caused by the sampling window rolling into the period around the Independence Day holiday (a period of high seasonal demand), while the July decline reflects prices for air travel around the start of the new school year (a seasonally weak period). The seasonal adjustment factors have not yet been able to conform to the new seasonal patterns, as seasonal factors for the CPI are never revised until the January report. As a result, while we may see a bit of continued softness in August, the autumn numbers will probably begin to reflect the ramp-up in ticket prices associated with the holiday travel season”.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.