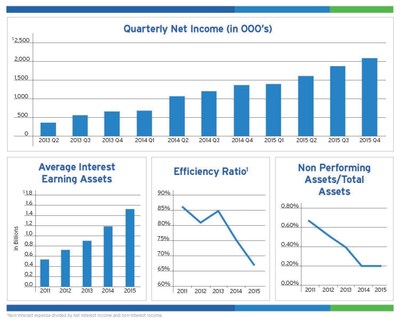

BELMONT, Mass., Feb. 11, 2016 /PRNewswire/ -- BSB Bancorp, Inc. BLMT (the "Company"), the holding company for Belmont Savings Bank (the "Bank"), a state-chartered savings bank headquartered in Belmont, Massachusetts, today reported net income of $2.07 million, or $0.23 per diluted share, for the quarter ended December 31, 2015, compared to net income of $1.37 million, or $0.16 per diluted share, for the quarter ended December 31, 2014, or an increase in net income of 51.2%. For the year ended December 31, 2015, the Company reported net income of $6.91 million, or $0.78 per diluted share, compared to net income of $4.29 million, or $0.49 per diluted share, for the year ended December 31, 2014, or an increase in net income of 61.1%.

Robert M. Mahoney, President and Chief Executive Officer, said, "Through strong organic growth and expense control, we have achieved 10 consecutive quarters of earnings improvement. Credit quality remains good."

NET INTEREST AND DIVIDEND INCOME

Net interest and dividend income before provision for loan losses for the quarter ended December 31, 2015 was $10.63 million as compared to $8.53 million for the quarter ended December 31, 2014, or a 24.6% increase. The provision for loan losses for the quarter ended December 31, 2015 was $886,000 as compared to $565,000 for the quarter ended December 31, 2014, or a 56.8% increase, primarily due to loan growth. This resulted in an increase of $1.78 million, or 22.3%, in net interest and dividend income after provision for loan losses for the quarter ended December 31, 2015 as compared to the quarter ended December 31, 2014. Net interest and dividend income before provision for loan losses for the year ended December 31, 2015 was $38.21 million as compared to $31.60 million for the year ended December 31, 2014, or a 20.9% increase. The provision for loan losses for the year ended December 31, 2015 was $2.32 million, as compared to $1.55 million for the year ended December 31, 2014, or a 49.3% increase, primarily due to loan growth. This resulted in an increase of $5.85 million, or 19.5%, in net interest and dividend income after provision for loan losses for the year ended December 31, 2015 as compared to the year ended December 31, 2014.

NONINTEREST INCOME

Noninterest income for the quarter ended December 31, 2015 was $768,000 as compared to $920,000 for the quarter ended December 31, 2014, or a decrease of 16.5%. This decrease was primarily driven by a decrease in net gains on sales of loans due to lower sales volume of both auto loans and 1-4 family residential real estate loans. Noninterest income for the year ended December 31, 2015 was $3.17 million as compared to $3.29 million for the year ended December 31, 2014, or a decrease of 3.9%. This decrease was primarily driven by lower loan servicing fee income due to decreases in the balance of auto loans that we service for others. Partially offsetting this was an in increase in income from bank owned life insurance due to $10 million of additional policies purchased in the third quarter of 2014 and $5 million purchased in the second quarter of 2015.

NONINTEREST EXPENSE

Noninterest expense for the quarter ended December 31, 2015 was $7.17 million as compared to $6.66 million for the quarter ended December 31, 2014, or an increase of 7.8%. This increase was primarily driven by an increase in salaries and employee benefits costs. Our efficiency ratio improved to 62.9% during the quarter ended December 31, 2015 from 70.4% during the quarter ended December 31, 2014 as we continue to grow the balance sheet and manage costs. Noninterest expense for the year ended December 31, 2015 was $27.82 million as compared to $26.49 million for the year ended December 31, 2014, or an increase of 5.0%. This increase was primarily driven by an increase in salaries and employee benefits costs. Our efficiency ratio also improved to 67.3% during the year ended December 31, 2015, from 75.9% during the year ended December 31, 2014.

BALANCE SHEET

At December 31, 2015, total assets were $1.81 billion, an increase of $387.37 million or 27.2% from $1.43 billion at December 31, 2014. The Company experienced net loan growth of $355.56 million, or 30.1%, from December 31, 2014. Residential 1-4 family real estate loans, commercial real estate loans, construction loans, home equity lines of credit and commercial loans increased by $258.85 million, $54.21 million, $29.33 million, $28.41 million and $14.03 million, respectively. Partially offsetting these increases was a decrease in indirect auto loans of $28.0 million, driven by the suspension of new originations due to current market conditions. The asset growth was primarily funded by growth in deposits.

At December 31, 2015, deposits totaled $1.27 billion, an increase of $284.96 million or 28.9% from $984.56 million at December 31, 2014. Core deposits, which we consider to include all deposits other than CD's and brokered CD's, increased by $252.74 million from December 31, 2014. Hal R. Tovin, Executive Vice President and Chief Operating Officer, said, "Our deposit growth throughout 2015 was an important, cost effective funding source for our strong asset growth. We were very pleased with the fact that it came from building customer relationships in many business segments - most notably business banking, municipal banking and commercial real estate."

Total stockholders' equity increased by $9.19 million from $137.01 million as of December 31, 2014 to $146.20 million as of December 30, 2015. This increase is primarily the result of earnings of $6.91 million and a $2.22 million increase in additional paid-in capital related to stock-based compensation.

ASSET QUALITY

The allowance for loan losses in total and as a percentage of total loans as of December 31, 2015 was $11.24 million and 0.73%, respectively, as compared to $8.88 million and 0.75%, respectively, as of December 31, 2014. For the year ended December 31, 2015, the Company recorded net recoveries of $42,000, as compared to net charge offs of $629,000 for the year ending December 31, 2014. Total non-performing assets were $3.64 million, or 0.20% of total assets, as of December 31, 2015, as compared to $2.82 million, or 0.20% of total assets as of December 31, 2014.

Company Profile

BSB Bancorp, Inc. is headquartered in Belmont, Massachusetts and is the holding company for Belmont Savings Bank. The Bank provides financial services to individuals, families, municipalities and businesses through its six full-service branch offices located in Belmont, Watertown, Cambridge, Newton and Waltham in Southeast Middlesex County, Massachusetts. The Bank's primary lending market includes Essex, Middlesex, Norfolk and Suffolk Counties, Massachusetts. The Company's common stock is traded on the NASDAQ Capital Market under the symbol "BLMT". For more information, visit the Company's website at www.belmontsavings.com.

Forward-looking statements

Certain statements herein constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on the beliefs and expectations of management, as well as the assumptions made using information currently available to management. Since these statements reflect the views of management concerning future events, these statements involve risks, uncertainties and assumptions. As a result, actual results may differ from those contemplated by these statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like "believe," "expect," "anticipate," "estimate," and "intend" or future or conditional verbs such as "will," "would," "should," "could" or "may." Certain factors that could cause actual results to differ materially from expected results include changes in the interest rate environment, changes in general economic conditions, our ability to continue to increase loans and deposit growth, legislative and regulatory changes that adversely affect the businesses in which the Company is engaged, changes in the securities market, and other factors that may be described in the Company's annual report on Form 10-K and quarterly reports on Form 10-Q as filed with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. The Company disclaims any intent or obligation to update any forward-looking statements, whether in response to new information, future events or otherwise, except as may be required by law.

|

BSB BANCORP, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Dollars in thousands, except per share data) | |||||||

|

December 31, 2015 |

December 31, 2014 | ||||||

|

(unaudited) |

|||||||

|

ASSETS |

|||||||

|

Cash and due from banks |

$ 1,871 |

$ 2,275 | |||||

|

Interest-bearing deposits in other banks |

49,390 |

49,492 | |||||

|

Cash and cash equivalents |

51,261 |

51,767 | |||||

|

Interest-bearing time deposits with other banks |

131 |

131 | |||||

|

Investments in available-for-sale securities |

21,876 |

22,079 | |||||

|

Investments in held-to-maturity securities (fair value of $136,728 as of |

|||||||

|

December 31, 2015 and $119,447 as of December 31, 2014) |

137,119 |

118,528 | |||||

|

Federal Home Loan Bank stock, at cost |

18,309 |

13,712 | |||||

|

Loans held-for-sale |

1,245 |

- | |||||

|

Loans, net of allowance for loan losses of $11,240 as of |

|||||||

|

December 31, 2015 and $8,881 as of December 31, 2014 |

1,534,957 |

1,179,399 | |||||

|

Premises and equipment, net |

2,657 |

3,066 | |||||

|

Accrued interest receivable |

3,781 |

2,977 | |||||

|

Deferred tax asset, net |

6,726 |

5,642 | |||||

|

Income taxes receivable |

- |

321 | |||||

|

Bank-owned life insurance |

29,787 |

23,888 | |||||

|

Other assets |

5,067 |

4,040 | |||||

|

Total assets |

$ 1,812,916 |

$ 1,425,550 | |||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|||||||

|

Deposits: |

|||||||

|

Noninterest-bearing |

$ 192,476 |

$ 179,205 | |||||

|

Interest-bearing |

1,077,043 |

805,357 | |||||

|

Total deposits |

1,269,519 |

984,562 | |||||

|

Federal Home Loan Bank advances |

374,000 |

285,100 | |||||

|

Securities sold under agreements to repurchase |

3,695 |

1,392 | |||||

|

Other borrowed funds |

1,020 |

1,067 | |||||

|

Accrued interest payable |

993 |

961 | |||||

|

Deferred compensation liability |

6,434 |

5,751 | |||||

|

Income taxes payable |

184 |

- | |||||

|

Other liabilities |

10,868 |

9,707 | |||||

|

Total liabilities |

1,666,713 |

1,288,540 | |||||

|

Stockholders' Equity: |

|||||||

|

Common stock; $0.01 par value, 100,000,000 shares authorized; 9,086,639 and 9,067,792 |

|||||||

|

shares issued and outstanding at December 31, 2015 and December 31, 2014, respectively |

91 |

91 | |||||

|

Additional paid-in capital |

89,648 |

87,428 | |||||

|

Retained earnings |

60,517 |

53,603 | |||||

|

Accumulated other comprehensive loss |

(116) |

(22) | |||||

|

Unearned compensation - ESOP |

(3,937) |

(4,090) | |||||

|

Total stockholders' equity |

146,203 |

137,010 | |||||

|

Total liabilities and stockholders' equity |

$ 1,812,916 |

$ 1,425,550 | |||||

|

Asset Quality Data: |

|||||||

|

Total non-performing assets |

$ 3,639 |

$ 2,818 | |||||

|

Total non-performing loans |

$ 3,631 |

$ 2,770 | |||||

|

Non-performing loans to total loans |

0.24% |

0.23% | |||||

|

Non-performing assets to total assets |

0.20% |

0.20% | |||||

|

Allowance for loan losses to non-performing loans |

309.56% |

320.59% | |||||

|

Allowance for loan losses to total loans |

0.73% |

0.75% | |||||

|

Share Data: |

|||||||

|

Outstanding common shares |

9,086,639 |

9,067,792 | |||||

|

Book value per share |

$ 16.09 |

$ 15.11 | |||||

|

BSB BANCORP, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in thousands, except per share data) | |||||||||||||||

|

Three months ended |

Twelve months ended | ||||||||||||||

|

December 31, |

December 31, | ||||||||||||||

|

2015 |

2014 |

2015 |

2014 | ||||||||||||

|

(unaudited) |

(unaudited) |

||||||||||||||

|

Interest and dividend income: |

|||||||||||||||

|

Interest and fees on loans |

$ 12,522 |

$ 9,764 |

$ 44,890 |

$ 35,293 | |||||||||||

|

Interest on taxable debt securities |

821 |

773 |

3,064 |

3,131 | |||||||||||

|

Dividends |

128 |

42 |

373 |

143 | |||||||||||

|

Other interest income |

21 |

21 |

79 |

85 | |||||||||||

|

Total interest and dividend income |

13,492 |

10,600 |

48,406 |

38,652 | |||||||||||

|

Interest expense: |

|||||||||||||||

|

Interest on deposits |

2,083 |

1,678 |

7,768 |

5,809 | |||||||||||

|

Interest on Federal Home Loan Bank advances |

770 |

382 |

2,394 |

1,209 | |||||||||||

|

Interest on securities sold under agreements to repurchase |

1 |

1 |

4 |

3 | |||||||||||

|

Interest on other borrowed funds |

7 |

7 |

28 |

30 | |||||||||||

|

Total interest expense |

2,861 |

2,068 |

10,194 |

7,051 | |||||||||||

|

Net interest and dividend income |

10,631 |

8,532 |

38,212 |

31,601 | |||||||||||

|

Provision for loan losses |

886 |

565 |

2,317 |

1,552 | |||||||||||

|

Net interest and dividend income after provision |

|||||||||||||||

|

for loan losses |

9,745 |

7,967 |

35,895 |

30,049 | |||||||||||

|

Noninterest income: |

|||||||||||||||

|

Customer service fees |

226 |

210 |

894 |

874 | |||||||||||

|

Income from bank-owned life insurance |

257 |

207 |

893 |

559 | |||||||||||

|

Net gain on sales of loans |

16 |

158 |

395 |

486 | |||||||||||

|

Loan servicing fee income |

151 |

190 |

614 |

826 | |||||||||||

|

Other income |

118 |

155 |

369 |

549 | |||||||||||

|

Total noninterest income |

768 |

920 |

3,165 |

3,294 | |||||||||||

|

Noninterest expense: |

|||||||||||||||

|

Salaries and employee benefits |

4,532 |

4,119 |

17,610 |

16,581 | |||||||||||

|

Director compensation |

269 |

326 |

912 |

1,032 | |||||||||||

|

Occupancy expense |

255 |

256 |

1,074 |

1,060 | |||||||||||

|

Equipment expense |

111 |

150 |

533 |

605 | |||||||||||

|

Deposit insurance |

283 |

195 |

969 |

749 | |||||||||||

|

Data processing |

792 |

705 |

3,108 |

2,933 | |||||||||||

|

Professional fees |

205 |

182 |

749 |

765 | |||||||||||

|

Marketing |

217 |

232 |

926 |

975 | |||||||||||

|

Other expense |

510 |

492 |

1,943 |

1,790 | |||||||||||

|

Total noninterest expense |

7,174 |

6,657 |

27,824 |

26,490 | |||||||||||

|

Income before income tax expense |

3,339 |

2,230 |

11,236 |

6,853 | |||||||||||

|

Income tax expense |

1,270 |

862 |

4,322 |

2,562 | |||||||||||

|

Net income |

$ 2,069 |

$ 1,368 |

$ 6,914 |

$ 4,291 | |||||||||||

|

Earnings per share |

|||||||||||||||

|

Basic |

$ 0.24 |

$ 0.16 |

$ 0.80 |

$ 0.50 | |||||||||||

|

Diluted |

$ 0.23 |

$ 0.16 |

$ 0.78 |

$ 0.49 | |||||||||||

|

Return on average assets |

0.47% |

0.40% |

0.44% |

0.35% | |||||||||||

|

Return on average equity |

5.64% |

3.98% |

4.87% |

3.20% | |||||||||||

|

Interest rate spread |

2.33% |

2.40% |

2.33% |

2.47% | |||||||||||

|

Net interest margin |

2.46% |

2.56% |

2.48% |

2.64% | |||||||||||

|

Efficiency ratio |

62.94% |

70.43% |

67.25% |

75.91% | |||||||||||

|

Contact: |

Robert M. Mahoney |

|||

|

President and Chief Executive Officer |

||||

|

Phone: |

617-484-6700 |

|||

|

Email: |

Photo - http://photos.prnewswire.com/prnh/20160211/332279

Logo - http://photos.prnewswire.com/prnh/20160113/322031LOGO

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/bsb-bancorp-inc-reports-fourth-quarter-results--year-over-year-earnings-growth-of-61-300219025.html

SOURCE BSB Bancorp, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.