Lightlake Therapeutics' LLTP intranasal naloxone could receive priority review after inking fast-track designation from the FDA earlier this week. This event could accrete more than $50M, or $8 per share, to the present value of the Company.

Priority review means the FDA has a mandate to review a new drug application (NDA) within 6 months of receipt versus a standard 10 months. The question, then, is how much is this accelerated approval schedule worth to a drug developer entering a billion-dollar market?

We note that Regeneron REGN and partner Sanofi SNY paid BioMarin BMRN $67.5 Million, in January of this year, to acquire a priority review voucher - or effectively cut the FDA review period from 10 to 6 months on their pending cholesterol drug. The net effect puts Regeneron 1 month ahead of rival Amgen AMGN.

In November 2014, Gilead GILD dished out $125 Million for a priority review voucher to Knight Therapeutics. The Company has not indicated which NDA it intends to apply priority review to, but implied that the present value of a product that's first-to-market or 4 months' ahead of schedule is worth at least 9 figures in segments where the addressable market is north of a billion.

Priority review not only cuts time to market, but accretes overhead savings and reallocates resources towards the next most profitable opportunity for Lightlake. In December 2014, the Company partnered with Adapt Pharma, in exchange for more than $55 Million and tiered royalties on sales - which could reasonably be expected in 2016 - to commercialize and market intranasal naloxone.

We believe priority review could be on the table for Lightlake's intranasal naloxone and will accrete tremendous shareholder value, particularly to its current valuation.

Priority Review Likely For Intranasal Naloxone Based On Precedent with Peers and FDA Definition

According to the FDA, companies that receive fast-track designation are eligible for "Accelerated Approval and Priority Review, if relevant criteria are met".

The criteria for priority review, the FDA continues, is based on "significant improvements" over standard of care in a disease setting. The agency goes on to define what this means:

"Significant improvement may be demonstrated by the following examples:

- evidence of increased effectiveness in treatment, prevention, or diagnosis of condition;

- elimination or substantial reduction of a treatment-limiting drug reaction;

- documented enhancement of patient compliance that is expected to lead to an improvement in serious outcomes; or

- evidence of safety and effectiveness in a new subpopulation."

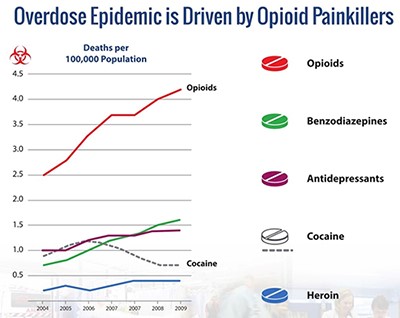

Naloxone is the gold standard in reversing opioid overdose, yet statistics show an alarming increase in overdose-related deaths (as shown below).

Source: Lightlake/CDC

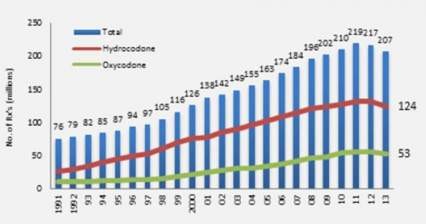

Part of the reason is the limited availability of the drug as an injection. An intransal version of naloxone clearly meets the definition of "reduction in treatment-limited drug reaction" for priority review as outlined by the FDA (and referenced above). Presumably, intranasal naloxone could play a substantial role in preventing overdose-related death, with wider availability of the product, better compliance among opioid users, and physicians possibly prescribing the product alongside opioids to help mitigate risk of overdose. The graph below shows the rise of opioid prescriptions in the U.S. since 1991 and continued need for this therapy in a more accessible form, eg. intranasal spray.

Source: IMS/DrugAbsue.gov

According to the same source, "the United States is the biggest consumer globally, accounting for almost 100 percent of the world total for hydrocodone (e.g., Vicodin) and 81 percent for oxycodone (e.g., Percocet)." This explains why partner Adapt Pharma was willing to pay more than $55 Million and offer tiered royalties to commercialize and market Lightlake's intranasal naloxone in the U.S.

Kaleo, the privately-held maker of naloxone auto-injector Evzio, received fast-track designation and subsequently priority review, before their approval 6 months ahead of [normal] schedule last year. The FDA noted that the auto-injector proposed a significant improvement over naloxone administered in a syringe and this formed the basis of a priority – or 6 month – review process. In reality, the FDA approved Evzio, well ahead of schedule, creating strong precedent for Lightlake to capture priority review for their own reformulation of naloxone, intranasal naloxone.

Why Priority Review Would Be Worth Upwards of $50 Million to Lightlake Shareholders

Time to market creates variability and incurs a time value of money cost. For Lightlake, expedited review would accrete shareholder value in 3 ways:

- Receipt of significant milestone payment(s) from partner Adapt Pharma;

- Reallocation of resources towards development of Lightlake's binge eating disorder, bulimia and other clinical programs;

- Increase in present value of future cash flows from the commercialization of intransal naloxone for opioid overdose and other indications.

Per their agreement with Adapt Pharma, Lightlake is entitled to receive more than $55 Million in milestone payments related to the commercialization of their intranasal naloxone. Under the assumption that the FDA approves their product-candidate, Lightlake would presumably trigger a major milestone payment. Redeploying these resources to the development of candidates in the Company's pipeline could accrete tremendous value to shareholders. If we assume a discount rate of 30% and assign a future value of $200 Million to intranasal naloxone, and $125 Million to each of the 3 other clinical products Lightlake intends to commercialize, discounting over a 5-year period would result in a present value of $155M versus $200M when discounting over a 4-year period. We think that priority review could potentially trigger a $5 Million milestone payment from Adapt Pharma and follow-on payments of $10 million for each the [potential] drug approval and product commercialization, all 6 months ahead of schedule. Certainly, Evzio's approval creates precedent for this timeline. And we suspect a 6-month head start for Adapt is commercially meaningful as well.

Importantly, as we wrote in an earlier note, we believe that Lightlake entering into a partnership with Adapt Pharma was and continues to be an overlooked de-risking and value creation event. Adapt Pharma's executive management has an impressive background with successes at Elan (acquired by Perrigo for $8.6B in 2013) and Azur Pharma (merged with Jazz Pharmaceuticals JAZZ in a deal then worth $500M; now worth upwards of $2B).

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service.

Legal Disclaimer: This research note has been prepared by One Equity Research, LLC on behalf of Lightlake Therapeutics Inc, as part of research coverage services. One Equity Research expects to be compensated up to twenty thousand dollars per month and up to fifty thousand restricted shares of the company for ongoing research coverage and advisory services. This research note is not an offer or solicitation to buy or sell the securities of Lightlake Therapeutics. The report is for information purposes only, and is not intended to (and is provided explicitly on the condition that it not) be used as the sole basis to make any investment decision. Investors should make their own determinations whether an investment in any particular security is consistent with their investment objectives, risk tolerance, and financial situation.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.