This report identifies the best and worst ETFs and mutual funds based on the quality of their holdings and their costs across all styles. As detailed in “Low-Cost Funds Dupe Investors”, there are few funds that have both good holdings and low costs. While there are lots of cheap funds, there are very few with high-quality holdings.

Without speculating on the cause for this disconnect, I think it is fair to say that there is a severe lack of quality research into the holdings of mutual funds and ETFs. There should not be such a large gap between the quality of research on stocks and funds, which are simply groups of stocks.

After all, investors should care more about the quality of a fund’s holdings than its costs because the quality of a fund’s holdings is the single most important factor in determining its future performance.

My Predictive Rating system rates 7400+ mutual funds and ETFs according to the quality of their holdings (portfolio management rating) and their costs (total annual costs rating).

The following is a summary of my top picks and pans for all style ETFs and mutual funds. I will follow this summary with a detailed report on each style, just as I did for each sector.

Figure 1 shows the best ETF or mutual fund in each investment style as of July 16, 2012. There are no attractive funds in any of the Mid Cap and Small Cap styles.

For a full list of all ETFs and mutual funds for each investment style ranked from best to worst, see our free ETF and mutual fund screener.

Figure 1: Best Style ETFs and Mutual Funds

Only one style fund gets my Very Attractive rating, GMO Trust: GMO Quality Fund (GQLOX). 34% of this fund is allocated to Very Attractive stocks, including Microsoft (MSFT) and Philip Morris International (PM). Another 28% is allocated to Attractive stocks. About 18% is in Neutral stocks and there are no Dangerous-or-worse-rated stocks. Now that is a fund manager earning his pay!

One of the fund’s top holdings is Philip Morris International (PM), which gets my Very Attractive rating. Since it spun out of Altria Group (MO) in 2008, PM’s profits have climbed steadily. The company’s NOPAT has grown every year and their 2011 ROIC was an impressive 35%, up from 29% in 2008. You may not approve of smoking cigarettes, but there can be no denying that tobacco is a profitable business. And Philip Morris International does it more profitably than most. Profitable growth creates value for shareholders. The current market price, today around $90.84, implies PM’s profit growth ends this year, and that the company will never see growth again in the future. That seems like a pessimistic expectation for a company with high and rising ROIC, consistent growth, and some of the most recognizable and popular brands in the world. Owning Very Attractive stocks that offer a combination of impressive profitability and attractive valuations is one of the reasons GQLOX earns my Very Attractive Predictive Rating.

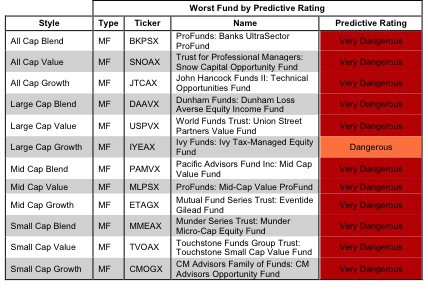

Figure 2 shows the worst ETF or mutual fund for each investment style as of July 16, 2012. No ETFs rank as the worst of any of the styles.

Dangerous-or-worse-rated funds have a combination of low-quality portfolios (i.e. they hold too many Dangerous-or-worse rated stocks) and high costs (they charge investors too much for the [lack of] management they provide).

Figure 2: Worst Style ETFs and Mutual Funds

ProFunds: Banks UltraSector ProFund (BKPSX) is the worst All Cap Blend fund and gets my Very Dangerous rating. The portfolio management and total annual costs ratings for this fund are both Very Dangerous, resulting in a lose-lose value proposition for investors. Over 93% of 7400+ ETFs and mutual funds in our coverage universe charge lower annualized fees than BKPSX. The managers at BKPSX have a lot of nerve charging investors over 4% (annualized) when 71.51% of the stocks in their portfolio are rated Dangerous-or-worse. Investors should avoid BKPSX. It’s truly an example of pay more, get less.

One of my least favorite stocks in this fund is Citigroup (C). It gets my Very Dangerous rating because of misleading earnings and an expensive valuation. The company’s ROIC was 0.4% in 2011, well below its cost of capital. In fact ,Citigroup has never had ROIC higher than its WACC since 1998. In order to justify its stock price, Citigroup needs to grow its profits at 18% compounded annually for 25 years. Expectations of performance at that level indicate that the stock price still does not reflect Citigroup’s consistent erosion of shareholder value.

Traditional mutual fund research has focused on past performance and low management costs. The quality of a fund’s holdings has been ignored. Our portfolio management rating examines the fund’s holdings in detail and takes into account the fund’s allocation to cash. Our models are created with data from over 40,000 annual reports. This kind of diligence is necessary for understanding just what you are buying when you invest in a mutual fund or an ETF.

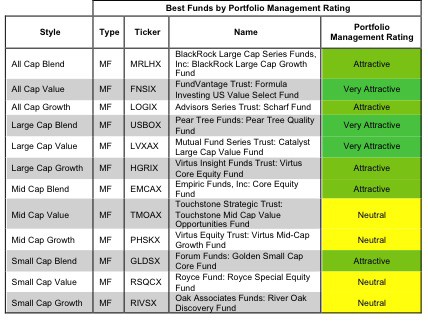

Figure 3 shows the best fund based on our Portfolio Management Rating for each investment style as of July 16, 2012. No ETFs rank at the top of any of the styles based on Portfolio Management Rating.

Attractive-or-better-rated funds own high-quality stocks and hold very little of the fund’s assets in cash – investors looking to hold cash can do so themselves without paying management fees. Only 3.6% of funds receive our Attractive or Very Attractive ratings, so investors need to be cautious when selecting a mutual fund or ETF – there are thousands of Neutral-or-worse-rated funds.

Figure 3: Style Funds With Highest Quality Holdings

Figure 4 shows the worst fund based on our Portfolio Management Rating for each investment style as of July 16, 2012. No ETFs rank as the worst of any investment style by Portfolio Management Rating.

The worst fund for each investment style is an actively managed mutual fund; none of the worst investment style funds are passively managed ETFs. Investors pay mutual fund managers to pick stocks for them. Even ignoring costs, these mutual fund managers do a poor job investing money for their clients.

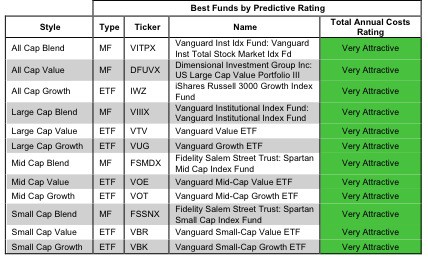

Investors should care about all of the fees assocated with a fund in addition to the quality of the fund’s holdings. The best funds have both low costs and quality holdings – and there are plenty of low cost funds available to investors.

Figure 5 shows the best fund in each investment style according to our total annual costs rating. An ETF ranks as the lowest cost for seven of the twelve style categories.

Total Annual Costs incorporates all expenses, loads, fees, and transaction costs into a single value that is comparable across all funds. Passively managed ETFs and index mutual funds are generally the cheapest funds.

Figure 5: Style Funds With Lowest Costs

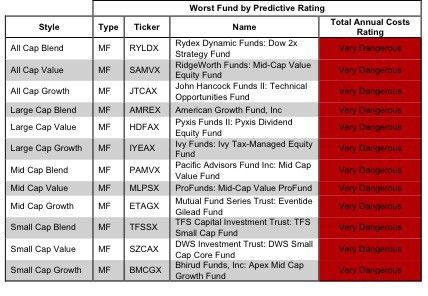

The most expensive fund for each investment style has a Very Dangerous Total Annual Costs Rating. Investors should avoid these funds and other funds with a Very Dangerous Total Annual Costs Ratings because they charge investors too much. For every fund with a Very Dangerous Total Annual Costs Rating there is an alternative fund that offers similar exposure and holdings at a lower cost. We cover over 7000 mutual funds and over 400 ETFs. Investors have plenty of alternatives to these overpriced funds.

Figure 6 shows the worst fund in each investment style according to our total annual costs rating. No ETFs ranks as the most expensive for any style category.

Figure 6: Style Funds With Highest Costs

Disclosure: I own PM. I receive no compensation to write about any specific stock, sector or theme.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.