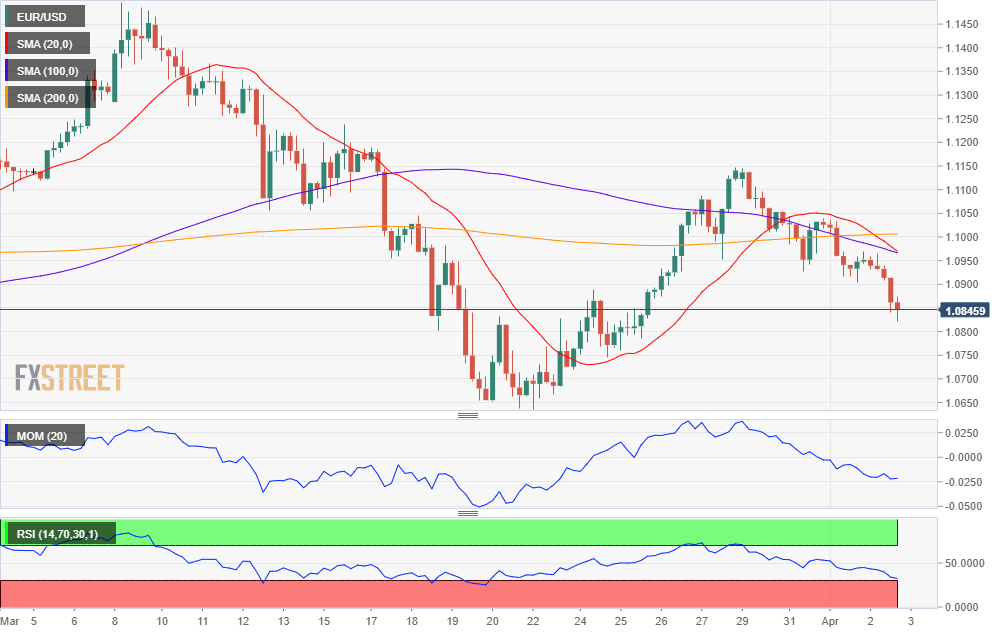

EUR/USD Current Price: 1.0845

- US unemployment claims jumped to 6.648 million in the week ended March 27.

- EU Markit Services PMI expected to suffer downward revisions.

- EUR/USD bearish, heading toward the yearly low at 1.0635.

The EUR/USD pair fell to 1.0826, its lowest for this week, as the ongoing uncertainty keeps fueling demand for the greenback. While movements are not as wild as those witnessed last week, market players still prefer the dollar over most of its rivals, even with US data showing the economic scenario continues to worsen. The key macroeconomic figure released this Thursday was the US unemployment claims, which jumped to 6.648M almost doubling the market’s expectations. Also, the Challenger Job Cuts report showed that US-based employers announced 222,288 cuts in March, up 292% from February. The numbers are just the tip of the iceberg on how the coronavirus pandemic is hitting the economy.

The final readings of March Markit Services PMI for the EU and the US are scheduled to be out this Friday, with those in the Union expected to be downwardly revised. The US will also release the official ISM Non-Manufacturing PMI, expected at 44 from 57.3 previously. The country will also release the March Nonfarm Payroll report and is expected to have lost 100,000 ´positions. The unemployment rate is seen jumping from 3.4% to 3.8% while wage growth is seen up by 0.2% MoM and by 3.0% YoY. Given that data was compiled to mid-March, it won’t fully reflect the current situation of the labor market, and may have a limited effect on currencies.

EUR/USD Short-Term Technical Outlook

The EUR/USD pair is pressuring the 61.8% retracement of its latest bullish run, maintaining its negative bias ahead of the Asian opening. In the 4-hour chart, the pair is extending its slide below all of its moving averages, with the 20 SMA moving below the larger ones, although all of them still confined to a tight range. Technical indicators in the mentioned chart stand at daily lows although losing their bearish strength. Anyway, the risk remains skewed to the downside, with the market looking to re-test the yearly low at 1.0635.

Support levels: 1.0810 1.0770 1.0725

Resistance levels: 1.0850 1.0890 1.0940

Image sourced by Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.