Tesla Motors Inc TSLA is due to report its second quarter earnings July 24 after the closing bell. Though shares of the controversial automaker are down 16.5% year-to-date, the stock has rallied hard off its $176.99 low from June 3.

If you’re one of the few people on the fence about Tesla and are looking for clarity from sell-side analysts, look elsewhere.

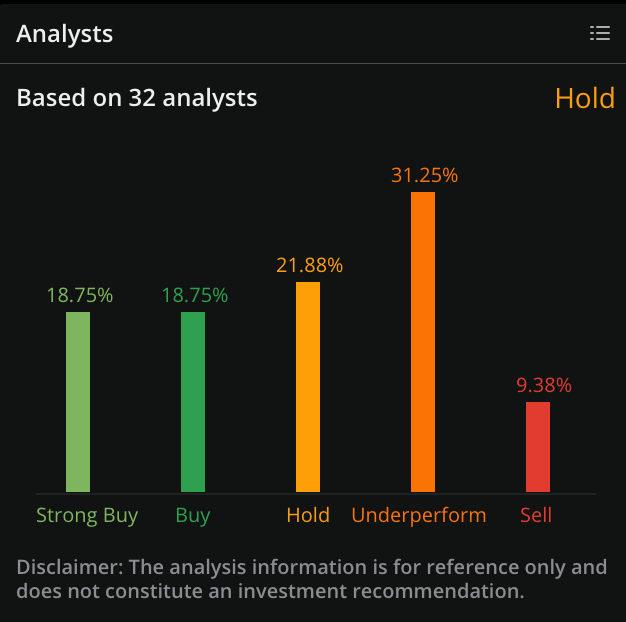

Of the 32 analysts who cover Tesla, six have a Strong Buy, six have a Buy, seven have a Hold, 10 have an Underperform, and three have a Sell. Not exactly a clear sentiment.

Image courtesy of Webull

The average price target of those analysts—the predicted price of the stock in the next 12 months—is $277.50, but the sheer range of these estimates show just how divided Wall Street analysts are. Berenberg’s Alexander Haissl has the Street-high price target among analysts of $500, with Gordon Johnson of Vertical Research coming in at $54.

Expectations For Tesla Earnings

Analysts are expecting Tesla to report a loss of $0.48 per share on $6.43 billion in revenue in the prior quarter. Options traders are currently pricing in an expected 8.53% move over the next week.

The company had previously said it delivered about 95,200 vehicles in the second quarter, falling in-line with its previously given guidance of 90-100K deliveries. The data point was seen as hugely promising for investors, as it suggested the company was figuring out how to scale its production to meet demand.

Image courtesy of Webull

Webull is a content partner of Benzinga

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.