Amazon.com, Inc. AMZN reports second-quarter earnings after market close on Thursday, July 26.

For the second quarter, AMZN is expected to report adjusted EPS of $2.49 on revenue of $53.27 billion, according to third-party consensus analyst estimates. In the same quarter last year, AMZN reported adjusted EPS of $0.40 on revenue of $37.95 billion. The company has beat earnings estimates by a wide margin in the past three quarters.

Management’s guidance for Q2 was revenue between $51 billion and $54 billion, and operating income ranging from $1.1 billion to $1.9 billion.

Even though Prime Day technically fell in the third quarter, management might still provide some additional commentary on results on the earnings call. The 36-hour shopping event got off to a rocky start with some glitches, which the company was able to resolve.

AMZN doesn’t release specific sales figures for Prime Day, but it did say that it was the biggest shopping day in the company’s history when comparing 36-hour periods. It also said that more people signed up for Prime on July 16 than any other day previously.

On last quarter’s call, the company announced it was raising the price of Prime membership by $20 to $119 a year, the second price increase ever for the service. The hike went into effect May 11 and would apply to membership renewals starting June 16, shortly after the end of Q2. So the price hike will only be reflected in a small portion of this quarter’s results.

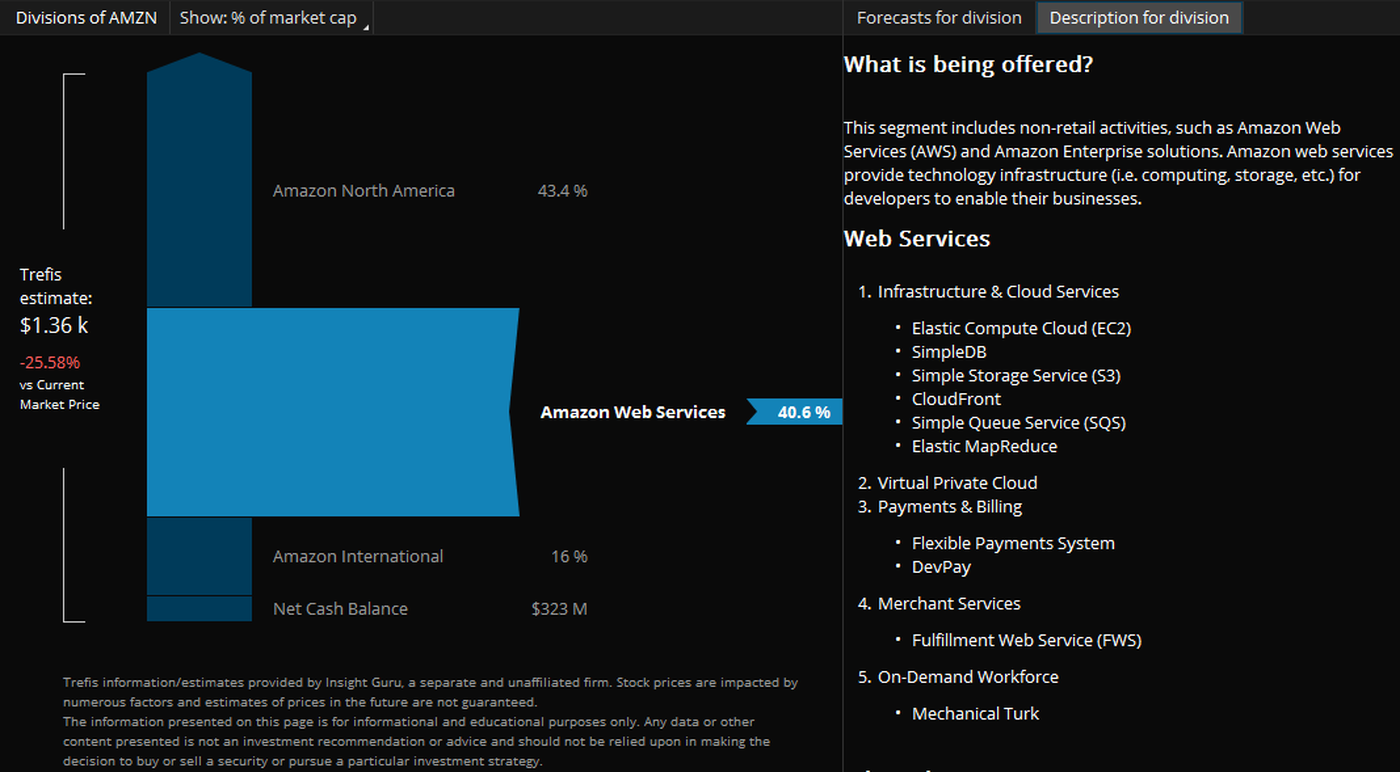

Amazon Company Divisions. Amazon’s three main divisions are shown in the Company Profile above. Historically, Amazon Web Services has been an important business for the company, and has generated a large portion of its operating income. TD Ameritrade clients can analyze potential revenue drivers of a stock on the Fundamentals tab on the thinkorswim® platform. Trefis information and estimates used in Company Profile are provided by Insight Guru, a separate and unaffiliated firm. Not a recommendation. For illustrative purposes only. Past performance does not guarantee future results.

Amazon Company Divisions. Amazon’s three main divisions are shown in the Company Profile above. Historically, Amazon Web Services has been an important business for the company, and has generated a large portion of its operating income. TD Ameritrade clients can analyze potential revenue drivers of a stock on the Fundamentals tab on the thinkorswim® platform. Trefis information and estimates used in Company Profile are provided by Insight Guru, a separate and unaffiliated firm. Not a recommendation. For illustrative purposes only. Past performance does not guarantee future results.

Amazon Web Services, or AWS, has been an important business for AMZN and that segment has been an important profit driver for the company. In Q1, AMZN reported that AWS grew 48.6 percent year over year to $5.44 billion, while operating income grew 57.3 percent to $1.4 billion.

That made AWS the company’s smallest division from a revenue perspective, but it’s largest from a profit perspective. Analysts are expecting that segment to grow around 45-47 percent in Q2, putting its total revenue around $6 billion.

Amazon Options Trading Activity

Around AMZN’s earnings release, options traders have priced in about a 3.8 percent stock move in either direction, according to the Market Maker Move indicator on the thinkorswim® platform. That might not seem like a huge move as a percentage, but it translates into a 70-point move.

Implied volatility was pretty close to the middle of the road at the 57th percentile as of this morning.

2018 Rally. Outside of a few dips here and there, AMZN pretty much started the year at its low and has marched higher since. The stock hit a new all-time high of $1858.88 on July 18. It has pulled back since and has been trading between $1800 and $1830 for the most part ahead of earnings. Chart source: thinkorswim® by TD Ameritrade. Not a recommendation. For illustrative purposes only. Past performance does not guarantee future results.

2018 Rally. Outside of a few dips here and there, AMZN pretty much started the year at its low and has marched higher since. The stock hit a new all-time high of $1858.88 on July 18. It has pulled back since and has been trading between $1800 and $1830 for the most part ahead of earnings. Chart source: thinkorswim® by TD Ameritrade. Not a recommendation. For illustrative purposes only. Past performance does not guarantee future results.

Overall, there hasn’t been a whole lot of options activity that stands out. At the July 27 weekly expiration, the 1827.5 and 1830 strike prices have been a little more active than other strikes, while trading on the put side has been spread out across a range of strikes.

Looking at the August 17 monthly expiration, there also hasn’t been a lot of recent activity that stands out. Open interest is highest at the 1800-strike calls and puts, which has been a key level for the stock. The 1800-strike call had 9,080 contracts open at the end of Tuesday’s session, and the 1800-strike put had 5,627 contracts open.

Note: Call options represent the right, but not the obligation, to buy the underlying security at a predetermined price over a set period of time. Put options represent the right, but not the obligation to sell the underlying security at a predetermined price over a set period of time.

What’s Coming Up

There are quite a few reports from big tech companies coming up. Some of the notable ones include Facebook, Inc. FB after the closing bell today; Intel Corporation INTC after the close Thursday, July 26; and Twitter, Inc. TWTR before market open on Friday, July 27. Next week, Apple, Inc. AAPL is scheduled to release results after the close on Tuesday, July 31.

For a look at what else is going on, check out today’s Market Update if you have time.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.