- GBP/USD has hit a fresh two-year low after the Fed's hawkish decision.

- The Bank of England's rate decision and preparations for a hard Brexit are set to dominate trading today.

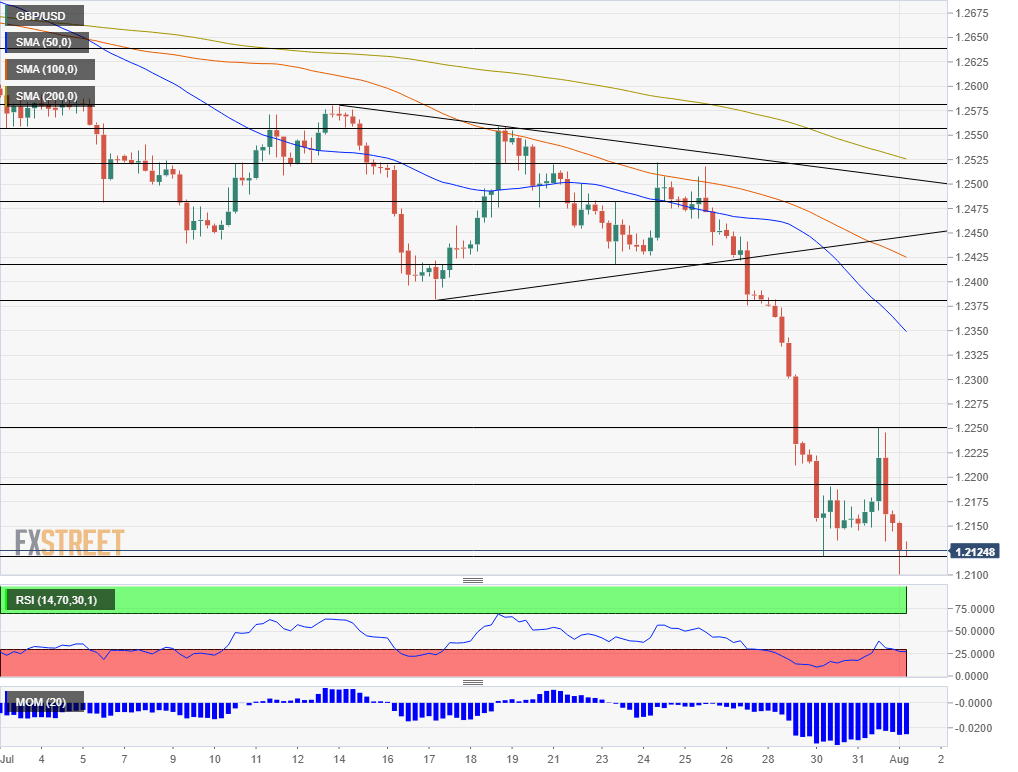

- Thursday's four-hour chart suggests mild oversold conditions.

A dead-cat bounce tends to be followed by a fresh dive – and that is what GBP/USD has been struggling with. The US Federal Reserve has failed to soothe investors' fears and while it cut interest rates as expected, the bank signaled that further stimulus is not imminent. The greenback soared in response and sterling fell to a new trough around 1.2100 – the lowest since January 2017.

Fed Chair Jerome Powell has said that the outlook remains favorable for the US economy and that the rate cut – the first in over a decade – is a merely an "insurance" against risks to the outlook. While he left the door open to additional moves, the world's most powerful central bank stressed that this is not the beginning of a classic cycle of repetitive rate cuts.

BOE and a hard-Brexit in focus

GBP/USD had only just begun recovering from the losses it suffered early in the week as the new government stepped up its preparations for a no-deal Brexit – when the Fed sent it down. Developments in the UK also support a lower exchange rate. Chancellor of the Exchequer Sajid Javid has announced an additional budget of £2.1 billion toward preparations for a hard exit and PM Boris Johnson's senior adviser David Frost conveyed the government's unwillingness to compromise on the thorny Irish Backstop issue to European leaders.

The focus now shifts to the Bank of England which announces its rate decision and releases its Quarterly Inflation Report (QIR) later today. The BOE is set to leave its policy unchanged but may drop its intention to raise interest rates. In this case, Governor Mark Carney and his colleagues will be following the footsteps of the Fed, the European Central Bank, and other central banks which have either announced monetary stimulus or moved to that direction.

Moreover, Carney will be scrutinized by reporters about the bank's assessment of Brexit. The BOE's forecasts have been based on a smooth Brexit and investors are wondering if this is still the case given the recent political developments and the downfall of the pound.

See: BOE Super Thursday Preview: Time to abandon rosy assumptions? – Five scenarios for GBP/USD

Ahead of the decision, Markit's Manufacturing Purchasing Managers' Index is set to show ongoing contraction in the sector, but traders will likely wait for the BOE to move GBP/USD.

In the US, the ISM Manufacturing PMI is due later in the day, serving as another hint towards Friday's all-important Non-Farm Payrolls report. Markets are currently still digesting the Fed decision.

See: ISM Manufacturing PMI Preview: The homeward turn

GBP/USD Technical Analysis

The Relative Strength Index on the four-hour chart is back below 30 – indicating oversold conditions and implying a bounce. However, it has already been at the far lower ground before the highly-anticipated bounce came along. Therefore, the price action from earlier this week indicates that the recovery may not be imminent.

Momentum remains to the downside and the pair is trading significantly below the 50, 100, and 200 Simple Moving Averages.

The fresh low of 1.2100 is the first support line to watch. Next, we find 1.1985 and 1.1866 – two swing lows dating to late 2016 and early 2017.

Some resistance awaits at 1.2190, which has capped a recovery attempt early in the week. Wednesday's swing high of 1.2250 is the next level on the radar. Further up, 1.2380 and 1.2420 are eyed.

Image Sourced From Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.