- GBP/USD bounces off the sub-1.2400 area.

- Sterling rallied as ‘no deal’ option lost some traction.

- Boris Johnson still leads the run-up to be Prime Minister.

The British Pound rallied on Thursday, managing at the same time to leave behind fresh lows in sub-1.2400 levels, after the Parliament passed a bill that could reduce the risk of Britain leaving the EU without a deal.

Despite the auspicious news, the Sterling is expected to remain under heavy pressure on stagnant Brexit negotiations and unabated uncertainty in the UK political arena.

On the more macro view, UK fundamentals remain fragile in spite of yesterday’s better-than-expected results from domestic retail sales. The bearish view on GBP is also reinforced by the now neutral/dovish stance from the Bank of England, as investors are now factoring in the possibility of a rate cut in the near/medium term.

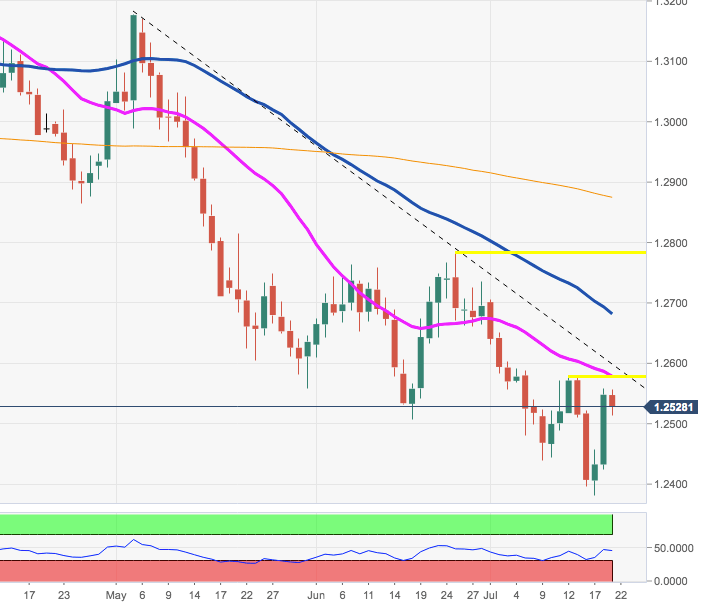

On the technical sphere, Cable faces interim hurdle in the 1.2580 region, where converge the 21-day SMA and last week’s tops. Further up emerges the 55-day SMA at 1.2679, considered the last defense of a visit to June peaks just below 1.2800 the figure. On the downside, the resumption of the selling mood should initially target the 10-day SMA at 1.2498 ahead of yesterday’s multi-month lows in the 1.2385/80 band.

Image Sourced by Pixabay

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.