The mid-week mood on Wall Street looks to be positive after a blockbuster media and telecom merger got the go-ahead and as investors look toward the potential Fed interest rate hike.

Investor focus today is likely to be on the conclusion of the Federal Open Market Committee meeting and press conference scheduled for this afternoon. If the Fed does what investors seem to be thinking it will, there might not be much market reaction immediately after the announcement.

Fed funds futures were pointing to a near certainty that the Fed will raise rates today. What investors appear to be waiting for is commentary from the central bank that could give clues to the Fed’s thoughts on a fourth rate hike this year.

If that language appears to be increasingly hawkish, stocks could move lower as investors worry about further monetary policy tightening. More dovish language could have the opposite effect. But digesting that could take some time and stocks may not react until tomorrow, if they do at all.

The More the Merrier?

Investors may also be looking for an indication of whether the Fed will increase the number of press conferences, Wayne Wicker, senior vice president and chief investment officer with retirement plan manager ICMA-RC, said Tuesday.

On Tuesday, with the U.S.-North Korea summit out of the way and not making too many ripples in the markets, investors appeared to be keeping their powder dry ahead of the Fed meeting. The S&P 500 (SPX) and Nasdaq (COMP) were up a bit while the Dow Jones Industrial Average ($DJI) lost just 0.01 percent.

Telecom-bination

Investors also spent much of Tuesday waiting for an antitrust decision on whether AT&T Inc. T purchase of Time Warner Inc. TWX could go forward. The deal got the green light, potentially setting a precedent for big deals inside and outside of the media space.

The deal unites T’s telecom might with TWX’s media empire. How times have changed since the 1980s, when AT&T was in breaking-up mode.

Increased merger-and-acquisition activity can potentially have the effect of boosting bullish investor sentiment.

This morning, TWX’s shares were up more than 3.8 percent while T’s were down around 4.4 percent. It often happens that an acquirer’s shares will decline and a target’s shares will rise because of the premiums paid for acquisitions. Meanwhile, Twenty-First Century Fox Inc. FOXA was up around 8 percent, apparently on expectations that Comcast Corporation CMCSA and Walt Disney Co DIS could get into a bidding war for some Fox assets. Meanwhile, shares of T-Mobile US Inc. TMUS, which has announced plans to combine with Sprint Corp S, were up more than 1.6 percent while Sprint was up around 2.5 percent.

In economic news, core producer price index data came in at 0.3 percent, slightly higher than the Briefing.com consensus expectation of 0.2 percent. That’s on the heels of a core consumer price index number that registered a 0.2 percent gain, in line with economists’ expectations. Those numbers show economic growth but aren’t likely to raise too many fears about inflation.

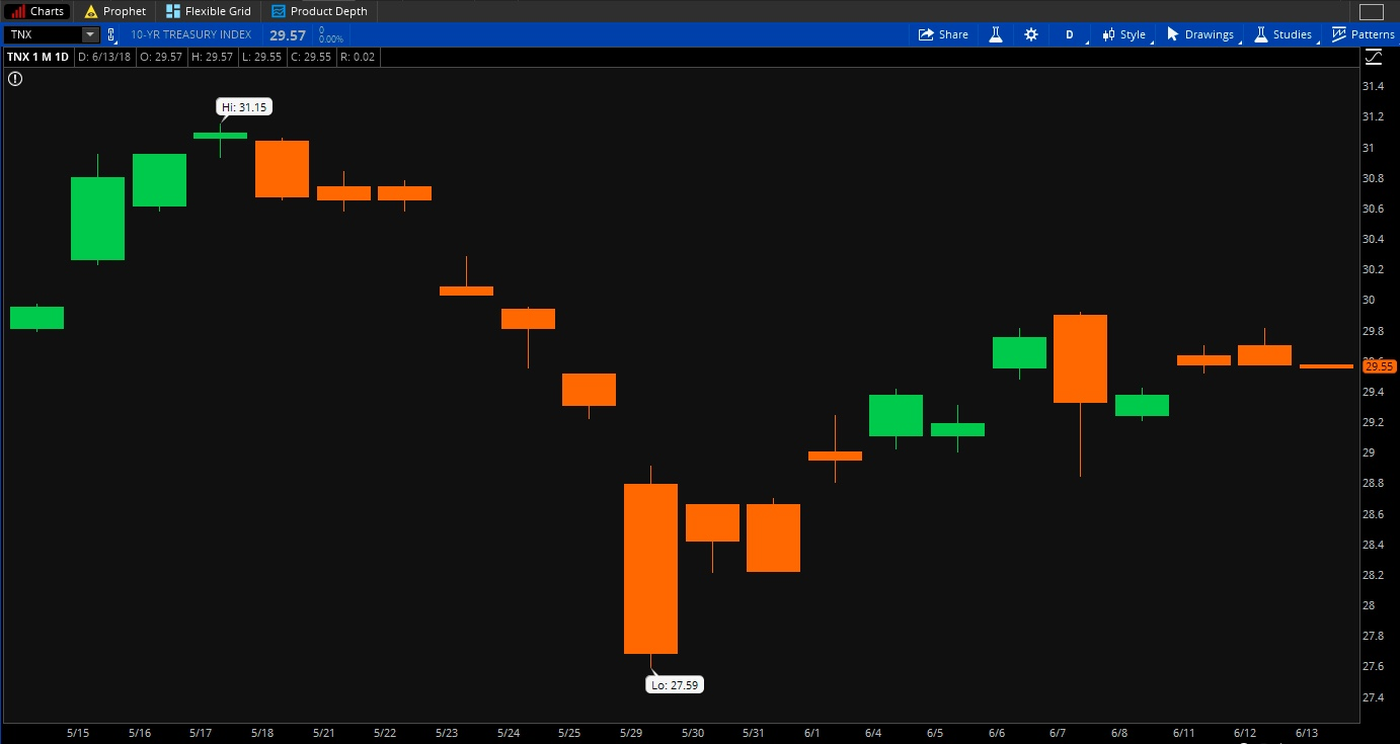

Figure 1: Flatlining: The yield on the 10-year Treasury has flattened over the last couple of weeks, keeping in a close range just below the 3 percent level as investors await word from the Fed. Inflation data this week also could have an impact on the future direction of yields. Data Source: CME Group. thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Want a Soda With That?

Shares of McDonald’s Corporation MCD have been on the upswing lately, partly due to analyst upgrades as the company executes a cost-savings program and refurbishes stores. At the same time, shares of The CocaCola Company KO climbed last week and hit a nearly two-month high of their own Tuesday despite a lack of much news directly affecting the company. This might illustrate one of those patterns sometimes seen in the stock market where shares of one firm get a lift in part from how shares of another are doing. Think of the close relationship between MCD and KO products. A lot of people ordering burgers at MCD are probably also ordering a Coke, and if you look at chart patterns, the two companies have actually been close over the last two years from a performance standpoint. Though each company has its own fundamentals, it might be prudent to never discount the fact that no firm trades in a vacuum.

Layoffs and Inflation

While much of the market appears focused on the potential for higher inflation, especially with a tight jobs market, there are some winds apparently blowing the opposite direction. The Financial Times has reported that in the next five years Citigroup Inc. C could cut 10,000 technology and operations jobs from its investment banking unit. Meanwhile, Tesla Inc. TSLA and MCD are also in layoff mode, according to reports. While job losses are a sad life event, it may be reassuring for those losing their jobs that there is plenty of hiring demand out there. If layoffs end up meaningfully adding to the number of people seeking jobs, that could take some of the upward pressure off of wages, a key component of inflation. Because the layoffs seem to be more about cost streamlining rather than a weak economy, the job losses could ironically be good for the economy overall by lessening inflationary pressure a bit. While that’s little solace for the recently laid off, it does seem to be at least a silver lining in general.

Beyond the Fed Funds Rate

Investors might learn today about another type of interest rate: Interest on Excess Reserves, or IOER. It’s a complicated concept, but basically it means that in response to the financial crisis, Congress let the Fed pay banks for surplus cash they store at the central bank. Since it began raising rates, the Fed tried to keep the top of its target Fed funds range aligned with the IOER. Now, the Fed funds rate is rising toward the top of its range for various reasons. So the Fed might be tempted today to raise the IOER by just 20 basis points to keep the rates aligned and prevent people from potentially losing trust in the Fed’s ability to control rates. How would this affect investors? That’s hard to say, but ultimately some analysts think it could potentially cause a steepening in the Treasury market yield curve by putting more weight on short-term yields.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.