The auto industry has been under pressure lately as the First Trust NASDAQ Global Auto Index Fund CARZ has sold off roughly five percent since the early July highs of $41.60.

Friday's heavy morning selling in auto majors may be profit-taking, coupled with a strong sell off in Japanese yen futures.

Thursday was bullish for the autos, as Morgan Stanley MS released a note outlining the overall strength in automotive lending. Morgan Stanley analysts found that credit quality is strong and, thanks to lenders demanding higher down payments, availability remains strong.

Major automakers are down Friday:

- Toyota Motors TM down 1.5 percent

- Ford F down 1.1 percent

- General Motors GM down 0.84 percent

- Honda Motor HMC down 1.04 percent

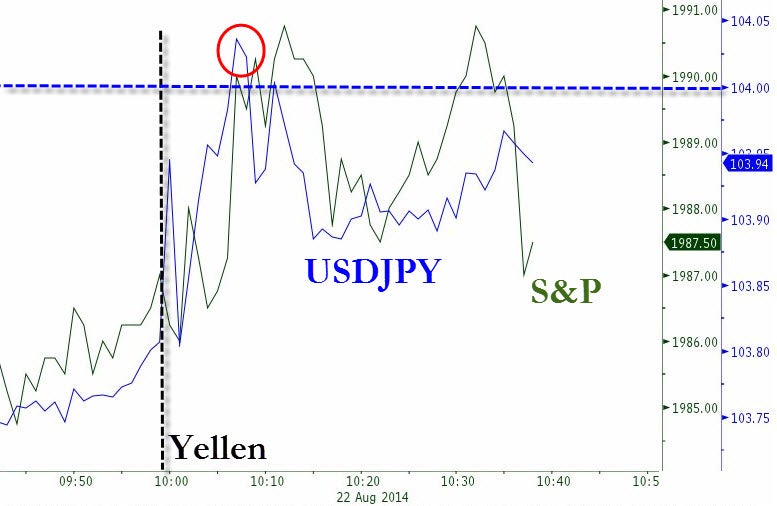

Most of the move can be attributed to Toyota's selloff, as the Japanese yen sells off the most in more than a year during of Fed Chair Yellen’s Jackson Hole speech Friday morning.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.