OK, cheating a bit here.

OK, cheating a bit here.

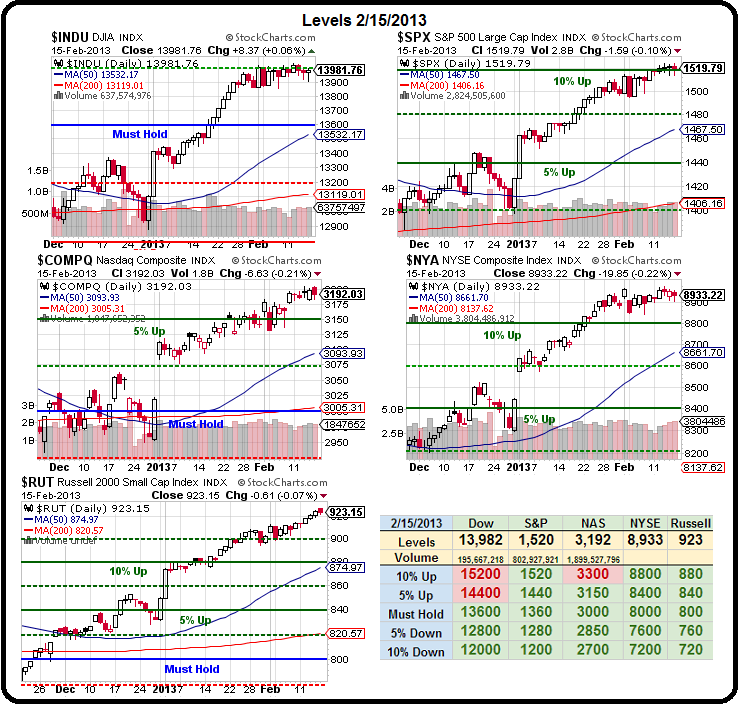

I started this article on Friday and we were reviewing Anthony Mirhaydari's list as it's an excellent jumping-off point for contemplating the current market situation. I ran out of time on Friday, as I hadn't intended to get into such a major topic at first, so we're going to finish the list off this morning and discuss on this market holiday below (also, there was lots of good stuff in weekend Member Chat – see the end of Friday's comments):

Since it is Friday Monday, and a holiday weekend, let's review something we discussed in yesterday's Member Chat – which was an article by Anthony Mirhaydari titled "10 Big Worries About This Market."

Now Anthony's a smart guy so I review this out of respect but we all need to keep in mind that a lot of people are "bearish" for a lot of the wrong reasons and, since this is a list of 10 good ones – it's worth taking a hard look at them.

Before we begin, I just want to mention another smart bear who is being backed into a corner today – poor Bill Ackman is being taken to the woodshed for daring to piss off Carl Icahn, who disclosed a 13% stake in HLF today and sent the stock flying up 22% pre-market. There is nothing worse than a short squeeze when you are bearish and the worst part is, to get out of the trade you have to capitulate by BUYING the stock you hate – thereby adding to the run-up.

Before we begin, I just want to mention another smart bear who is being backed into a corner today – poor Bill Ackman is being taken to the woodshed for daring to piss off Carl Icahn, who disclosed a 13% stake in HLF today and sent the stock flying up 22% pre-market. There is nothing worse than a short squeeze when you are bearish and the worst part is, to get out of the trade you have to capitulate by BUYING the stock you hate – thereby adding to the run-up.

While we all know Bill Ackman has a litany of very good reasons to be short HLF – who cares if more people are buying than selling – especially when one or two of the buyers are so big they totally overwhelm the sellers? The whole market is like that – it's all about sentiment – until it isn't. Our job is only to know when the wind is changing so we can get out. We're not here to fight the battles with the big boys.

"Can we rally on?" asks Mirhaydari – and he acknowledges the Fed and other Central Banks as the primary driver of the rally but he also premises his outlook on what he believes is a coming Global Recession (or the continuation of one we only papered over so…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.