By Poly

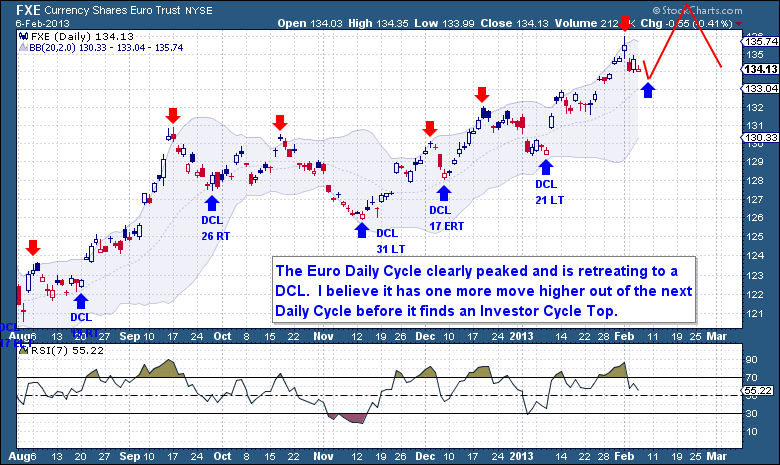

The Euro Cycle topped on Friday as I had suspected was possible. In the weekend report I mentioned the Bollinger Band break that occurred deep in the Cycle timing as a key development. Unfortunately I was looking for a possible final surge into a top that did not develop.

So with 4 days of flat to lower action, it's now clear that the Euro is seeking a DCL. I do expect this decline to be short-lived though because I'm looking for the Dollar to begin its waterfall decline into an eventual ICL. That's obviously not at all possible with a dropping Euro, so I expect the ECB meeting tomorrow to possibly be a catalyst for the Euro to surge higher again.

I said the Euro was ripe for a short and I was right. However I was looking for one more pop higher before getting into a trade. It shouldn't matter, the next Euro Daily Cycle should move back up towards $1.38 and that will be the best IC short trade level. Looking at entering into EUO within the next 2 weeks.

In the weekend report I said “Although there is still some small upside potential, it's probably time to close the positions.” Well the Euro clearly topped since then and it's now on its way to a DCL. I believe this will be short lived and the Euro will be back on its way up to the $1.37-39 level where it will find its Investor Cycle Top. A little more downside to $1.335 and I would go long the Euro again.

This as is an excerpt from this week's premium update published on Wednesday (2.06) focusing on the EURO from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly, as well as real time trade alerts to profit from market inefficiencies.

They offer a FREE 15-day trial where you'll receive complete access to the entire site. Coupon code (ZEN) saves you 15%.

Related Posts:

Austerity Could Trigger Next Recession

Pay Close Attention To Silver Next Week

Dollar Remains Resilient While Facing H/S Pattern

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.