Spain is fixed again.

Spain is fixed again.

In a report that surprised no one, Spanish banks passed their stress tests with flying colors on Friday but Europe was closed at the time so they weren't able to rally until this morning and the markets over there are up over 1% this morning (7:30 – not reflected in Dave's chart). Sure the banks are short about $76Bn in capital but that doesn't even seem like a big number these days and sure the tests assume GDP growth of 0.7% next year and 1.2% in 2014 and sure their most adverse scenario only has the market down 5% in 2013 and then flat in 2014 but – hey – they passed!

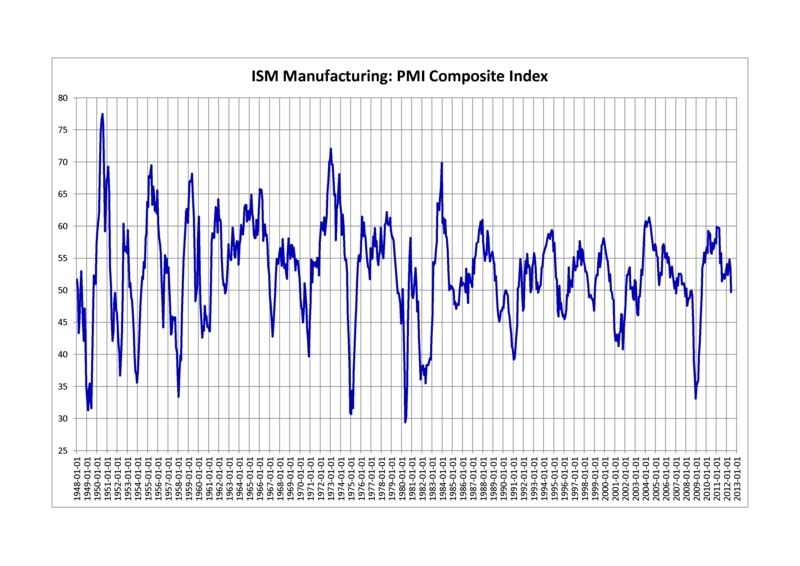

Even better for this morning, Global PMI Reports are coming in and other than a few stragglers (notably France at a disastrous 42.7 and Australia at 44.1), we have improvements across the board or, at least, a flattening of the downturn. We were discussing over the weekend how the drought was probably giving us a bad string of numbers as greatly reduced crop production has been a factor in taking down the Transports, bringing down inventory levels and lowering orders for Durables – notably farm equipment.

Keep in mind that all the PMI does is ask Purchasing Managers whether conditions are worse, the same or better than previous months and the percentage of managers who report "better" (with some weightings) is the PMI number, this is why it's a highly cyclical indicator – good times give tough comps, bad times give easy comps – so it's the trends that matter and improvement in the PMI (not there yet) is a great early indicator of some economic recovery.

Deutsche Bank thinks things are good enough to package several Commercial Mortgage Bonds that are rated BBB- (the lowest investment-grade ranking) together and rate the bundle at "A" for resale. Isn't that BRILLIANT? The bank plans to offer investors 4% debt for this A-rated paper and, before you say "Hey, isn't that what destroyed the economy in 2008?" – I will remind you that it's now 2012 and this time it's sure to be different.

The fact that this is even still legal is appalling. The logic behind it is that, by spreading your risk across several bad loans, you have less risk than…

The fact that this is even still legal is appalling. The logic behind it is that, by spreading your risk across several bad loans, you have less risk than…

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.