US Default Seen As A "Financial Apocalypse"

With the United States two weeks away from a possible default (according to a Congressional Budget Office estimate reported by Reuters), Bloomberg reporter Yalman Onaran attempted to gauge the impact a default would have ("US Default Seen As Catastrophe Dwarfing Lehman's Fall"). According to Onaran:

Among the dozens of money managers, economists, bankers, traders and former government officials interviewed for this story, few view a U.S. default as anything but a financial apocalypse.

DEFCON 3

Although the odds of a default occurring this month still appear slim, judging by the modest cost of hedging the iShares Barclays 20+ Year Treasury Bond ETF TLT, Morgan Stanley MS economists Vincent Reinhardt and Ellen Zentner, as reported by Business Insider, note that risks are rising:

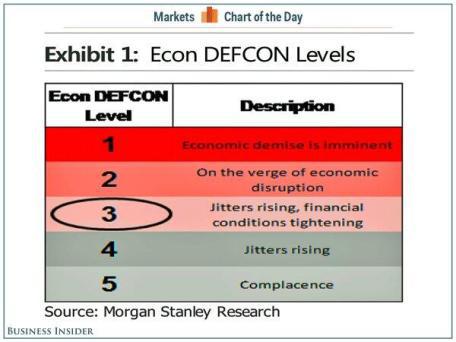

In week two of the government shutdown and debt ceiling standoff, we have raised our assessment to level 3 Econ DEFCON.

Reinhardt and Zentner included this handy threat level chart, reproduced by Business Insider:

Apocalypse Insurance Is Still Inexpensive

So far, despite the Morgan Stanley economists' DEFCON 3 assessment, the cost of apocalypse insurance remains fairly inexpensive. And yet the potential impact of a US default remains huge. As Bloomberg reporter Yalman Onaran noted in an article we quoted above, the stock market lost nearly half of its value in the 5 months following the collapse of Lehman Brothers. How much worse would the markets fare after what many observers believe would be a more severe event, a "financial apocalypse"?

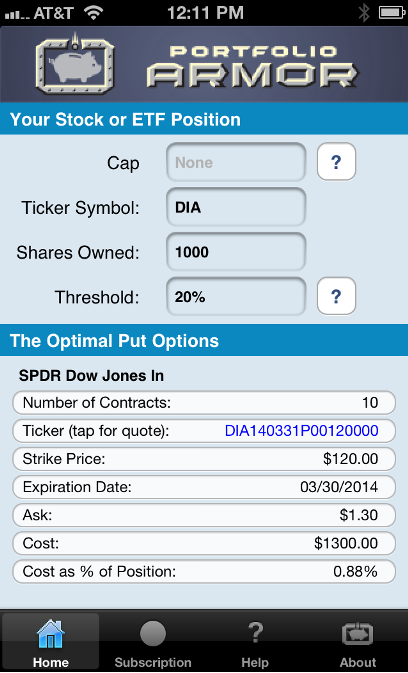

For investors looking to limit their losses in a worst case scenario, these were the optimal puts*, as of intraday Wednesday, to hedge 1000 shares of Dow-tracking ETF SPDR Dow Jones Industrial Average (DIA) against a greater-than-20% drop over the next six months.

As you can see at the bottom of the screen capture below, the cost of this protection, as a percentage of position value, was 0.88%.

Possibly More Protection Than Promised

In some cases, hedges such as the ones above can provide more protection than promised. For an example of that, see this post about hedging shares of the SPDR Gold Trust ETF (GLD).

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones. The screen capture above comes from the Portfolio Armor iOS app.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.