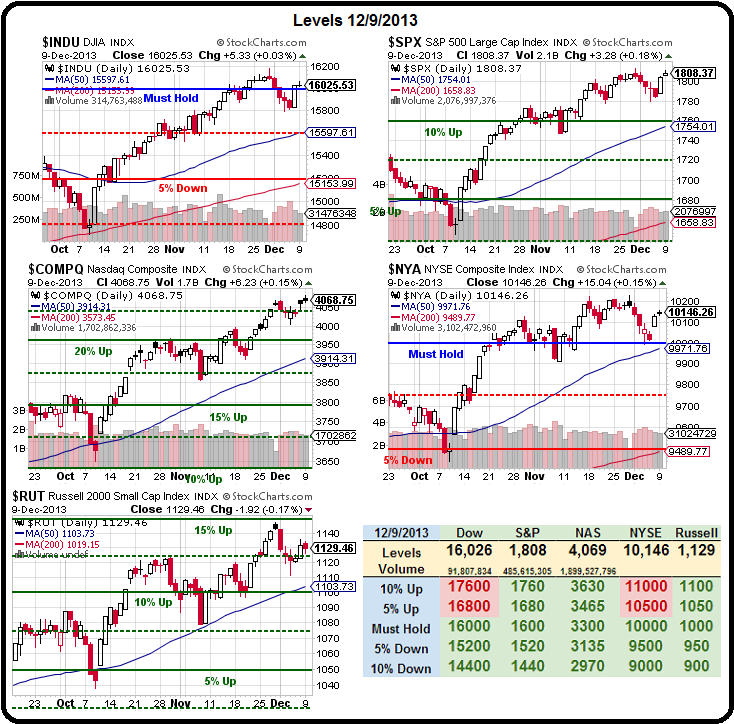

Nothing but blue skies on our Big Chart this week.

Nothing but blue skies on our Big Chart this week.

The S&P came within inches of making a new all-time high and the Nasdaq made their new 13-year high while the Dow, NYSE and Nasdaq also reach for the skies in what David Stockman calls:

"The kind of speculative froth you get at the top of a cycle where valuation loses any anchor in the real world; from earnings or the prospects of the economy."

Well, Jimmy Crack Corn and we're in cash (so we don't care) but just yesterday, both Bullard and Fisher from the Fed said tapering is on the table at next week's meeting (but Fisher always says this) and,. more notably, Gov Lacker also said it would be discussed. Discussion is not action but we may be getting close.

While the official unemployment reports have us down to 7%, the chart on the left from Zero Hedge gives you a much better idea of what's going on in the real World. The number of employees actually working at the 2,000 companies that make up the Russell has dropped by 50% since 2007 and has made little, if any recovery since bottoming out in 2011.

While the official unemployment reports have us down to 7%, the chart on the left from Zero Hedge gives you a much better idea of what's going on in the real World. The number of employees actually working at the 2,000 companies that make up the Russell has dropped by 50% since 2007 and has made little, if any recovery since bottoming out in 2011.

The index, however, is up 169% since the 2008 low so the message to corporate America is clearly to cut the dead weight (employees) and don't go back to the old ways. "America's Economy is Officially Inside-Out" says the Harvard Business Review, with the top 1% making 95% of the gains in this so-called recovery. According to HRB: "The plain fact is that the average household is poorer in the “recovery” than during the “recession.”

When growth rises and living standards fall, that begins to hint that there is something wrong—very wrong, perhaps terribly wrong—with the way things are. It suggest that what is happening to this society is not merely a simple, passing, self-healing ailment; but a chronic, possibly permanent, definitely debilitating condition. Not a flu—but a cancer.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.