Are we overbought yet?

Are we overbought yet?

Not so much according to Dave Fry's NYMO chart, where it looks like we can get away with another few days before gravity takes its toll on our indexes and that will take us right into next week's Fed meeting and… uh oh…

Darn, we were so worried about International terror with Syria and China that we forgot about the Domestic Bankster Terrorists, who are celebrating 40 years of destroying the working class (since Nixon took us off the gold standard and allowed workers to be paid in scrip).

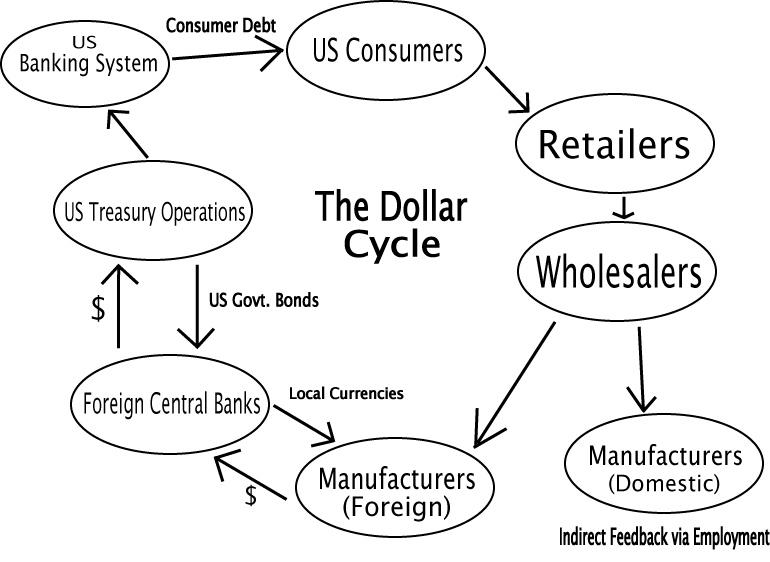

Since that time, the scam has been refined and now, as you can tell from this chart, we have lost the majority of the "feedback" we used to get from Domestic Manufacturing jobs and have, instead, substituted the supply of fresh money by having the Fed simply print it, hand it to the banks, who drive the consumers into debt to keep things going for another cycle.

Since that time, the scam has been refined and now, as you can tell from this chart, we have lost the majority of the "feedback" we used to get from Domestic Manufacturing jobs and have, instead, substituted the supply of fresh money by having the Fed simply print it, hand it to the banks, who drive the consumers into debt to keep things going for another cycle.

But the banks aren't even lending to bottom 90% consumers anymore, they are lending to the manufacturers and retailers who are busy buying each other with all the free money (artificially inflating their stock prices) or buying back their own stock (artificially inflating their stock prices) or investing in automation that enables them to lay even more people off (naturally inflating their stock prices).

The question is, are ther manufacturers laying off workers fast enough and saving enough money to justify the artificially inflated prices (from M&A) that were based on their POTENTIAL to do the same. You may have noticed that I didn't mention expanding sales. That's because our global GDP is up 2% and our stock market is up 20% so this is not real expansion of commerce, sales gained by one seller are lost by another for the most part.

The question is, are ther manufacturers laying off workers fast enough and saving enough money to justify the artificially inflated prices (from M&A) that were based on their POTENTIAL to do the same. You may have noticed that I didn't mention expanding sales. That's because our global GDP is up 2% and our stock market is up 20% so this is not real expansion of commerce, sales gained by one seller are lost by another for the most part.

IN PROGRESS

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.