I love good bounce, don't you?

I love good bounce, don't you?

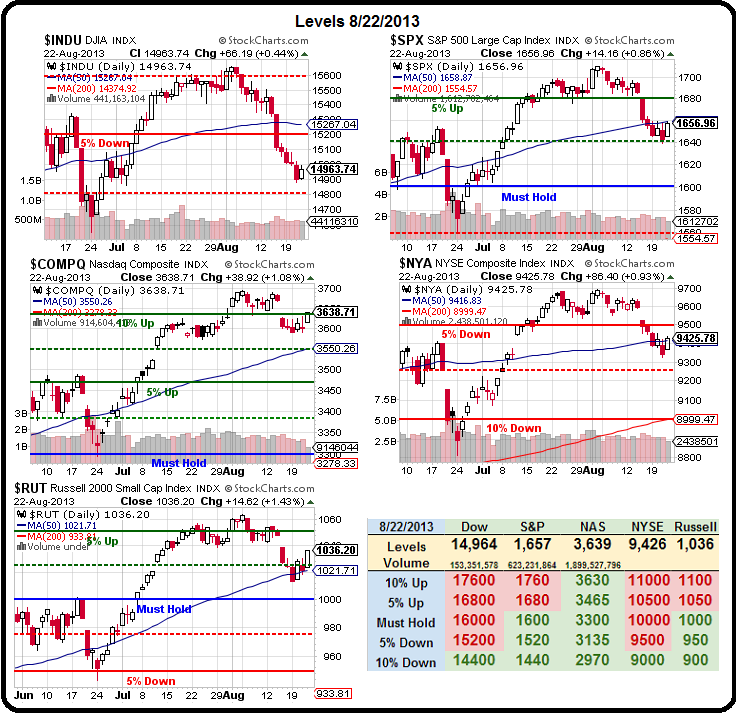

But just how good have our index bounces really been so far. While we had a pretty exciting session on Friday the voulum on a 0.34% up day on the SPY (see Dave Fry's chart) was only 1/2 what it was on the 0.64% drop on Wednesday. As Dave notes: "They don't put volume on your brokerage statement, but…." As to our bounce lines - not too impressive:

- Dow 14,960 (weak) and 15,120 (strong)

- S&P 1,658 and 1,671

- Nas 3,620 and 3,640

- NYSE 9,420 and 9,500

- Rut 1,020 and 1,030

The NYSE is barely over the line so we keep that black until it proves it and, so far, we only have weak bounces taken from the Nas (right on the strong bounce line) and the always-leading Russell, which makes a fantastic short in the Futures (/TF) below the 1,040 line (with very tight stops above). We were looking to at least make our strong bounce lines by Friday

The NYSE is barely over the line so we keep that black until it proves it and, so far, we only have weak bounces taken from the Nas (right on the strong bounce line) and the always-leading Russell, which makes a fantastic short in the Futures (/TF) below the 1,040 line (with very tight stops above). We were looking to at least make our strong bounce lines by Friday

The Dow couldn't even put a good day together on Friday and finished off it's third down week in a row failing to take back the 200 dma at 15,100 while the S&P tested theirs at 1,635 with AAPL and MSFT giving the S&P and Nasdaq most of their lift as well as TLSA, which flew up to the $160 level, putting the short-sellers into a bunker mentality.

Durable Goods this morning is likely to put the longs into a bunker as they should be trending much lower – based on the indications we've gotten from earnings reports this quarter. It's just part of some very negative news-flow I've been warning you about and our weekend reading did not do anything to make us more bullish, unfortunately.

IN PROGRESS

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.