The US Dollar weakened across the board amid reemergence of geopolitical tensions on North Korea Pacific Ocean nuclear rest remarks. According to South Korea's Yonhap news agency, North Korean Foreign Minister Ri Yong Ho was quoted saying that the North could consider a hydrogen bomb test on the Pacific Ocean of an unprecedented scale.

Renewed greenback selling bias helped the EUR/USD pair to build on Thursday's steady recovery move from the 1.1865-60 region and turn flat for the week. Investors are now looking forward to the release of flash Euro-zone PMI prints for September and a scheduled speech by the ECB President Mario Draghi for some short-term trading impetus.

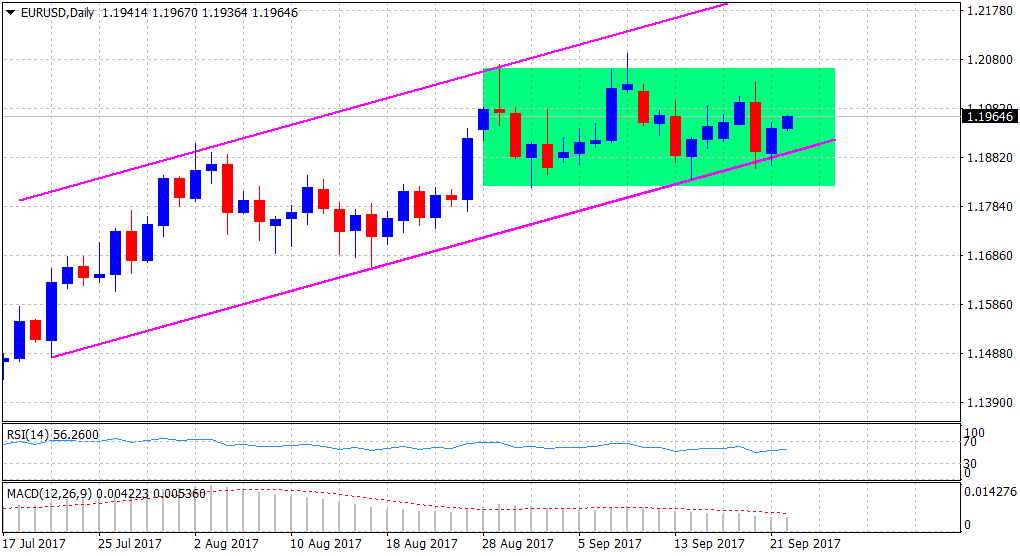

From a technical perspective, the pair has rebounded from a short-term ascending trend-channel support and seems to make a fresh attempt towards conquering the key 1.20 psychological mark. Any subsequent up move beyond the mentioned handle might continue to be capped at the top end of the monthly trading range near the 1.2050-60 region. A decisive break out of the consolidative band should open room for the resumption of the pair's prior appreciating move.

On the flip side, any retracement from higher levels might continue to find support near the 1.1900 handle. Failure to clear the 1.20 important barrier, and a subsequent drop below the mentioned support, could drag the pair towards an important horizontal support near the 1.1825-20 region. Meanwhile, a convincing break below the 1.1900 handle would mark a bearish breakdown and the pair would remain vulnerable to extend its term downward trajectory in the near-term.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.