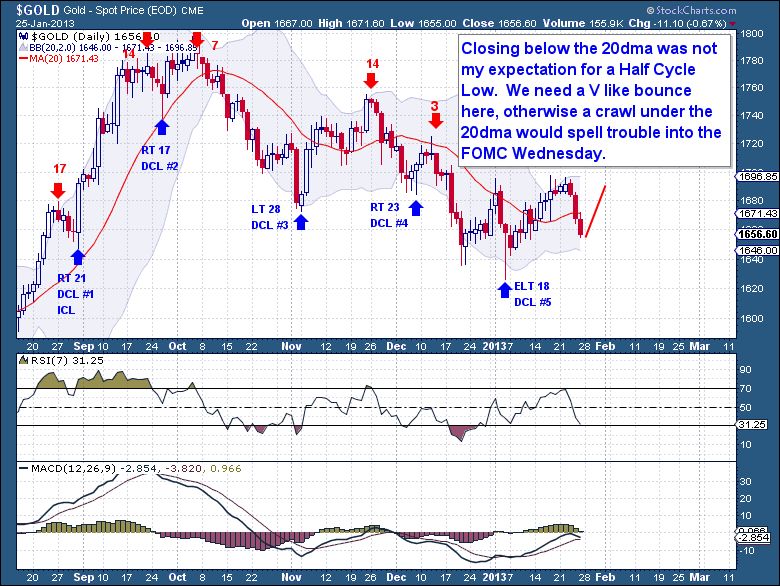

Friday's move lower in gold was not what I had expected. At least what I didn't expect was for gold to close near its lows, as I would have been fine with a midday reversal and a close back near the 20dma. My expectation earlier in the week was for a drop down to $1,670 with the $1,660 level acting as a floor to the Half Cycle Low. So to see gold close below $1,660 is a negative development.

But for now that should have been the extent of the Half Cycle decline and a sharp bounce should unfold. It's the move out of this low that I will be closely watching next week, as a failure to rally strongly will indicate that Gold is yet again in trouble.

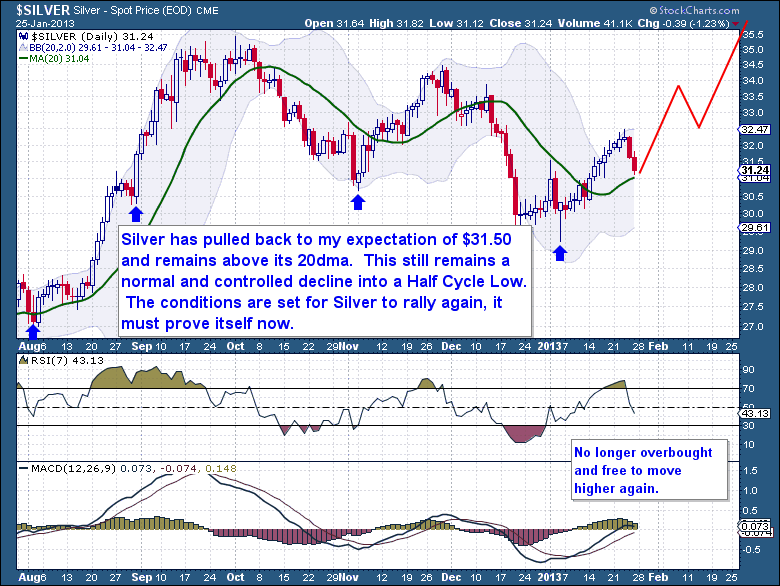

Part of the reason why I held up passing judgment on the gold Cycle on Friday was the performance out of Silver. I pay very close attention to Silver's day to day performance as I find it to be an excellent proxy for gold's overall direction. It's not always a rule, but generally Silver leads gold both to the upside and downside.

When I look at Silver's chart, I see nothing out of the ordinary at this time. To date we've seen two mild (by Silver standards) selling sessions that has Silver pulling back towards its 20dma. For the most part it's been a bullish and consistent 10% rally with what is an orderly regression. I believe the action in Silver early next week will reveal gold's true intent for both this Daily and Investor Cycles.

This as is an excerpt from this weekend's premium update published on Saturday (1.26) focusing on gold & silver from the The Financial Tap, which is dedicated to helping people learn to grow into successful investors by providing cycle research on multiple markets delivered twice weekly, as well as real time trade alerts to profit from market inefficiencies.

They offer a FREE 15-day trial where you'll receive complete access to the entire site. Coupon code (ZEN) saves you 15%.

Related Posts:

Dollar Remains Resilient While Facing H/S Pattern

Equities “Aura” is Powerful And Dangerous

Sharp Declines For US Dollar Coming

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.