A variety of reports is being released from the UK at 4:30 AM ET, Thursday, March 31, 2016 including:

- • Current Account

- • Final GDP

- • Net Lending to Individuals

- • Index of Services

- • M4 Money Supply

- • Mortgage Approvals

- • Revised Business Investment

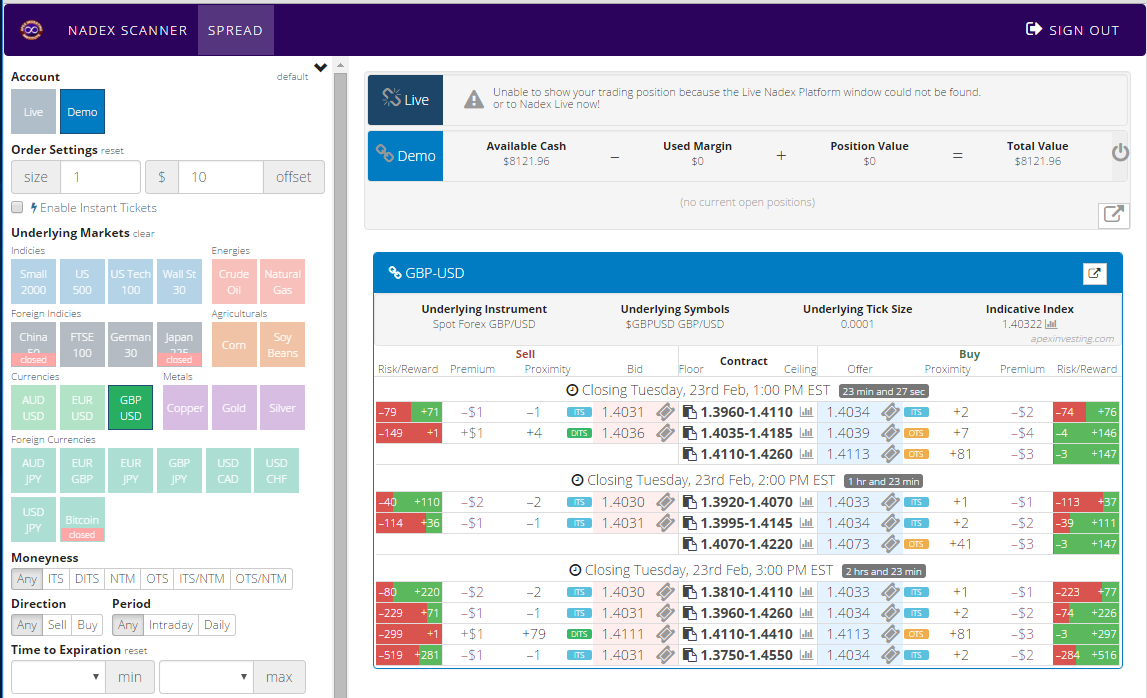

With numerous reports coming out, there is bound to be some implied volatility built into the market. You can place an Iron Condor trade using Nadex spreads for some premium collecting with a profit potential of $35 or more. No need to wake up in the middle of the night! You can enter as early as the night before on Wednesday, at 11:00 PM ET for 7:00 AM ET expirations.

Nadex spreads have defined capped risk. With a floor and a ceiling, they allow you to trade a range of a particular market. You can’t win or lose past the floor or ceiling depending on the direction, long or short, that you trade the spread. For this strategy, buy a Nadex GBP/USD spread below the market but with the ceiling where the market is trading at the time and sell a Nadex GBP/USD spread above the market but with the floor where the market is trading at the time.

Each spread should have a profit potential of approximately $17 or more. Since you are buying below the market and selling above the market, you want the market to stay in between the two spreads. Max profit is when the market is between the spreads at expiration. Alternatively, the market can make a move and one spread may profit, and then when the market pulls back, the other spread may profit as well. Be sure to place take profit limit orders once you have entered.

You can use the spread scanner available at www.apexinvesting.com to easily find your spreads at a glance. Simply choose your market, and then find the right floor and ceiling parameters listed down the center of the window. Next, look to the left outside for reward potential when selling and the right outside when buying. Finally, click the ticket icon and submit your order.

To view a larger image click HERE.

If the market makes a major move as far as 70 pips up or down, depending on your exact entries, then your trade has hit the 1:1 risk/reward ratio points and that is where you want to place stop limit orders for exiting. As long as the market stays within 35 pips up or down, depending on your exact entries, you will make some profit. For every pip away from the center between your spreads the market is at expiration, it is $1 less in profit. You can always trade more spreads just be sure to have the same number of spreads on each side of your Iron Condor.

Nadex is a US based CFTC regulated exchange and can be traded from 48 different countries. For a complete calendar of news events, visit www.apexinvesting.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.