New housing going up gets an economy charging. Wednesday, February 17, 2016 at 8:30 AM ET, numbers for US Building Permits and Housing Starts will be released. Before a house is built, a permit must be issued first, so news on Building Permits is of a high impact. Along with these numbers, the Producer Price Index (PPI) and Core (PPI) reports are also released. All of this economic news can build implied volatility into the market making for a nice trade opportunity using Nadex spreads.

Economic news of this kind comes out monthly. By tracking the reaction of the markets to these kind of news events, you can look for consistency. Apex Investing has done this and found that an Iron Condor strategy trading two Nadex EUR/USD spreads, going for a profit potential of $30 or more, can be a high probability trade. This strategy is designed for collecting profit if the market moves up or down. The key is that the market pulls back and then remains range bound until expiration.

You can enter the trade as early as 7:00 AM ET for 9:00 AM ET expirations. The set up involves buying a Nadex EUR/USD approximately 15 pips or more below the market and with the ceiling of the spread very close to, or at where the market is trading at the time. You also want to sell a Nadex EUR/USD spread approximately 15 pips or more above the market and with the floor of the spread very close to, or at where the market is trading at the time. With this strategy, the market can move 30 pips up or down and your trade will be at breakeven points. If the trade expires with the market anywhere in between those points, you will make some profit.

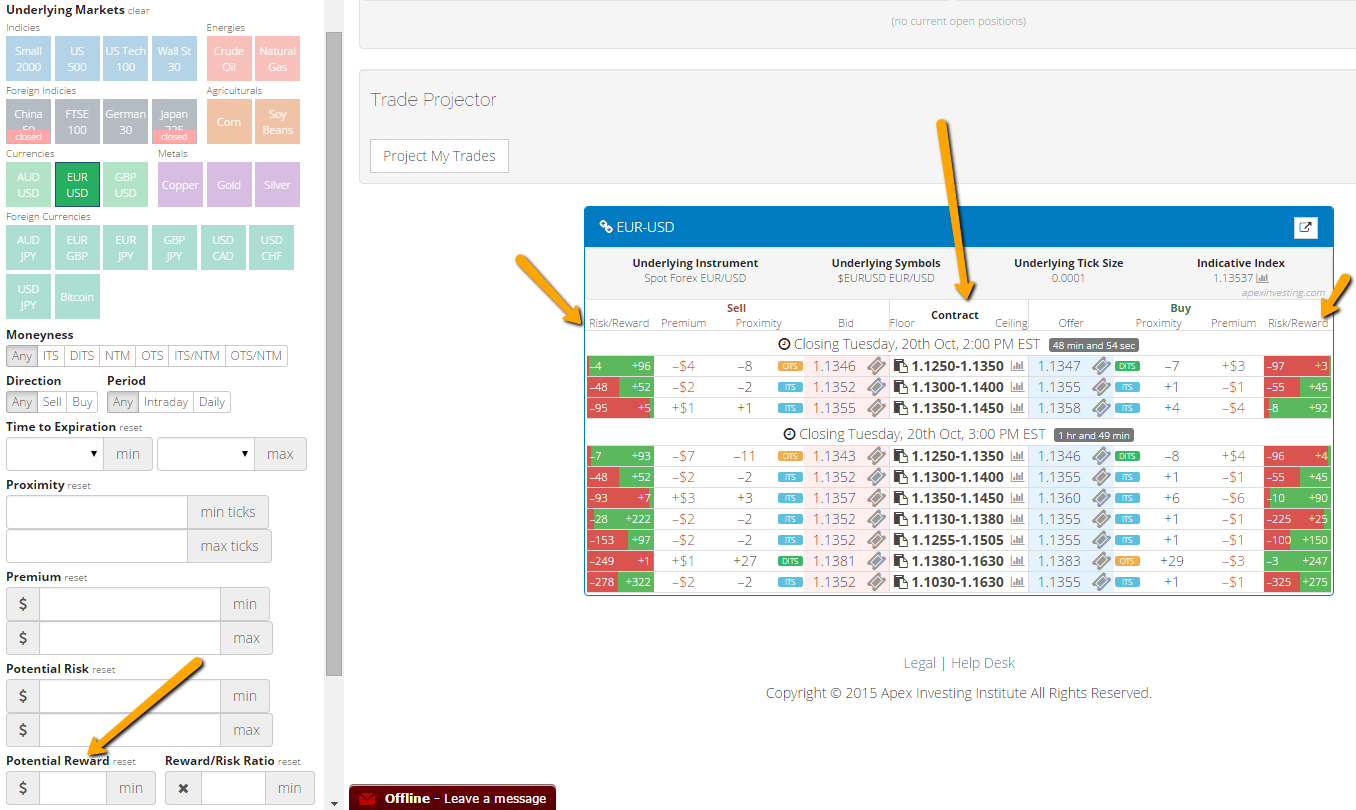

Looking on the spread scanner and using filters, you can easily find your market and spreads with the right parameters for the trade. The spread scanner is accessible for all traders at www.apexinvesting.com. You only need a free login. You also need a demo or live account with Nadex, which only takes moments to set up. Below you can see an example of the spread scanner listing Nadex EUR/USD spreads.

To view a larger image click HERE.

Spreads have a floor and a ceiling, which tell the area or range you can trade of the specific market. You can’t win or lose past the floor or ceiling and you can trade them long or short. They have capped risk and you put up the max risk to enter the trade although you won’t risk that amount. You want to exit early if necessary to manage risk. For this trade, the max 1:1 risk/reward points would be where the market hits 70 pips above or 70 pips below from where it was when you entered the trade. Max profit is when the market is right between your spreads in the center at expiration. It could be also, that one side profits when the market makes a move, and then when the market pulls back, the other side could profit.

To learn more on how to trade Nadex binaries and spreads as well as futures, forex and CFDs just visit www.apexinvesting.com. There you will find free education, as well as a 17,000+ member forum of traders helping traders to succeed. Nadex is a US based exchange regulated by the CFTC and can be traded from 48 different countries.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.