Even in the midst of uncertainty with the International headlines, it is possible to profit while trading Oil. The headlines can cause the market to be volatile and send traders to different, less volatile, markets. The 10 Minute Deviation system can be a profitable way to trade Oil using Nadex and Futures. This system is sometimes known as the Radical Reversal system.

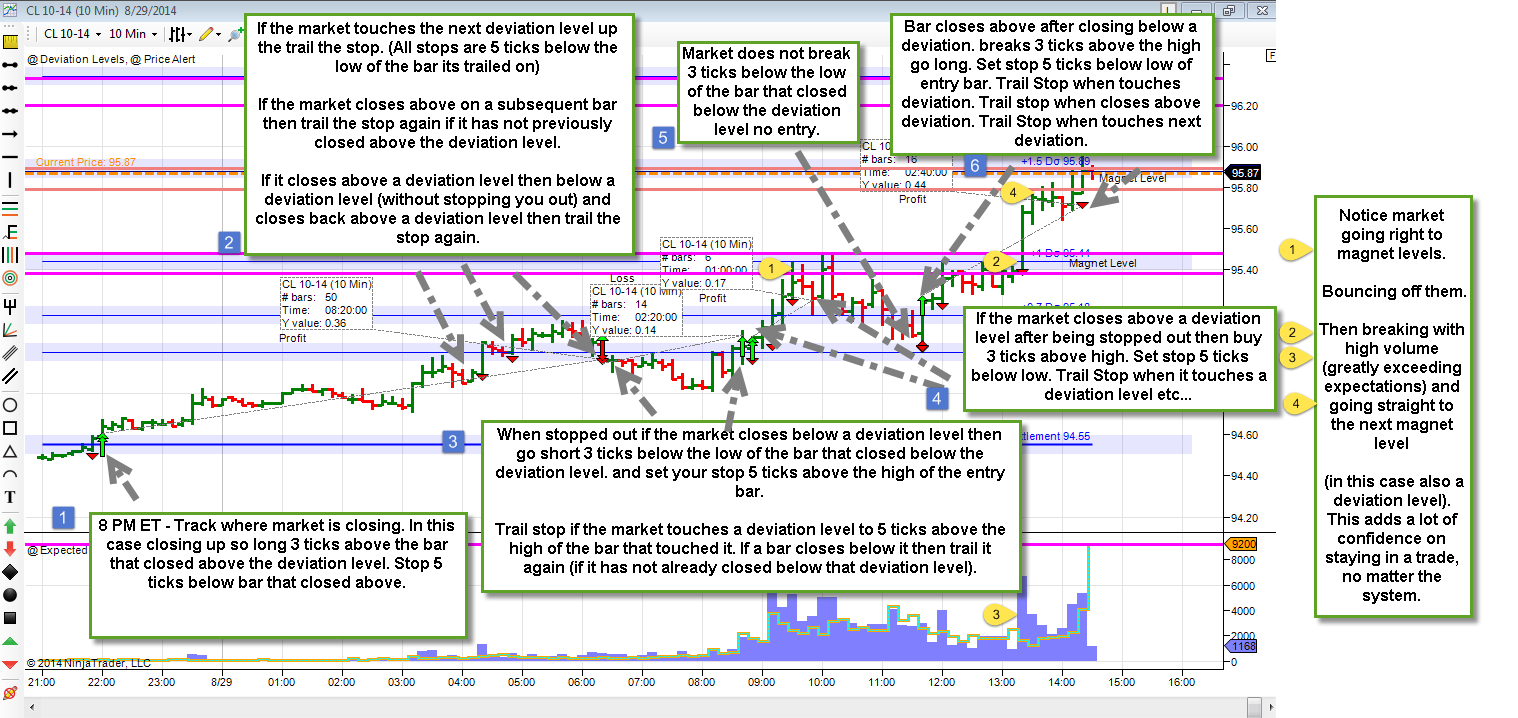

Markets like to move to deviations. Deviation levels are the amount of movement expected in a day. Knowing that the markets tend to move to deviations, can help determine trend, direction and stops. Is there a basic way to know what direction to go? Yes. Track where the market is closing. Watch for it to close above or below a deviation or settlement level. In the image below, there is a lot of information that helps in understanding how this strategy works. To view image click HERE.

On this chart, look at the box by 1. It shows that the market closed up, signalling an entry three ticks above the bar that closed above the deviation level. The stop was then set five ticks below the bar that closed above the deviation level. This is an oil chart being traded overnight. This trade is entered at 8:00 P.M. The first trade is long and is held until the market touches the next deviation level (box 2) and the stop is set at five ticks below the low of the bar that it is trailed on. The stop is trailed again if the market closes above on a subsequent bar. The first trade is profitable with 36 ticks. The next trade is short and loses 14 ticks followed by a long 17 tick profitable one. At box 5, the chart shows there was no entry because the market did not break three ticks below the low of the bar closing at the deviation level. It is important to follow the rules of whatever strategy being used.

On this chart, look at the box by 1. It shows that the market closed up, signalling an entry three ticks above the bar that closed above the deviation level. The stop was then set five ticks below the bar that closed above the deviation level. This is an oil chart being traded overnight. This trade is entered at 8:00 P.M. The first trade is long and is held until the market touches the next deviation level (box 2) and the stop is set at five ticks below the low of the bar that it is trailed on. The stop is trailed again if the market closes above on a subsequent bar. The first trade is profitable with 36 ticks. The next trade is short and loses 14 ticks followed by a long 17 tick profitable one. At box 5, the chart shows there was no entry because the market did not break three ticks below the low of the bar closing at the deviation level. It is important to follow the rules of whatever strategy being used.

This strategy continues on throughout the day, even with the volatility of the oil market. As it nears the end of the trading day, oil has made quite a nice jump up. By following the rules, overall, this trade is profitable, but the deviation level is not as close as you would like and you don’t want to give up all your profits.

What can be done to manage the trade? It’s called magnet pricing. Look back over the oil charts. Sometimes you have to look quite far back. Look for places where the market has had price levels. You will notice familiar levels on your charts where the market seemed to bounce off a level and either didn’t break through or it took a lot of volume for it to get through. That is a magnet. Just like a magnetic force that pulls the right metal towards it, the magnet price pulls the market to it until something (volume) causes it to break through. By knowing where these levels are, you can tighten your stops to these levels and protect your profits.

The following chart is the same oil chart as above, but simplified so you can see how the magnet levels are applicable to setting take profit or tightening stop loss prices/levels. To view image click HERE.

If you could scroll back on this chart, you would see where these levels came from. But on this chart, you will notice the magenta and orange lines showing where previous magnet levels have been located. Use these levels to your advantage. Adding in magnet pricing levels is the best thing to do when trading the 10 Minute Deviation system.

If you could scroll back on this chart, you would see where these levels came from. But on this chart, you will notice the magenta and orange lines showing where previous magnet levels have been located. Use these levels to your advantage. Adding in magnet pricing levels is the best thing to do when trading the 10 Minute Deviation system.

To learn more about the Radical Reversal or 10 Minute Deviation system and other trading strategies, go to www.apexinvesting.com. Apex Investing Institute offers free education, and free access to the Nadex Binary and Spread Scanner Analyzers. Member traders are invited to trade in the rooms, take advantage of trade signal services, have key indicators and access the Apex Forum. The forum content is updated daily and includes over 7000 members. In a supportive learning community of seasoned as well as up and coming traders, traders of all levels learn how to trade Nadex binaries and spreads in depth, as well as futures, Forex, stock and options, and gain an edge for successful trading overall.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.